Finance Basics

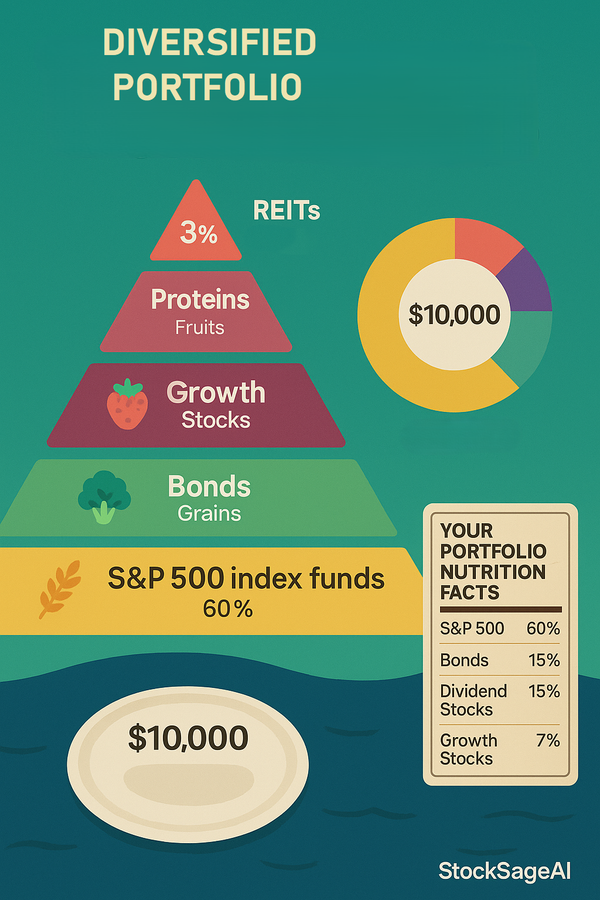

Understanding Portfolio Diversification: The Foundation of Smart Investing

Portfolio diversification isn't just spreading investments—it's engineered risk reduction. Learn how proper diversification adds 1-3% annual returns while cutting volatility by 40%.