The Restaurant Owner’s Secret to Measuring Profitability (ROE Explained)

Two restaurant owners each invested $100,000. One made $25,000 profit, the other made $15,000. Plot twist: The second owner is actually the…

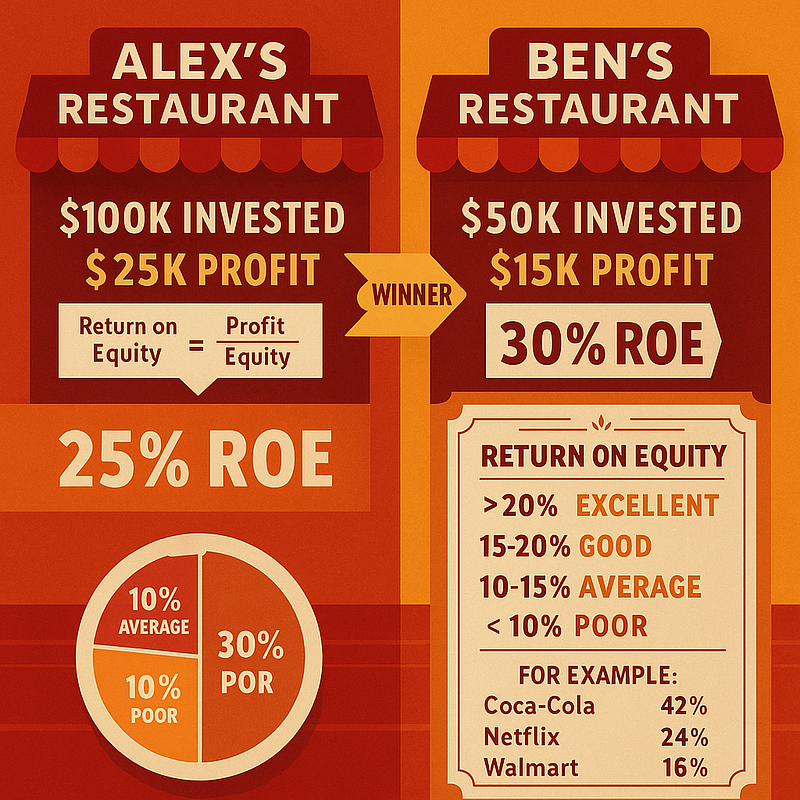

Two restaurant owners each invested $100,000. One made $25,000 profit, the other made $15,000. Plot twist: The second owner is actually the better businessman.

The Story: Meet Alex and Ben, both restaurant owners:

Alex’s Restaurant:

- Personal investment: $100,000

- Annual profit: $25,000

- Return on his investment: 25%

Ben’s Restaurant:

- Personal investment: $50,000

- Annual profit: $15,000

- Return on his investment: 30%

Who’s the better operator? Ben! He generated more profit per dollar of his own money invested.

The Stock Market Connection: This is Return on Equity (ROE) — how efficiently a company uses shareholders’ money to generate profits.

Formula: ROE = Net Income ÷ Shareholders’ Equity

Real Examples:

- Apple: $99.8B profit ÷ $62.1B equity = 161% ROE (exceptional!)

- Coca-Cola: $10.7B profit ÷ $24.2B equity = 44% ROE (excellent)

- Ford: $3.7B profit ÷ $44.8B equity = 8% ROE (needs improvement)

The ROE Quality Scale:

- Above 20%: Exceptional (like Ben’s restaurant)

- 15–20%: Good performance

- 10–15%: Average

- Below 10%: Poor capital efficiency

The Hidden Danger: Super high ROE (above 50%) might indicate excessive debt. It’s like a restaurant owner borrowing heavily to inflate profits — risky business.

Action Step: Check the ROE of your current stocks. Are you invested in efficient “restaurant owners” or capital-wasting managers?

Think About This: Would you rather own a restaurant generating 30% returns or invest in a savings account at 5%? ROE helps you find the 30% businesses.