The Time Machine Effect: Why Patience Pays in Investing

If you could travel back to 1980 and invest $1,000, would you choose the “safe” 10-year Treasury bond or the “risky” stock market? The…

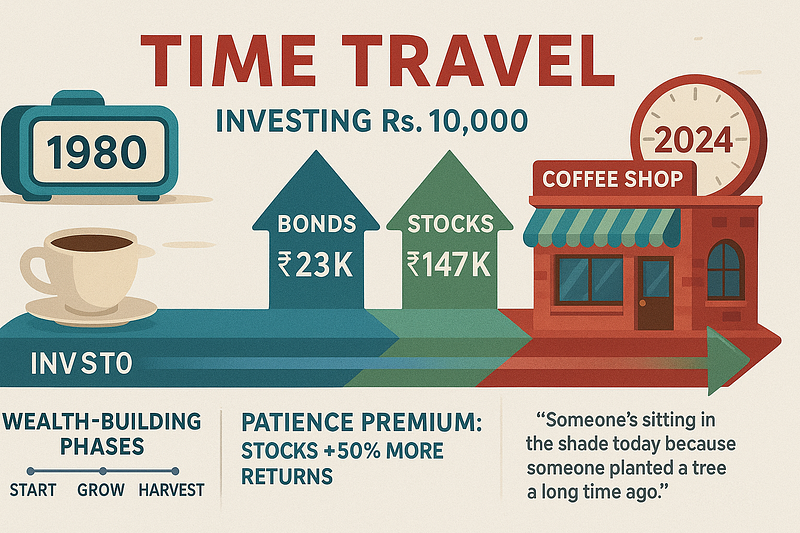

If you could travel back to 1980 and invest $1,000, would you choose the “safe” 10-year Treasury bond or the “risky” stock market? The answer will shock you.

The Time Machine Results:

The “Safe” Choice (10-Year Treasury Bonds):

- 1980 investment: $1,000

- 2024 value: $23,450

- Annual return: 7.8%

- Approach: Buy bonds, collect interest, reinvest

The “Risky” Choice (S&P 500 Stock Index):

- 1980 investment: $1,000

- 2024 value: $147,200

- Annual return: 12.1%

- Approach: Buy stocks, reinvest dividends, ignore volatility

Plot Twist: The “risky” choice made you 6x wealthier!

Why Time is Your Superpower:

The Compound Interest Magic: Think of compound interest as a snowball rolling downhill:

- Year 1: Small snowball

- Year 10: Basketball-sized

- Year 20: Boulder-sized

- Year 40: Avalanche-sized

Real Example — The Coffee Shop Test: Daily $5 coffee = $1,825 yearly

Option A: Spend on coffee for 40 years

- Total spent: $73,000

- What you get: 14,600 cups of coffee

Option B: Invest coffee money in stocks (10% return)

- Total invested: $73,000

- Ending value: $885,185

- Result: Nearly $900,000 (buy a coffee shop!)

The Patience Premium by Holding Period:

- 1 year holding: 68% chance of profit

- 5 year holding: 88% chance of profit

- 10 year holding: 94% chance of profit

- 20 year holding: 100% chance of profit (historically)

Real Long-Term Champions:

Microsoft (1990–2024):

- $1,000 investment: Now worth $380,000

- Annual return: 18.9%

- Key: Survived dot-com crash, adapted to cloud computing

Coca-Cola (1980–2024):

- $1,000 investment: Now worth $89,000

- Annual return: 10.8%

- Key: Consistent dividends, global expansion

The Wealth-Building Timeline:

Phase 1 (Years 1–10): The Boring Phase

- Returns seem slow

- Friends question your “boring” strategy

- Compound interest barely noticeable

Phase 2 (Years 11–20): The Momentum Phase

- Returns accelerate noticeably

- Portfolio starts feeling substantial

- Friends ask for investment advice

Phase 3 (Years 21–30): The Wealth Phase

- Compound interest becomes dominant force

- Portfolio generates significant passive income

- Financial freedom becomes reality

The Impatience Tax:

Average investor returns (2003–2023): 3.6%

S&P 500 returns (same period): 10.5%

Difference: 6.9% annually due to poor timing, panic selling, and impatience

The Dollar-Cost Averaging Secret: Instead of timing the market, invest consistently:

- $500 monthly for 30 years

- Total invested: $180,000

- Final value (at 10%): $1,130,244

- Autopilot wealth creation

Common Patience Killers:

- Checking portfolio daily (creates emotional decisions)

- Comparing to get-rich-quick stories

- Panic selling during market downturns

- Chasing last year’s hot stock

The Buffett Patience Test: “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Action Step: Set up automatic monthly investing and delete your brokerage app. Check your portfolio quarterly, not daily.

Think About This: Would you plant an oak tree if you knew it would make your grandchildren millionaires? Time in the market beats timing the market every single time.