Fundamental vs Technical Analysis: Which Path Should You Take?

Fundamental or technical analysis? Learn when each works, why combining both beats either alone, and which approach matches your investing timeline.

Fundamental or technical analysis? Learn when each works, why combining both beats either alone, and which approach matches your investing timeline.

Complete guide to gold investment taxation in FY 2026-27. Learn about tax implications of SGBs, Gold ETFs, physical gold, digital gold, and F&O. Maximize your after-tax returns with expert insights.

99% of market news is noise. Learn the 4-filter system professional investors use to identify the 1% of news that actually moves stock prices and creates opportunities.

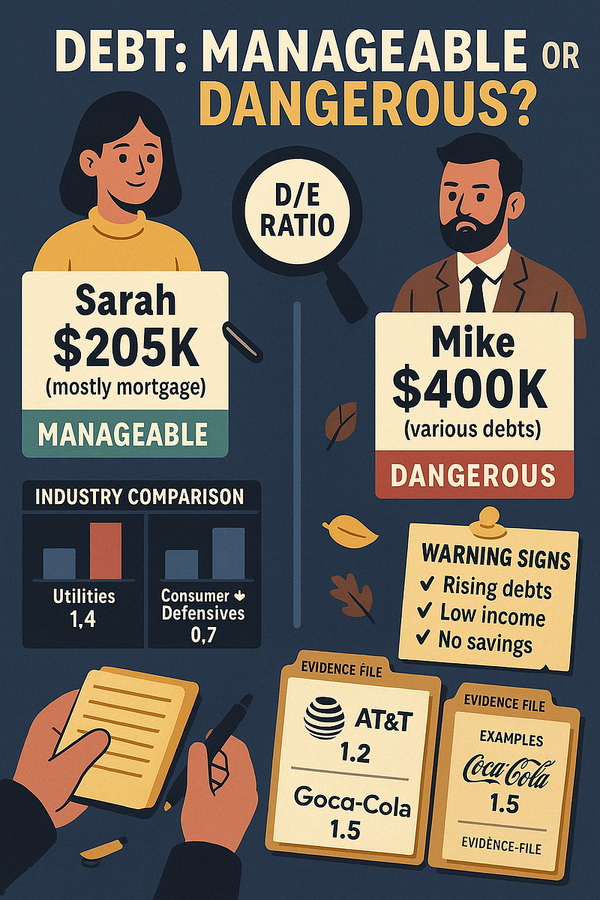

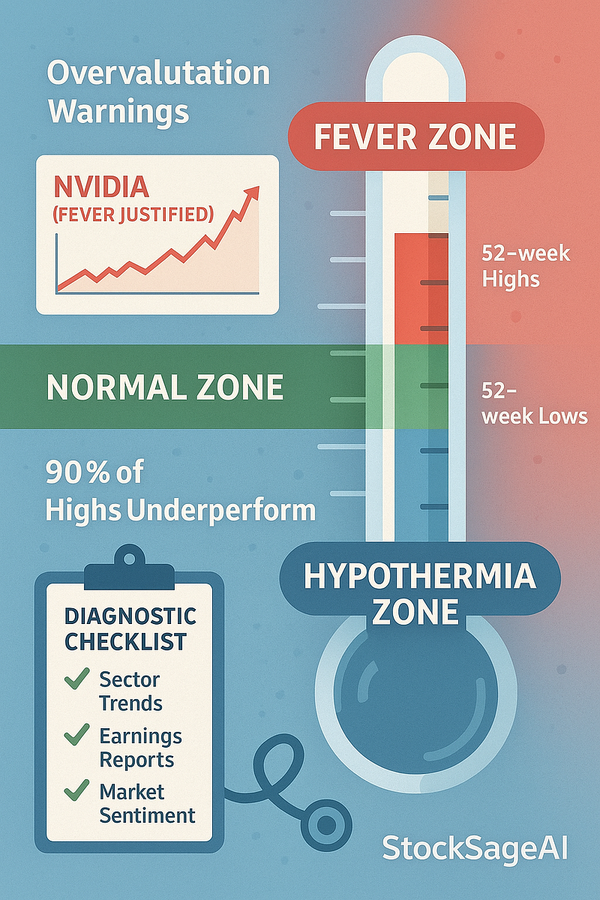

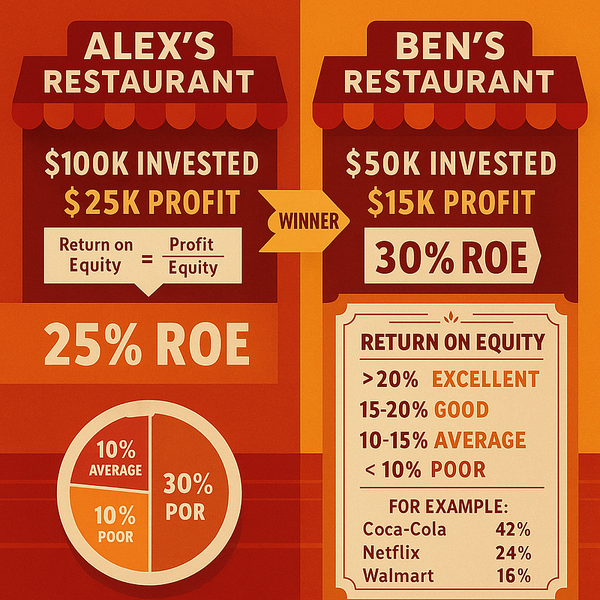

Financial ratios decode company health in minutes. Learn how P/E, PEG, ROE, ROCE, and D/E ratios reveal value that balance sheets hide from casual investors.

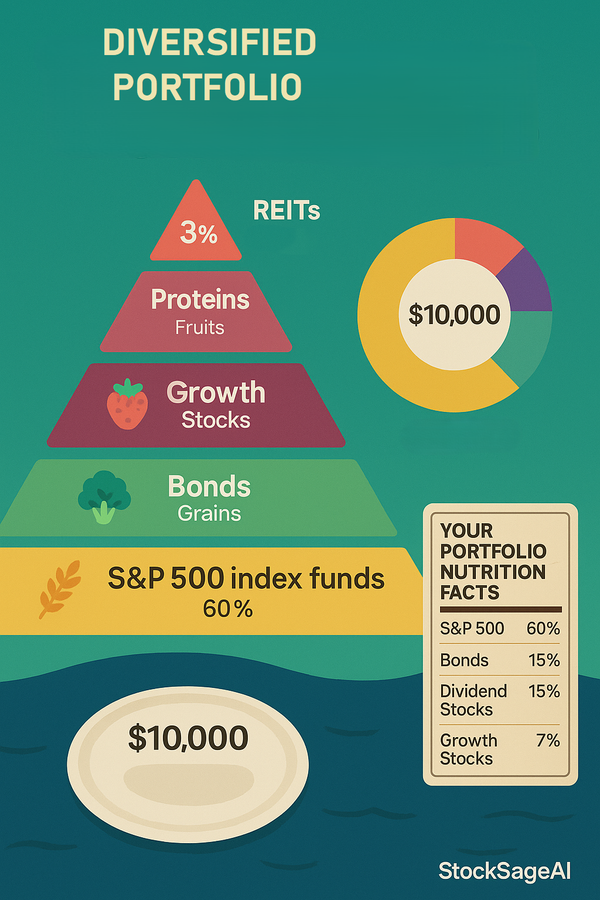

Portfolio diversification isn't just spreading investments—it's engineered risk reduction. Learn how proper diversification adds 1-3% annual returns while cutting volatility by 40%.

Behavioral finance reveals cognitive biases cost investors 3-5% annually. Learn how loss aversion, confirmation bias, and herd mentality sabotage returns.

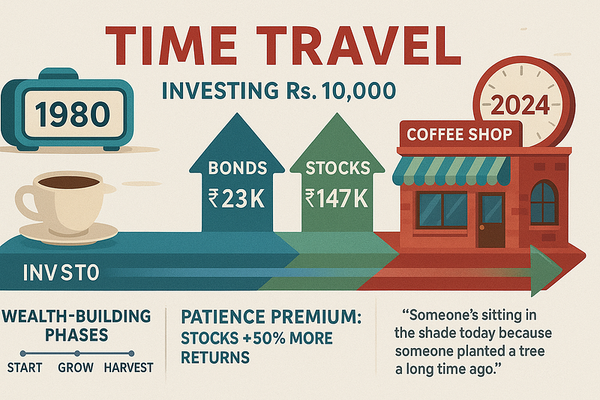

If you could travel back to 1980 and invest $1,000, would you choose the “safe” 10-year Treasury bond or the “risky” stock market? The…

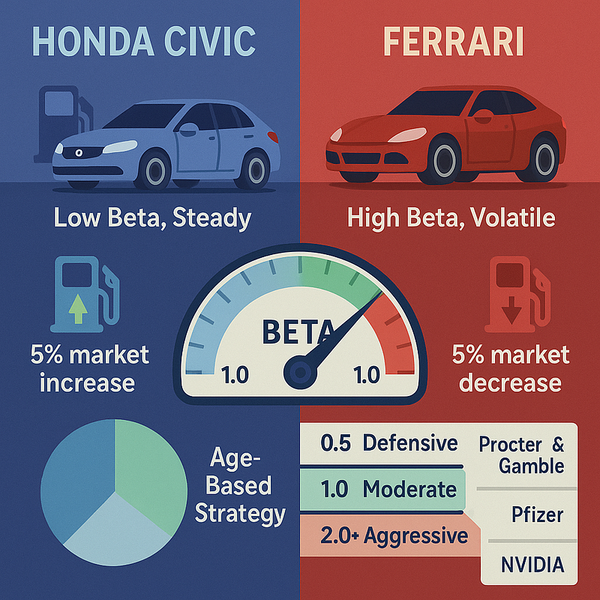

Your friend owns two cars: a steady Honda Civic and a thrilling Ferrari. When gas prices spike, guess which one hurts their wallet more…

Two investors walk into a bar. One has a crystal ball, the other has a calculator. Guess who makes more money in the long run?

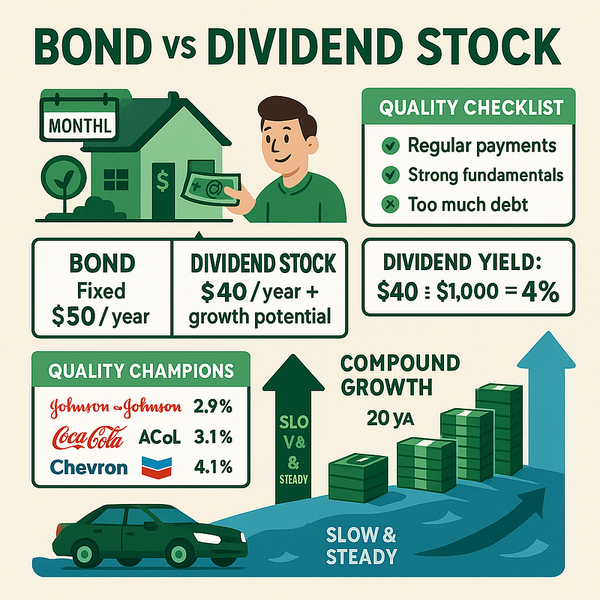

Imagine if your house paid you rent every month just for living in it. That’s exactly what dividend stocks do — they pay you for the…

Two friends earn $100,000 annually. One lives comfortably, the other is stressed and broke. The difference? Hidden debt that’s crushing…

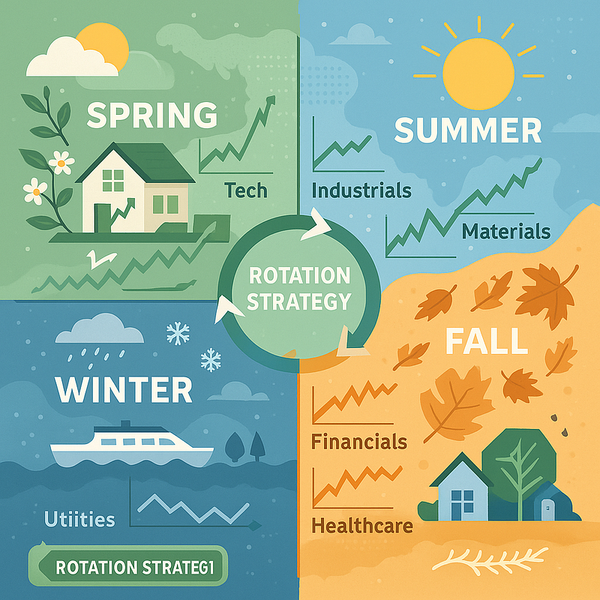

You wouldn’t wear shorts in a blizzard or a parka in summer. So why do investors ignore the “weather” in different market sectors?

Insights

Your fever thermometer tells you if you’re sick. The 52-week high/low is your stock’s health thermometer — and it reveals shocking…

Insights

A standing ovation with 10 people versus polite clapping from 10,000 people. Which performance was truly impressive? Stock volume holds the…

Insights

Two restaurant owners each invested $100,000. One made $25,000 profit, the other made $15,000. Plot twist: The second owner is actually the…

Insights

Your grandmother was right about eating your vegetables — and she’d be a brilliant investor too.

AI

Artificial intelligence stock screeners are transforming how investors sift through vast market data to pinpoint high-potential opportunities. By automatically analyzing structured price feeds, unstructured news and social sentiment, and historical indicators,

AI

Investing success hinges on timely insights and disciplined risk management, yet navigating vast market data can overwhelm even seasoned investors. By leveraging an AI stock analysis platform that combines machine learning algorithms with real-time data, you gain predictive analytics, automated screening, and optimized portfolio creation to make data-driven decisions with

AI

Accurate predictions can make or break investment strategies, and understanding how AI-based stock analysis compares to traditional stock analysis methods in accuracy is critical for investors. This comparative study defines traditional fundamental, technical, and quantitative methods, then explores

AI

Over the next decade, AI-managed assets are projected to surpass $6 trillion, offering investors precision-driven insights and deeper market intelligence for future growth.

AI

How reliable is AI-based stock analysis compared to traditional methods of stock evaluation? Investors face a critical challenge when choosing between time-tested fundamental and technical frameworks and cutting-edge algorithmic models driven by machine learning and alternative data.

Advanced Finance

Investors often assume that subscribing to an AI-powered trading platform ends their cost concerns, but hidden expenses—from data feeds and cloud compute to ongoing model retraining—can quickly inflate the total cost of ownership.

Finance Basics

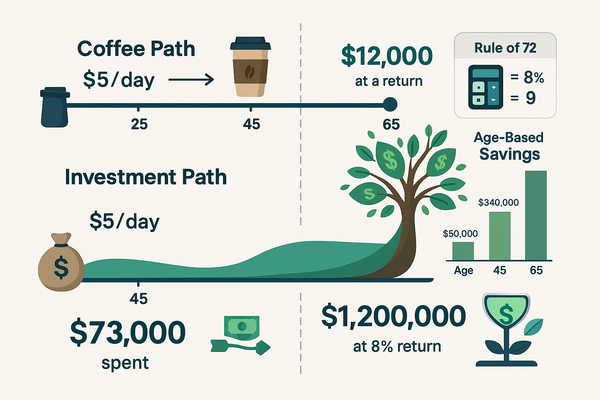

Transform small daily investments into massive wealth through the miracle of compound interest. Discover how investing just $5 daily can create $1.2 million over 40 years, and learn why time beats investment amount every single time in wealth building.

Advanced Finance

Navigate economic cycles with precision using sector rotation strategies that adapt to changing market conditions. Learn to identify optimal sectors for each economic phase and position your portfolio for the transition from late-cycle expansion to defensive positioning.