Why Your Stock Portfolio Should Be Like a Balanced Meal

Your grandmother was right about eating your vegetables — and she’d be a brilliant investor too.

Your grandmother was right about eating your vegetables — and she’d be a brilliant investor too.

Imagine if you ate only pizza for every meal. Delicious? Absolutely. Healthy? Disaster. Your body needs proteins, vegetables, grains, and fruits to thrive. Skip the variety, and you’ll pay the price.

The Investment Parallel: Your portfolio is your financial body. Feed it only tech stocks (the pizza of investing), and you’re setting yourself up for trouble.

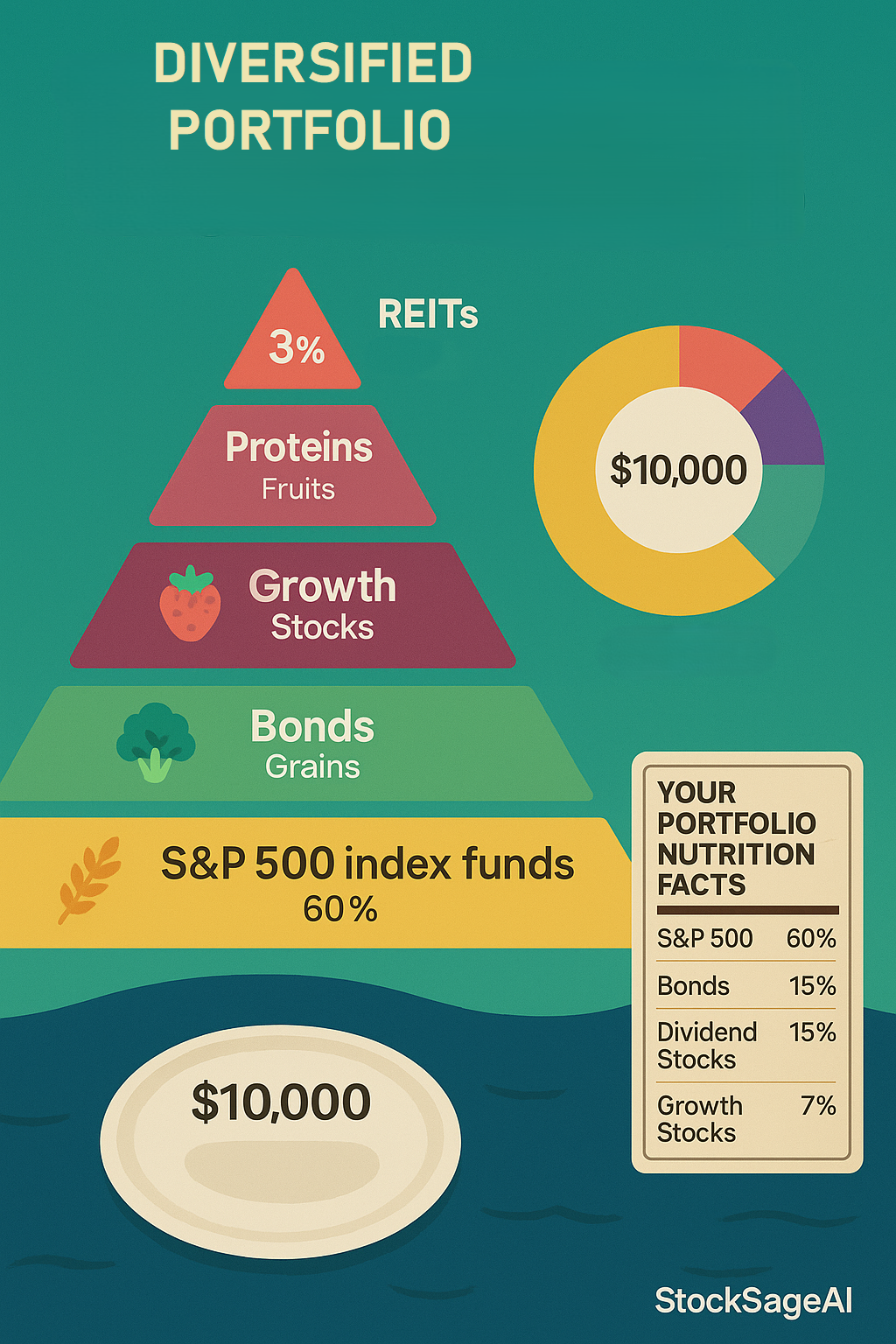

The Diversification Menu:

- Proteins (Dividend Stocks): Steady income, like utilities and consumer staples

- Vegetables (Bonds): Not exciting, but essential for stability

- Fruits (Growth Stocks): Sweet returns from companies like Amazon and Tesla

- Grains (International Stocks): Stable foundation from global markets

- Healthy Fats (REITs): Real estate investment trusts for balance

Real Portfolio Example: Instead of putting $10,000 all in NVIDIA:

- $3,000 in S&P 500 index (balanced foundation)

- $2,000 in dividend stocks (steady income)

- $2,000 in growth stocks (future potential)

- $1,500 in international funds (global exposure)

- $1,000 in bonds (stability)

- $500 in REITs (real estate exposure)

The Magic Number: Aim for no more than 5% of your portfolio in any single stock. Warren Buffett follows this rule religiously.

Action Step: Open your portfolio app right now. If any single stock represents more than 10% of your holdings, it’s time to rebalance.

Think About This: Would you trust a restaurant that only served one dish? Then why trust your future to one investment?

For more such insights visit www.stocksageai.com and use the platform to make intelligent investment decisions.