The Volatility Roller Coaster - Why the VIX Hit 30 and What It Means for You

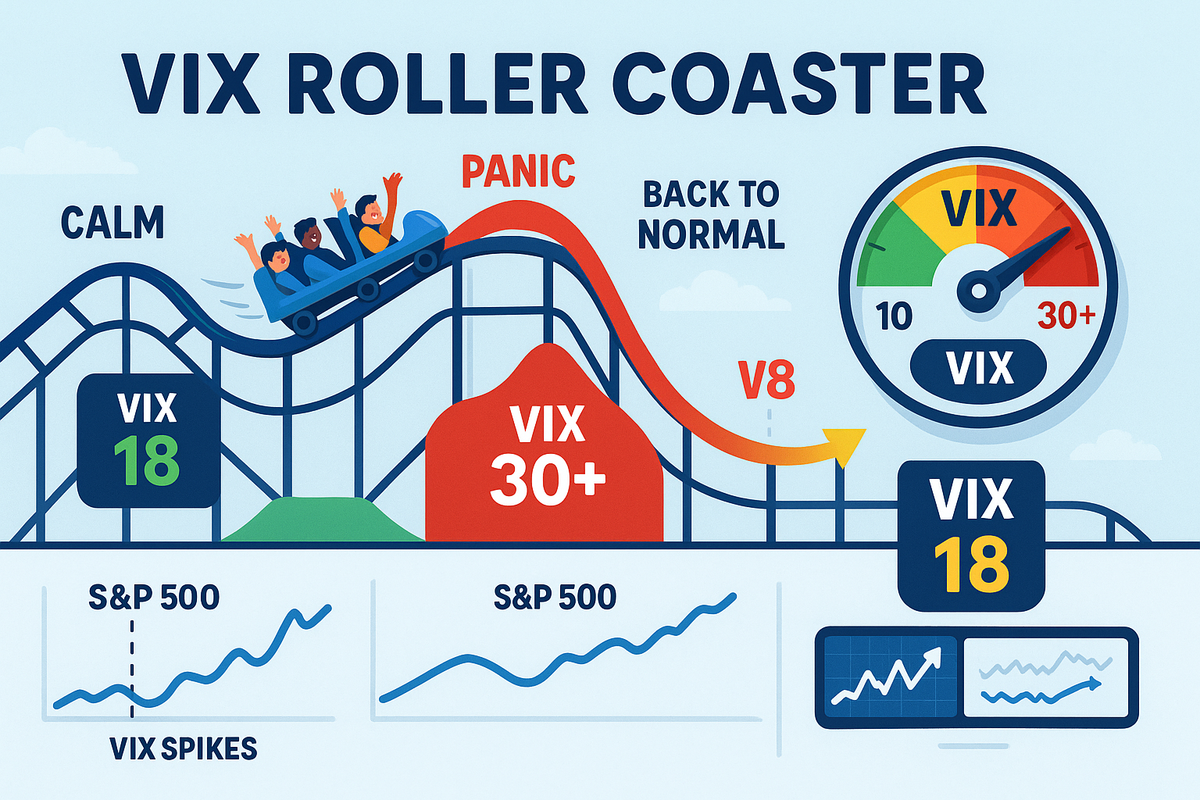

Master market volatility by understanding the VIX "fear gauge" that spiked to 30+ in 2025 before crashing back down. Learn how to use volatility patterns to time investments and turn market panic into systematic buying opportunities.

The market's "fear gauge" recently spiked to levels not seen since the 2022 bear market, then crashed back down within weeks. If you're not tracking this number, you're flying blind in turbulent weather.

The Story: Imagine you're a pilot and your instruments show severe turbulence ahead, but then suddenly everything goes calm. Do you trust the calm or prepare for more turbulence? That's exactly what happened with the VIX in 2025.

The VIX Decoder Ring: The CBOE Volatility Index (VIX) measures how much the market expects stocks to swing over the next 30 days. Think of it as the market's anxiety level:

- VIX 10-15: Market is calm, maybe too calm

- VIX 15-20: Normal market conditions

- VIX 20-25: Moderate anxiety, choppy conditions

- VIX 25-30: High anxiety, major swings expected

- VIX 30+: Market panic, opportunity for brave investors

2025's Wild VIX Ride: April 2025: VIX spiked above 30 as markets plunged

- Trigger: Trump tariff announcements, geopolitical tensions

- Market reaction: S&P 500 dropped 15% in weeks

- Smart money move: This was prime buying time

May 2025: VIX crashed to 18, marking dramatic calm

- Trigger: Trade war fears subsided, policy clarity emerged

- Market reaction: S&P 500 rallied 17% from lows

- Reality check: Calm after extreme fear often signals opportunity

The VIX and Your Money: High VIX (Above 25) Strategy:

✅ Start buying quality stocks - fear creates bargains

✅ Use dollar-cost averaging - spread purchases over time

✅ Focus on defensive sectors - utilities, consumer staples

✅ Avoid panic selling - volatility is temporary

Low VIX (Below 15) Strategy:

⚠️ Take some profits - complacency can be dangerous

⚠️ Increase cash reserves - prepare for future opportunities

⚠️ Reduce leverage - don't get caught overextended

⚠️ Consider protective strategies - options, stops losses

Real-World VIX Applications:

The Contrarian's Guide: When VIX is high, everyone's scared. When everyone's scared, stocks are on sale. Historical data shows:

- Buying when VIX > 30: Average 1-year return of 15%+

- Buying when VIX < 15: Average 1-year return of 8%

- The lesson: Fear creates opportunity

Volatility vs. Risk - The Crucial Difference: Volatility: How much prices swing (temporary) Risk: Permanent loss of capital (permanent)

Example: Tesla stock swinging from $200 to $300 is volatility. Tesla going bankrupt is risk.

The VIX Pattern Recognition: Markets follow predictable volatility patterns:

1. Complacency Phase (VIX 10-15):

- Markets drift higher

- Everyone feels safe

- Danger: Overconfidence builds

2. Reality Check (VIX 15-25):

- Minor corrections occur

- Some investors get nervous

- Opportunity: Selective buying

3. Panic Phase (VIX 25-40):

- Major selling waves

- Media screams doom

- Opportunity: Aggressive buying

4. Recovery Phase (VIX declining):

- Markets stabilize

- Confidence slowly returns

- Strategy: Hold winners, add selectively

Current Market Pulse Check (2025): Based on recent VIX action, we're transitioning from Panic Phase back to Reality Check. This suggests:

- Short-term: Continued market recovery likely

- Medium-term: Watch for VIX to drift lower (more opportunity)

- Long-term: Prepare for next volatility spike (they always come)

Volatility Trading Strategies:

For Conservative Investors:

- Use VIX as buying guide: Add to positions when VIX > 25

- Reduce risk when calm: Take profits when VIX < 15

- Never try to time perfectly: Use ranges, not exact levels

For Active Investors:

- VIX ETFs: Direct volatility exposure (complex, study first)

- Options strategies: Protective puts when VIX is low

- Sector rotation: Cyclicals in low VIX, defensives in high VIX

The Volatility Paradox: The biggest returns often come from the scariest times. When the VIX hit 82 in March 2020 (COVID crash), buying the S&P 500 delivered 70%+ returns over the following year.

Action Steps:

- Add VIX to your watchlist - check it weekly

- Create VIX-based rules: "I'll buy more when VIX > 25"

- Build a volatility scale: Define your strategy for each VIX level

- Stay disciplined: Don't let emotions override your VIX strategy

Think About This: The market's fear gauge is like a storm warning system. When everyone else is running for shelter, that's when you should be shopping for bargains.

Turn market volatility into opportunity with StockSageAI's volatility analysis and market timing tools. Our platform tracks VIX patterns, identifies oversold conditions during market panics, and highlights quality stocks trading at volatility-driven discounts. Access volatility-based screening, fear/greed indicators, and systematic buying signals across global markets. Never let market emotions drive your decisions again - start your disciplined volatility strategy at StockSageAI.com.