The Rental Property Secret to Understanding P/E Ratios

Would you pay $500,000 for a rental property that only makes $10,000 per year? That’s exactly what you’re doing when you buy overpriced…

Would you pay $500,000 for a rental property that only makes $10,000 per year? That’s exactly what you’re doing when you buy overpriced stocks.

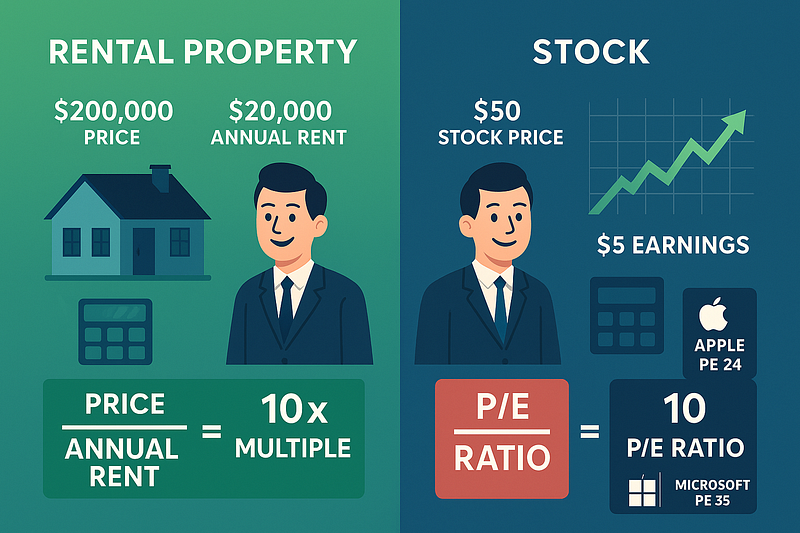

Meet Sarah, who’s shopping for rental properties. Property A costs $200,000 and generates $20,000 annual rent. Property B costs $400,000 but also generates $20,000 annual rent. Which would you choose?

Obviously Property A, right? It would take 10 years of rent to pay back your investment versus 20 years for Property B.

The Stock Market Connection: This is exactly how P/E ratios work. Instead of “Price-to-Rent,” we have “Price-to-Earnings.”

- Property A: Price ÷ Annual Rent = $200,000 ÷ $20,000 = 10x multiple

- Stock A: Stock Price ÷ Annual Earnings = $50 ÷ $5 = 10 P/E ratio

Real Example:

- Microsoft (MSFT): $420 stock price ÷ $12.93 earnings = 32.5 P/E

- Apple (AAPL): $195 stock price ÷ $6.42 earnings = 30.4 P/E

The Smart Investor’s Rule: Just like rental properties, lower P/E ratios generally mean better value — but check the neighborhood (industry averages) first. Tech stocks typically trade at 20–30 P/E, while utilities trade at 10–15 P/E.

Action Step: Before buying any stock, ask yourself: “Would I buy a rental property with this payback period?”

Think About This: If a company’s earnings are growing 25% annually, is a 25 P/E ratio actually reasonable? What would you pay for a rental property in a rapidly developing neighborhood?

For more such insights visit www.stocksageai.com and leverage the platform to make intelligent investment decisions.