Advanced Finance

Fundamental vs Technical Analysis: Which Path Should You Take?

Fundamental or technical analysis? Learn when each works, why combining both beats either alone, and which approach matches your investing timeline.

Advanced Finance Concepts - Stock Analysis, Stock Fundamentals, Stock Technical Analysis, AI powered Stock Analysis, AI Powered Investment Analysis, AI powered Portfolio Analysis,

Advanced Finance

Fundamental or technical analysis? Learn when each works, why combining both beats either alone, and which approach matches your investing timeline.

Advanced Finance

Investors often assume that subscribing to an AI-powered trading platform ends their cost concerns, but hidden expenses—from data feeds and cloud compute to ongoing model retraining—can quickly inflate the total cost of ownership.

Advanced Finance

Navigate economic cycles with precision using sector rotation strategies that adapt to changing market conditions. Learn to identify optimal sectors for each economic phase and position your portfolio for the transition from late-cycle expansion to defensive positioning.

Advanced Finance

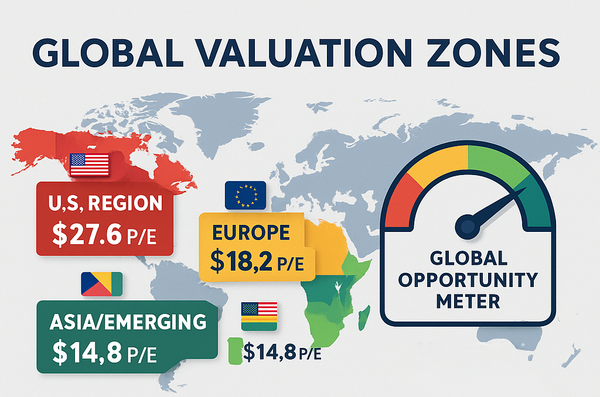

Discover hidden value in international markets where quality companies trade at 30-50% discounts to expensive U.S. stocks. Learn why diversifying beyond home country bias can significantly improve returns and reduce portfolio risk through global allocation strategies.

Advanced Finance

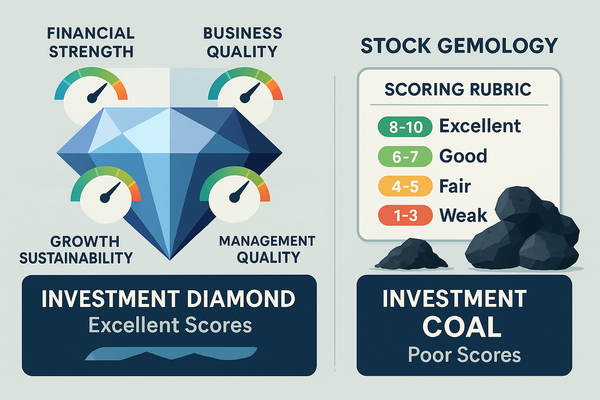

Master the art of quality investing with a comprehensive scorecard system that separates investment diamonds from coal. Learn to evaluate companies across financial strength, business quality, management excellence, and growth sustainability for superior long-term returns.

Advanced Finance

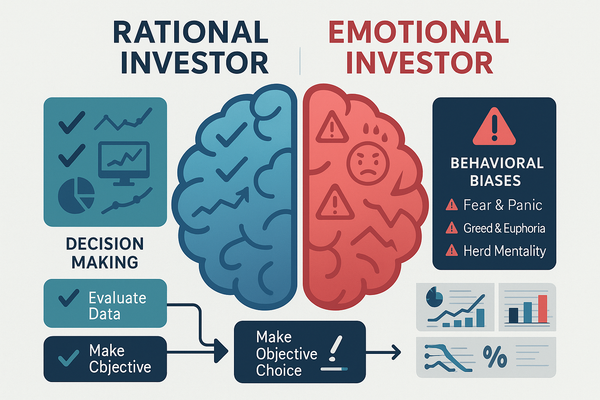

Overcome psychological investing traps that cause smart people to make costly mistakes. Learn how behavioral biases like loss aversion, anchoring, and herd mentality destroy returns, and discover systematic approaches to emotionally disciplined investing.

Advanced Finance

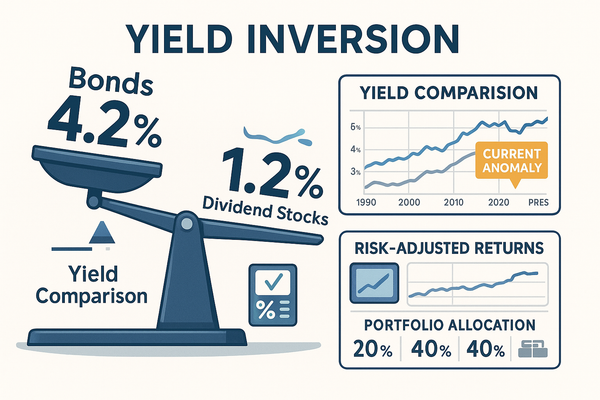

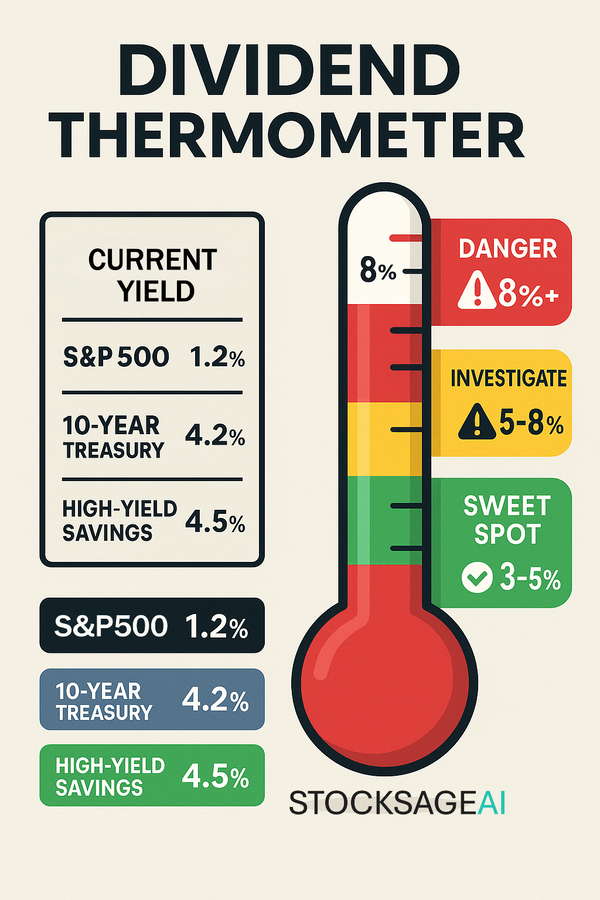

Navigate the income investing revolution as 4.2% risk-free bonds outpay 1.2% dividend stocks for the first time in decades. Discover how rising interest rates are reshaping portfolio allocation and creating new opportunities in fixed income.

Advanced Finance

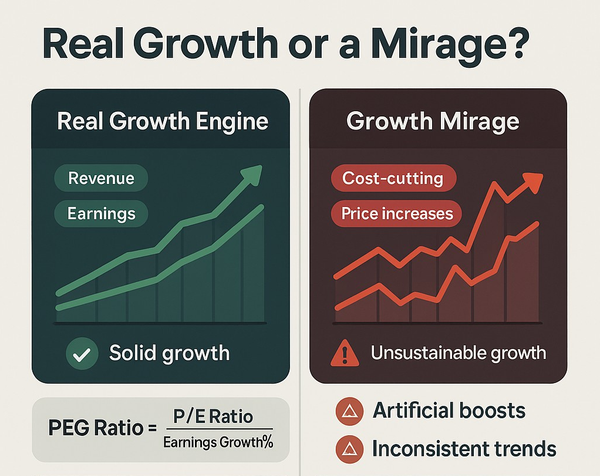

Decode the truth behind 2025's "record" 12% earnings growth and discover why Magnificent 7 companies drive 29.8% growth while everyone else manages just 6.6%. Learn to distinguish sustainable growth from accounting tricks and inflation.

Advanced Finance

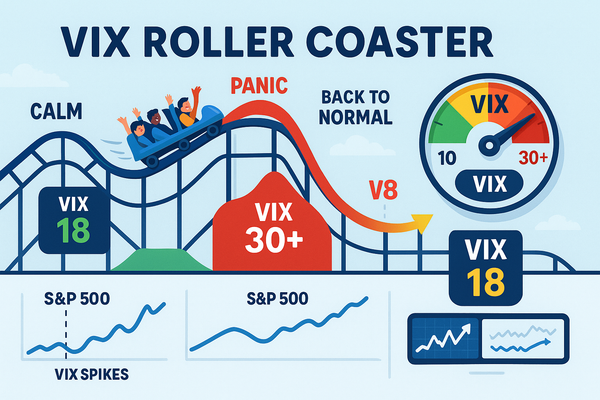

Master market volatility by understanding the VIX "fear gauge" that spiked to 30+ in 2025 before crashing back down. Learn how to use volatility patterns to time investments and turn market panic into systematic buying opportunities.

Advanced Finance

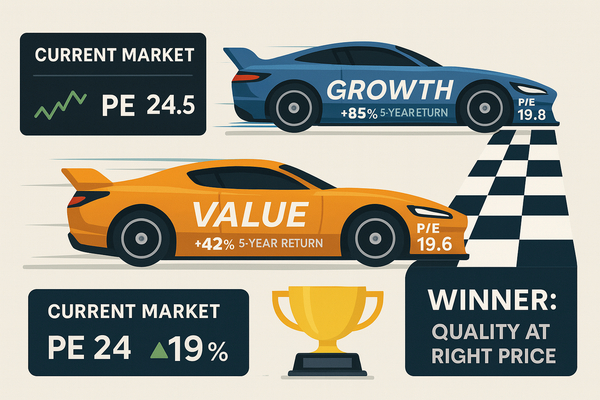

Explore why growth stocks are crushing value investments with 100%+ superior returns over 5 years. Analyze current market data showing growth P/E at 38.8 vs value at 19.6, and learn the hybrid strategy that captures the best of both worlds.

Advanced Finance

Uncover the hidden risks in dividend investing as S&P 500 yields hit 20-year lows at 1.2% while risk-free bonds pay 4.2%. Learn to identify sustainable dividend champions and avoid high-yield traps in today's challenging income environment.

Advanced Finance

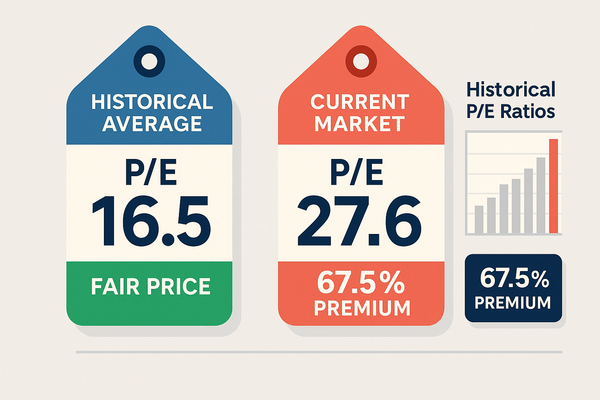

Discover why the S&P 500's current 67.5% overvaluation creates a dangerous premium trap for investors. Learn to identify fairly priced quality companies when markets are expensive and avoid the costly mistake of overpaying for earnings.