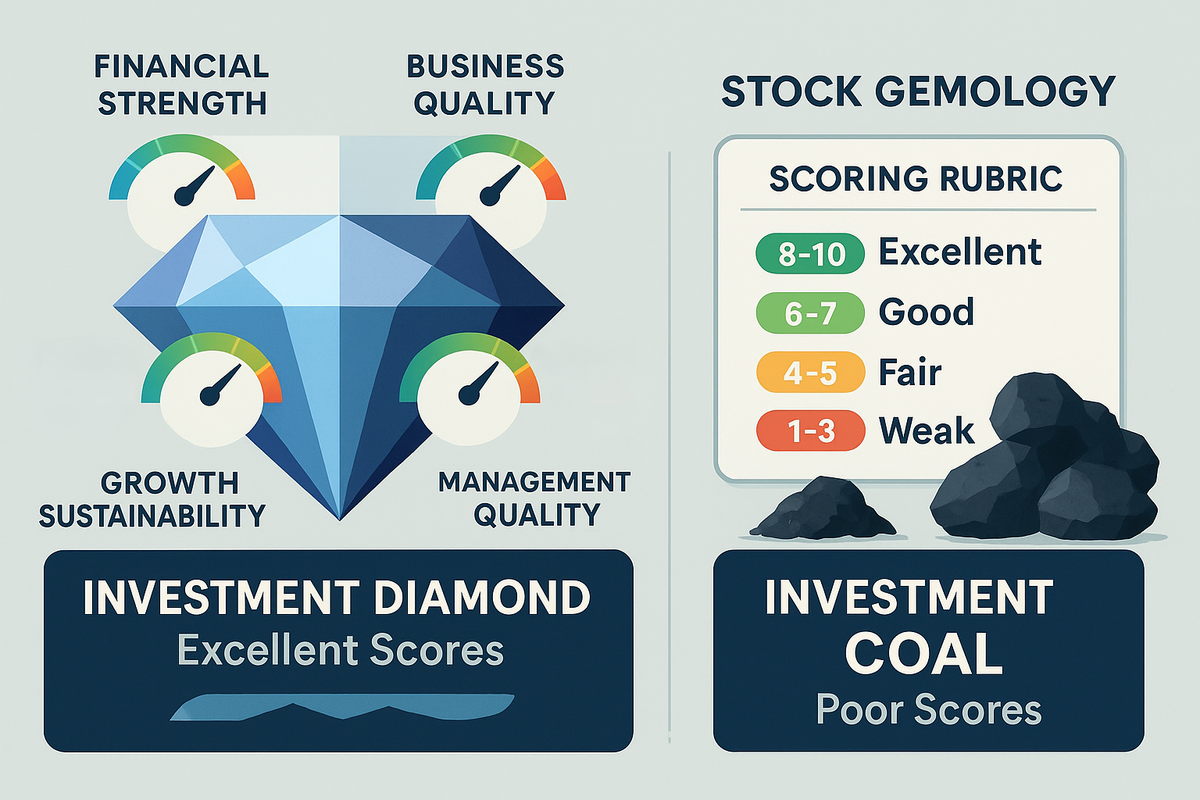

The Quality Score Card - How to Separate Investment Diamonds from Coal

Master the art of quality investing with a comprehensive scorecard system that separates investment diamonds from coal. Learn to evaluate companies across financial strength, business quality, management excellence, and growth sustainability for superior long-term returns.

Two companies have identical P/E ratios of 20. One is a future Amazon, the other is the next Enron. The difference isn't in the price - it's in the quality you can't see on the surface.

The Story: Imagine shopping for a used car. Two identical-looking cars are priced at $20,000. But one has a pristine maintenance record, low mileage, and careful ownership. The other has hidden engine problems, accident history, and questionable upkeep. Price is the same, but quality is worlds apart.

The Quality Investment Framework: High-Quality Company Characteristics:

✅ Strong competitive moats (hard to replicate advantages)

✅ Consistent profitability (makes money in good times and bad)

✅ Low debt levels (financial flexibility)

✅ Recurring revenue (predictable cash flows)

✅ Shareholder-friendly management (buybacks, dividends, transparency)

Low-Quality Company Warning Signs:

❌ Commoditized business (no pricing power)

❌ Erratic earnings (boom-bust cycles)

❌ High debt loads (financial risk)

❌ One-time revenue (unpredictable future)

❌ Management red flags (high turnover, poor communication)

The Quality Scorecard System:

Financial Strength (25 points possible):

- Debt-to-Equity under 0.5: +5 points

- Interest coverage over 10x: +5 points

- Current ratio over 1.5: +5 points

- Return on Equity over 15%: +5 points

- Free cash flow positive: +5 points

Business Quality (25 points possible):

- Market leadership position: +5 points

- Recurring revenue over 70%: +5 points

- Gross margins over 40%: +5 points

- Growing market share: +5 points

- Pricing power evident: +5 points

Management Quality (25 points possible):

- Long-tenured leadership: +5 points

- Shareholder-friendly actions: +5 points

- Clear strategic vision: +5 points

- Capital allocation discipline: +5 points

- Transparent communication: +5 points

Growth Sustainability (25 points possible):

- R&D spending over 5% of revenue: +5 points

- Market expansion opportunities: +5 points

- Technological advantages: +5 points

- Brand strength: +5 points

- Network effects present: +5 points

Quality Score Interpretation:

- 80-100 points: Elite quality, pay premium prices

- 60-79 points: High quality, fair value targets

- 40-59 points: Average quality, demand discounts

- 20-39 points: Below average, avoid

- 0-19 points: Poor quality, never buy

Real Company Quality Analysis:

Microsoft (Quality Score: 95/100) Financial Strength: 25/25

- Debt-to-equity: 0.35 ✅

- Interest coverage: 30x+ ✅

- Current ratio: 2.5 ✅

- ROE: 36% ✅

- Free cash flow: $65B+ ✅

Business Quality: 25/25

- Market leader in cloud computing ✅

- 95%+ recurring revenue (Office subscriptions) ✅

- Gross margins: 70% ✅

- Gaining Azure market share ✅

- Strong pricing power ✅

Management Quality: 23/25

- Satya Nadella's proven leadership ✅

- $60B+ annual buybacks ✅

- Clear AI and cloud strategy ✅

- Excellent capital allocation ✅

- Very transparent communication ✅

Growth Sustainability: 22/25

- R&D spending: 13% of revenue ✅

- AI and cloud expansion ✅

- Technology leadership ✅

- Strong brand recognition ✅

- Network effects in productivity software ✅

Generic Retail Company (Quality Score: 35/100) Financial Strength: 10/25

- High debt from store expansion ❌

- Thin interest coverage ❌

- Inventory management issues ❌

- Low ROE due to asset intensity ❌

- Positive but volatile cash flow ✅

Business Quality: 5/25

- Highly competitive retail space ❌

- Transaction-based revenue ❌

- Low margins due to competition ❌

- Losing market share to online ❌

- No pricing power ❌

Management Quality: 10/25

- Frequent leadership changes ❌

- Limited shareholder returns ❌

- Unclear digital strategy ❌

- Poor capital allocation (overbuilding stores) ❌

- Adequate communication ✅

Growth Sustainability: 10/25

- Minimal R&D investment ❌

- Declining market (brick-and-mortar retail) ❌

- No technological advantages ❌

- Weak brand differentiation ❌

- No network effects ❌

Quality Investing Strategies:

The Buffett Approach: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

- Focus: Quality first, price second

- Holding period: Forever (if quality remains)

- Valuation: Willing to pay premiums for exceptional businesses

The Quality-at-Discount Approach:

- Screen for high-quality companies (score 60+)

- Wait for temporary setbacks (market overreaction)

- Buy when quality meets value (temporarily depressed prices)

The Quality Growth Approach:

- Identify emerging quality leaders (score 70+)

- Pay fair prices for sustainable growth (PEG ratios under 2.0)

- Hold through market cycles (quality compounds over time)

Red Flags That Override Quality Scores: Even high-quality companies can become poor investments:

- Regulatory threats (antitrust, government intervention)

- Technological disruption (industry transformation)

- Management changes (cultural shifts)

- Market saturation (growth runway shrinking)

- Extreme overvaluation (price overwhelming quality)

Building a Quality Portfolio: Core Holdings (60% of portfolio):

- Quality Score 80+: Microsoft, Apple, Visa, Mastercard

- Characteristics: Market leaders, wide moats, consistent growth

Quality Growth (25% of portfolio):

- Quality Score 70+: Emerging leaders in growing markets

- Characteristics: High growth potential, building competitive advantages

Quality Value (15% of portfolio):

- Quality Score 60+: Temporarily discounted quality companies

- Characteristics: Short-term problems, long-term quality intact

Action Steps:

- Score your current holdings using the quality framework

- Identify quality gaps in your portfolio

- Research high-scoring companies in sectors you understand

- Set quality minimums (never buy below 40 points)

- Monitor quality changes (quarterly score updates)

Think About This: Price is what you pay, quality is what you get. In investing, as in life, quality eventually wins out over cheap alternatives.

Identify investment-grade companies with StockSageAI's comprehensive quality scoring and analysis tools. Our platform evaluates companies across multiple quality dimensions including financial strength, competitive moats, management quality, and growth sustainability. Access quality rankings, comparative analysis, and screening tools that help you build a portfolio of superior businesses across global markets. Start investing in quality companies at fair prices with StockSageAI.com.