The Truth About Stock Market News: Signal vs Noise

99% of market news is noise. Learn the 4-filter system professional investors use to identify the 1% of news that actually moves stock prices and creates opportunities.

The Story: When 1,000 Headlines Hid the One That Mattered

Meet Karan, a 38-year-old investor who prided himself on being "informed." His daily routine:

- 6:00 AM: Check 5 financial news apps

- 7:30 AM: Read 20+ market headlines over breakfast

- 9:15 AM: Watch CNBC/ET Now opening bell coverage

- Throughout day: Stock market news alerts pinging every 15 minutes

- 9:00 PM: Evening market wrap-up videos

Time invested in news: ~3 hours daily

In March 2023, Karan's inbox and newsfeed contained:

- 47 headlines about "market volatility"

- 23 articles on "Fed rate decision speculation"

- 31 analyst upgrades/downgrades

- 18 "top stocks to buy now" listicles

- 12 macro economy predictions

- 8 "market crash warning" alerts

The ONE piece of news Karan missed buried on page 4: "HDFC Bank and HDFC Ltd announce merger completion ahead of schedule"

This single event created:

- ₹1.2 lakh crore market cap shift

- 15% price movement in 3 trading sessions

- Ripple effects across entire financials sector

- Major index rebalancing impact

Karan's result: Consumed 90+ hours of news that month, yet missed the single most actionable event that would have generated 15% returns in 3 days.

Meanwhile, his colleague Shruti—who had implemented a systematic news filtering framework—caught this signal immediately because it met her criteria: "Structural corporate events affecting top-10 index components."

Research from Bloomberg Intelligence shows that 99% of financial news is noise—information that creates no actionable trading opportunity or long-term value insight. Yet the average retail investor spends 10-15 hours weekly consuming this noise while missing the 1% of true signals.

The game isn't about reading more news. It's about hearing the right frequency through the static.

The Sophisticated Concert Hall Analogy: The Selective Listening Problem

Imagine you're at a concert hall with 1,000 people. The stage has:

- 1 world-class violinist playing a masterpiece (the signal)

- 999 people in the audience all talking simultaneously (the noise)

The Challenge: Can you hear the violin?

Most Investors' Approach:

- Try to listen to EVERYTHING

- Get overwhelmed by cacophony

- Can't distinguish violin from conversations

- Leave exhausted, having heard nothing clearly

Professional Investors' Approach:

- Frequency filter: Tune to violin's frequency, ignore voice range

- Directional focus: Point ears toward stage, ignore back-row chatter

- Pattern recognition: Know what a valuable melody sounds like

- Volume control: Amplify stage, mute audience

The Market News Environment:

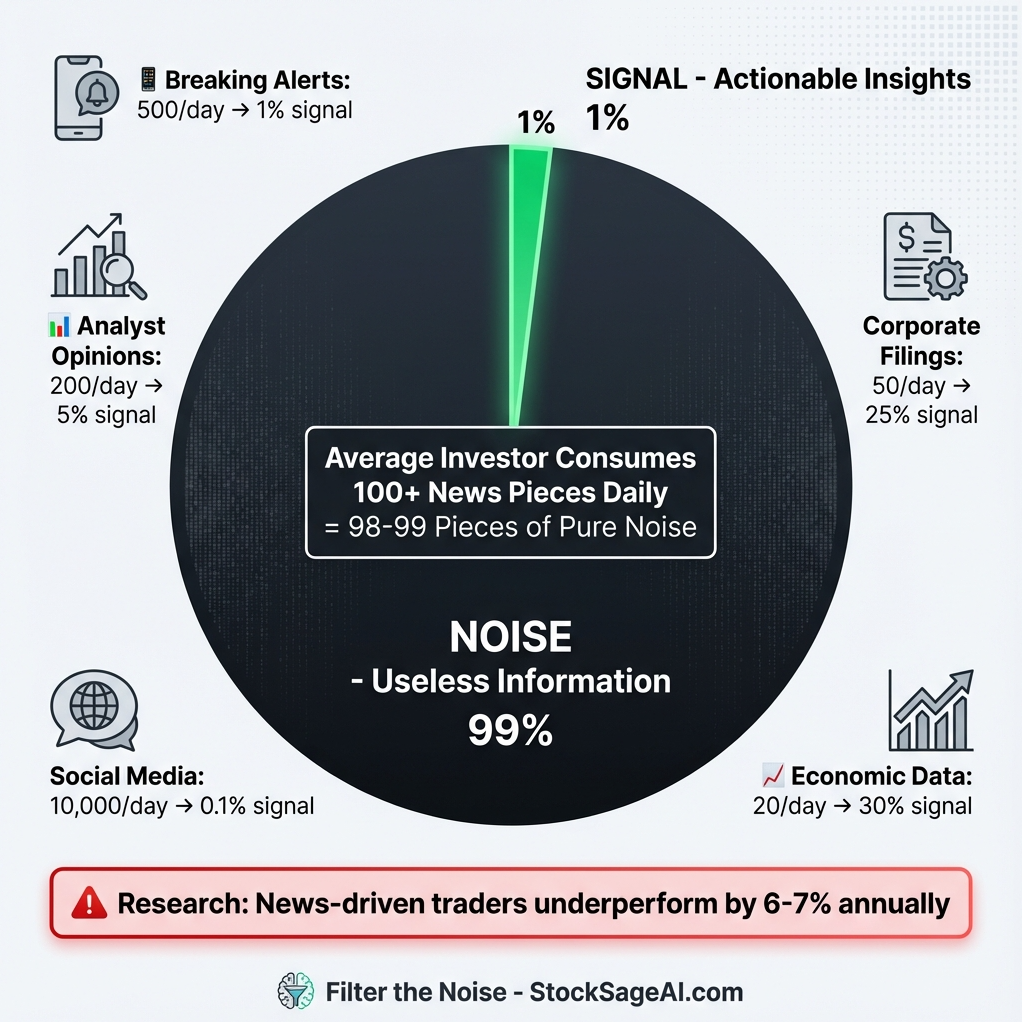

| Source Type | Daily Volume | Signal% | Noise% |

|---|---|---|---|

| Breaking news alerts | 500+ | 1% | 99% |

| Analyst opinions | 200+ | 5% | 95% |

| Social media posts | 10,000+ | 0.1% | 99.9% |

| Economic data releases | 20+ | 30% | 70% |

| Corporate announcements | 50+ | 25% | 75% |

| Price alerts | 1,000+ | 2% | 98% |

The Math: If you consume 100 pieces of financial news daily, statistically 98-99 are useless noise. Yet they demand your attention, time, and mental bandwidth.

Dr. Terrance Odean's research at UC Berkeley found that investors who trade more frequently based on news underperform those who ignore news by 6-7% annually. The noise isn't neutral—it actively destroys wealth through emotional reactions and overtrading.

The Four-Filter News Evaluation System

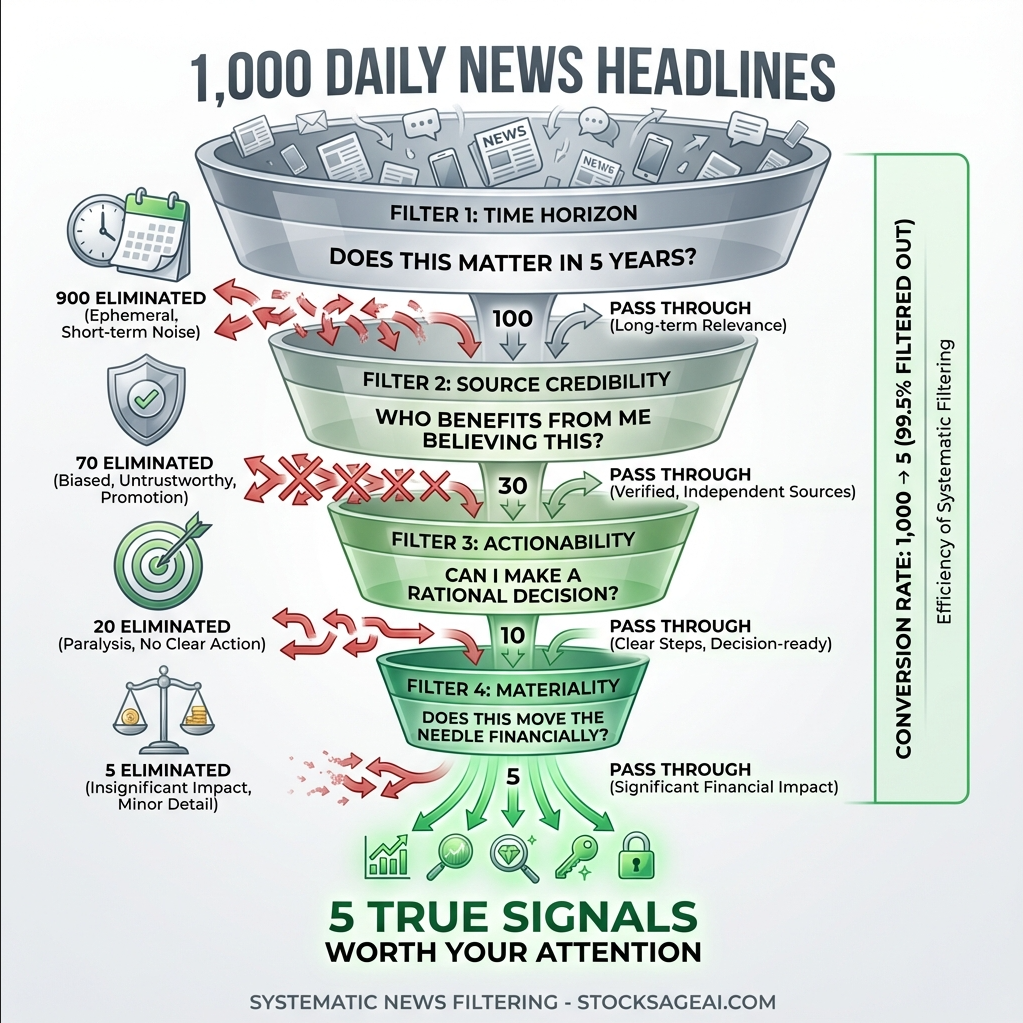

Filter 1: Time Horizon Relevance — "Does This Matter in 5 Years?"

The Test: If this news won't matter to the company's fundamentals in 5 years, it's noise.

NOISE Examples:

- ✗ "Stock up 3% on heavy buying interest"

- ✗ "Analyst raises target price by 5%"

- ✗ "Promoter sells 0.5% stake"

- ✗ "Brokers recommend profit booking"

- ✗ "Market may see volatility next week"

SIGNAL Examples:

- ✓ "Company wins 10-year government contract worth ₹5,000 Cr"

- ✓ "New regulation bans company's core product category"

- ✓ "Major technological disruption makes current product obsolete"

- ✓ "Management fraud uncovered in financial statements"

- ✓ "Company acquires key competitor, doubles market share"

The Warren Buffett Test:

"If you're not willing to hold a stock for 10 years, don't even think about holding it for 10 minutes."

Apply same logic to news: If it doesn't change your 10-year thesis, ignore it.

Real Example:

- NOISE: "Infosys stock down 2% on profit booking" (2023)

- SIGNAL: "Infosys wins $1.5B multi-year deal with major European bank" (2023)

The 2% dip is irrelevant. The $1.5B contract validates competitive positioning for years.

Filter 2: Source Credibility & Incentives — "Who Benefits From Me Believing This?"

The Incentive Matrix:

| News Source | Primary Incentive | Trust Level | Usage |

|---|---|---|---|

| Company Press Release | Present best light | Medium | Verify with filings |

| Regulatory Filings | Legal truth | High | Primary source |

| Paid Research | Institutional clients | Medium-High | Cross-check |

| Brokerage "Buy" Reports | Generate commissions | Low-Medium | Skeptical view |

| Financial Media Headlines | Clicks & views | Low | Ignore headlines |

| Anonymous Social Media | Pump & dump schemes | Very Low | Ignore |

| Company Conference Calls | Investor confidence | Medium-High | Read transcripts |

Red Flag Phrases (Automatic Noise):

- "Sources say..." (unnamed = unverifiable)

- "Market buzz suggests..." (gossip)

- "This stock could..." (speculation)

- "Top 10 stocks to buy..." (clickbait)

- "Don't miss this opportunity..." (FOMO manipulation)

- "Insiders are loading up..." (unverified)

Green Flag Indicators (Potential Signal):

- Named executive quotes from earnings call

- Specific contract values and terms

- Regulatory filing references (e.g., "Per BSE filing dated...")

- Quantified impacts ("This will add ₹500 Cr annual revenue")

- Management guidance with numbers

- Third-party audit or report citations

Real Disaster - Yes Bank Coverage (2018-2019):

- Brokerage reports: 15 out of 18 had "Buy" ratings until weeks before collapse

- Financial media: Headline "Banking on Yes Bank" 6 months before crash

- Regulatory filings: Red flags visible 2 years prior (NPA disclosures)

Lesson: High-incentive sources (brokerages, paid media) lag truth. Low-incentive sources (filings, data) lead truth.

Filter 3: Actionability — "Can I Make a Rational Decision Based on This?"

The Actionability Test:

NOISE (Cannot Act Rationally):

- ❌ "Market expected to be volatile" → What's the action? (Impossible to act)

- ❌ "Nifty may test 18,500 levels" → Based on what? (Speculation)

- ❌ "FIIs sold ₹2,000 Cr today" → So what? (Data without context)

- ❌ "Experts advise caution" → Caution about what specifically? (Vague)

SIGNAL (Clear Action Possible):

- ✓ "Company's largest customer (40% of revenue) terminates contract" → Action: Sell or significantly reduce position

- ✓ "New competitor enters market with 50% cheaper product" → Action: Investigate pricing power sustainability

- ✓ "Regulatory approval granted for new blockbuster drug" → Action: Model incremental revenue impact

- ✓ "Debt rating downgraded from AA to BBB" → Action: Assess refinancing risk

The Decision Tree:

- Read news →

- Ask: "What specific decision does this enable?" →

- If answer is clear → Investigate further →

- If answer is vague → Ignore

Real Example - Adani Group Controversy (Jan 2023):

- NOISE: "Stock falls 10% on report allegations" (price movement isn't actionable)

- SIGNAL: "Hindenburg report alleges specific accounting manipulations in subsidiaries X, Y, Z with documented evidence" (actionable → investigate claims → evaluate holdings)

The specific allegations with evidence are actionable. The price fall itself is not.

Filter 4: Materiality — "Does This Move the Needle Financially?"

The Materiality Formula:

Impact is material if:

- Revenue impact >5% of annual revenue, OR

- Profit impact >10% of annual profit, OR

- Asset value change >10%, OR

- Affects core business model fundamentals

NOISE (Immaterial):

- ✗ "Company launches new product variant" (if it's 1 of 500 products)

- ✗ "CFO resigns" (if leadership bench is strong)

- ✗ "Opens new retail store" (if they have 500 stores already)

- ✗ "Small acquisition for ₹50 Cr" (if company revenue is ₹10,000 Cr)

SIGNAL (Material):

- ✓ "Largest production facility catches fire, offline for 6 months" (supply shock)

- ✓ "CEO resigns amid board conflict" (governance risk)

- ✓ "Government increases import duty by 40% on key raw material" (margin compression)

- ✓ "Acquires competitor for ₹5,000 Cr" (debt increase + market share gain)

Quick Materiality Math:

Example: Reliance Industries (₹6 lakh Cr revenue):

- ₹500 Cr contract announcement: 0.08% of revenue → NOISE

- ₹30,000 Cr Saudi Aramco JV: 5% revenue impact → SIGNAL

Example: Mid-cap company (₹2,000 Cr revenue):

- ₹500 Cr contract: 25% of revenue → SIGNAL

- CEO change: Potential fundamental shift → SIGNAL

The Scale Rule: The smaller the company, the lower the threshold for materiality. A ₹100 Cr event is noise for Reliance but game-changing for a ₹500 Cr market cap company.

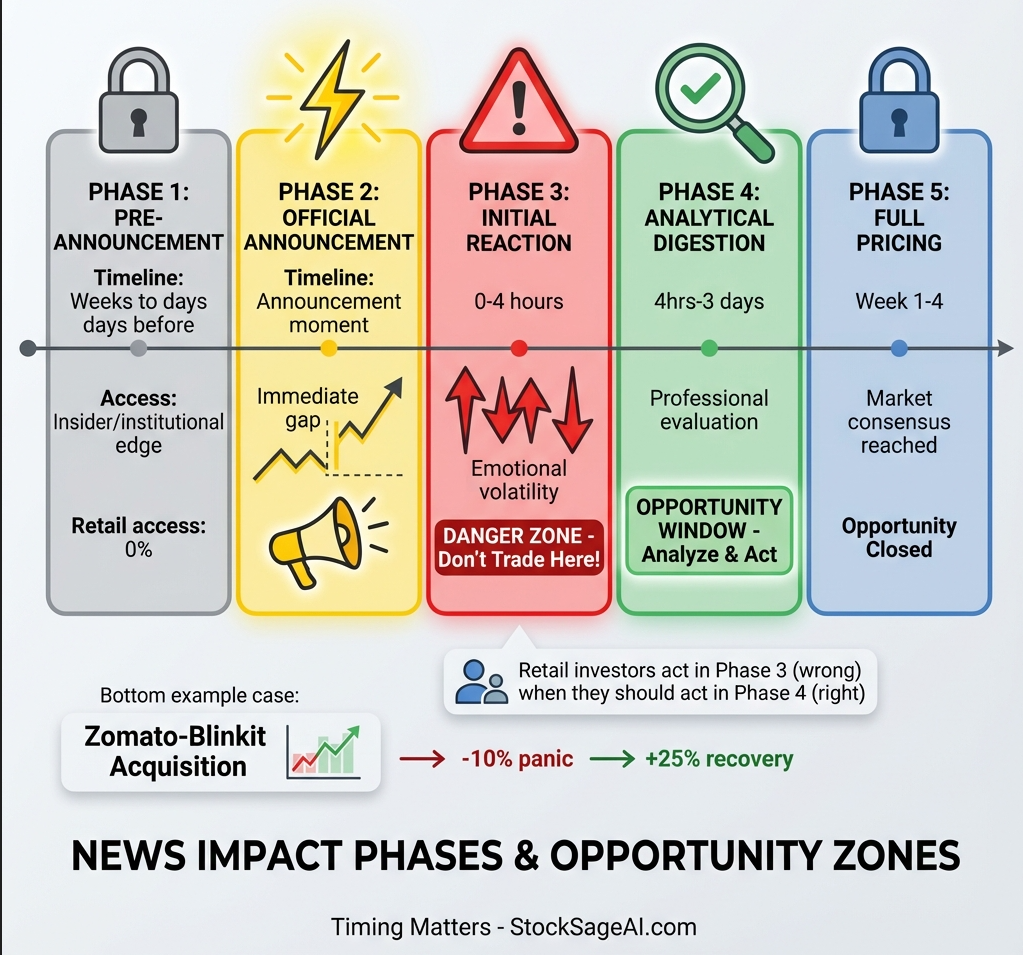

The News Impact Timeline: When Signals Actually Create Opportunities

Understanding the News Pricing Cycle:

Phase 1: Pre-Announcement (Insider/Institutional Edge)

- Timing: Weeks to days before public announcement

- Who knows: Company insiders, investment banks, institutional investors

- Price movement: Subtle, often dismissed as "normal volatility"

- Retail investor access: Almost zero (unless you notice unusual volume/options activity)

Phase 2: Official Announcement (The Information Release)

- Timing: Official press release, filing, or announcement

- Who knows: Everyone simultaneously

- Price movement: Immediate gap up/down (5-15% common)

- Retail investor access: Theoretical but...

Phase 3: Initial Reaction (The Noise Explosion)

- Timing: First 30 minutes to 4 hours

- Who knows: Everyone, but no one understands yet

- Price movement: Extreme volatility, emotional overreaction

- Retail investor access: Danger zone (FOMO buying or panic selling)

Phase 4: Analytical Digestion (Professional Evaluation)

- Timing: 4 hours to 3 days

- Who knows: Analysts, professionals who read full details

- Price movement: Correction of initial overreaction

- Retail investor opportunity: Prime window if you've done homework

Phase 5: Full Pricing (Market Consensus)

- Timing: Week 1 to Week 4

- Who knows: Everyone + analyst reports published

- Price movement: Settles to fair value with volatility

- Retail investor access: Too late for alpha, but can still participate

The Retail Investor Mistake: Most retail investors act in Phase 3 (emotional) when they should act in Phase 4-5 (analytical).

Real Example - Zomato Blinkit Acquisition (2022):

- Phase 1: Rumors circulate (stock +3% on "buzz")

- Phase 2: Official announcement ₹4,447 Cr deal

- Phase 3: Stock drops 10% in 30 minutes (panic: "Too much debt!")

- Phase 4: Analysts dig in, realize synergies + market expansion

- Phase 5: Stock recovers +25% over next 4 months

Lesson: The initial -10% was noise (emotional reaction). The real signal required reading the deal structure and understanding unit economics. Phase 4 investors who analyzed captured the 25% gain.

Professional Insights: Building Your News Filtering System

✅ Create Your "Signal Watchlist"

Don't monitor all news. Monitor only news that affects:

- Your holdings (portfolio companies)

- Your watchlist (potential buys)

- Sector-wide changes (regulations, disruptions)

- Macro catalysts (interest rates, economic policy)

Ignore everything else. You don't need to know about 495 Nifty 500 companies you'll never own.

✅ Implement the 24-Hour Rule for Non-Urgent News

Unless news requires immediate action (company fraud, bankruptcy filing, major negative surprise):

- Wait 24 hours before making any trade

- Read full context (not just headlines)

- Check company's official response

- Review analyst interpretations

Why it works: 24 hours allows emotional reaction to subside and analytical brain to engage.

✅ Reverse-Engineer Headlines to Find Truth

Headline: "Stock surges 5% on analyst upgrade"

Reverse Engineering:

- Who is the analyst? (Track record?)

- Why the upgrade? (Read actual report, not headline)

- What changed fundamentally? (Earnings revision? Target price?)

- Is this consensus or contrarian? (If 15 analysts already said "buy," one more is noise)

Often the truth: Stock already up 20% this month, analyst is merely catching up to price (not predicting). → Noise

✅ Track "Surprise" vs "Expected" Events

Markets price based on expectations, not absolutes.

NOISE:

- "Company posts Q4 profit of ₹500 Cr" → But market expected ₹490 Cr → Expected

SIGNAL:

- "Company posts Q4 profit of ₹500 Cr" → But market expected ₹650 Cr → Negative surprise → Material

Focus on:

- Guidance changes (company raises/lowers future outlook)

- Earnings beats/misses >10% vs estimates

- Unexpected announcements (acquisitions, CEO changes)

Expected news is already in the price. Surprises create opportunity.

✅ Develop News Source Hierarchy

Tier 1 (Check Daily):

- Company investor relations (press releases, filings)

- Regulatory exchange filings (BSE, NSE announcements)

- Official economic data (RBI, government statistics)

Tier 2 (Check Weekly):

- Earnings call transcripts

- Annual/quarterly reports

- Industry association reports

Tier 3 (Scan Monthly):

- Long-form institutional research

- Management interviews (full versions, not soundbites)

- Industry white papers

Tier 4 (Ignore):

- Real-time price alerts

- Intraday market commentary

- Social media stock tips

- "Hot stocks" listicles

How StockSageAI Filters News Noise with AI

AI-Powered News Sentiment Analysis: StockSageAI's intelligent platform processes thousands of news articles daily and automatically:

- Filters by materiality using NLP to detect revenue impact, profit impact, or structural changes

- Scores sentiment (positive/negative/neutral) based on language patterns, not just keywords

- Identifies source credibility weighting official filings 10x higher than unnamed sources

- Highlights actionable insights separating speculation from fact-based reporting

Automated Signal Detection: The AI flags high-value news events:

- Corporate actions (mergers, acquisitions, spin-offs)

- Earnings surprises (>10% beat/miss vs consensus)

- Regulatory changes affecting specific sectors

- Management changes in top executives

- Contract wins/losses above materiality threshold

News Impact Correlation: See historical data showing:

- Which news types actually moved stock prices (vs noise that didn't)

- Average price reaction to similar events in past

- Time decay of news impact (when alpha opportunity closes)

Personalized News Feeds: Instead of firehose, get curated streams:

- News affecting only your portfolio holdings

- Sector-specific regulatory updates

- Peer comparison alerts (competitor news affecting your holdings)

- Material events only (no "market may be volatile" noise)

Action Steps to Filter News Like a Pro

- Create your signal watchlist - List only companies/sectors you actually care about (10-30 max)

- Unsubscribe from noise - Delete real-time alerts, price notifications, social media stock groups

- Set Tier 1 source alerts - Company filings, exchange announcements only

- Implement 24-hour rule - No trades within 24 hours of non-urgent news

- Weekly news review - Spend 1 hour on Sundays reviewing week's material events

- Track your decisions - Journal which news led to actions, review quarterly for patterns

Cut through market noise with StockSageAI's AI-powered news intelligence platform. Our advanced NLP algorithms process 10,000+ news articles daily, filtering out the 99% noise to surface only material, actionable signals that affect your portfolio. Access automated sentiment scoring, source credibility analysis, materiality detection, and news impact correlation showing which events actually move prices versus empty hype. Get personalized news feeds for your holdings, AI-generated news summaries highlighting key investment implications, and real-time alerts only for events meeting your custom materiality thresholds. Join hundreds of investors who've recovered 10-15 hours weekly and improved decision quality by letting AI separate signal from noise. Stop drowning in information and start making informed decisions at StockSageAI.com—because 99% of news is designed to distract you, not inform you.