The Psychology of Investing: Why Smart People Make Dumb Money Mistakes

Behavioral finance reveals cognitive biases cost investors 3-5% annually. Learn how loss aversion, confirmation bias, and herd mentality sabotage returns.

Behavioral finance reveals cognitive biases cost investors 3-5% annually. Learn how loss aversion, confirmation bias, and herd mentality sabotage returns.

The Story: When Your Brain Becomes Your Worst Enemy

Meet Rajesh, a successful software engineer with an IQ of 140. He built complex algorithms, managed teams of developers, and made logical decisions daily. Yet when it came to investing, he repeatedly made the same mistakes:

- March 2020: Sold all his stocks in panic as markets crashed, locking in 35% losses

- November 2020: Bought back in after markets had already recovered 60%, missing the entire rebound

- January 2021: Dumped ₹5 lakhs into trending "meme stocks" at peak valuations

- December 2021: Held onto losing tech stocks hoping they'd "come back," refusing to acknowledge his mistakes

The result? Despite a stellar bull market from 2020-2021, Rajesh underperformed bank fixed deposits.

The irony? Rajesh's brain—the same brain that solved complex engineering problems—was systematically sabotaging his investment returns.

Research from Dalbar's Quantitative Analysis of Investor Behavior reveals a shocking truth: The average equity investor underperforms the market by 2-3% annually—not because they pick bad stocks, but because their psychology leads them to buy high, sell low, and make emotional decisions at the worst possible moments.

Your brain isn't broken. It's running software designed for survival on the African savannah, not for navigating modern financial markets.

The Sophisticated Brain Analogy: Your Mental Operating System

Think of your brain as running two different operating systems simultaneously:

System 1 - The Survival OS (Fast Brain):

- Designed 200,000 years ago for immediate threats (lions, snakes, rival tribes)

- Makes instant decisions based on pattern recognition and emotion

- Optimized for: "Don't think, just run from the lion!"

- Processing speed: Milliseconds

- Energy usage: Low

- Accuracy in modern finance: Terrible

System 2 - The Analysis OS (Slow Brain):

- Evolved for complex problem-solving and logical reasoning

- Makes deliberate decisions based on data and analysis

- Optimized for: "Let me calculate the probability of this outcome"

- Processing speed: Seconds to hours

- Energy usage: High (requires glucose and mental effort)

- Accuracy in modern finance: Much better

The Problem: When money is involved, System 1 hijacks System 2. Your survival brain sees a market drop and screams "DANGER! SELL EVERYTHING!" before your analytical brain can calculate that historically, market corrections recover 100% of the time.

Nobel Prize winner Daniel Kahneman's research demonstrates that emotional reactions override rational analysis in 80% of financial decisions—even among professional investors who know better.

The Four Cognitive Biases Destroying Your Returns

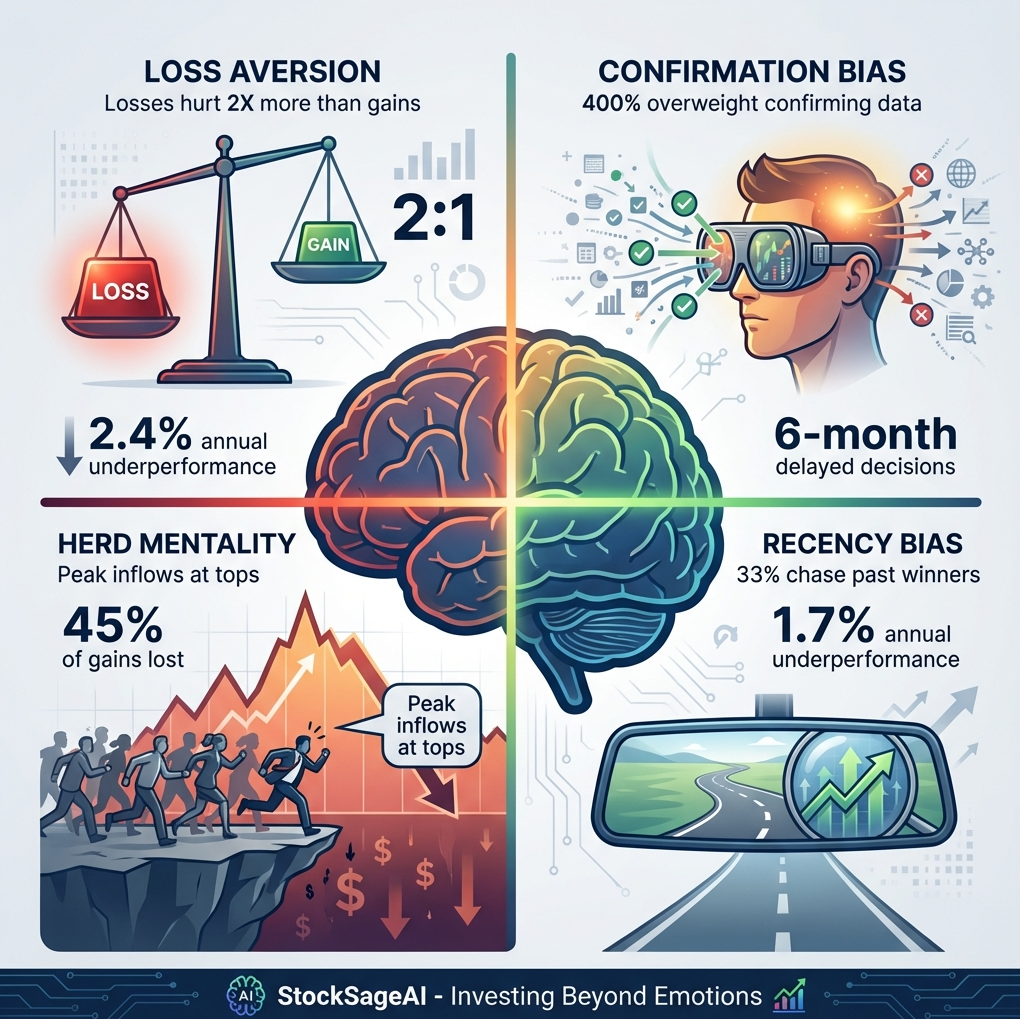

1. Loss Aversion: The 2:1 Pain-to-Pleasure Ratio

The Science: Research by Kahneman and Tversky proved that losing ₹1,000 causes twice as much emotional pain as gaining ₹1,000 brings pleasure.

How It Sabotages You:

- You hold losing stocks hoping they'll "come back" (avoiding the pain of admitting loss)

- You sell winning stocks too quickly (locking in pleasure before it "disappears")

- You avoid high-potential investments due to fear of potential losses

Real-World Impact: A Berkeley study tracked 10,000 retail investors over 5 years:

- Investors held losing stocks 124% longer than winning stocks

- Cost: 2.4% annual underperformance compared to buy-and-hold strategy

- Primary cause: Unwillingness to realize losses and admit mistakes

The Paradox: By trying to avoid small losses, you guarantee larger losses through opportunity cost.

2. Confirmation Bias: Your Brain's Echo Chamber

The Science: Once you own a stock or form an opinion, your brain selectively filters information to confirm your existing belief.

How It Sabotages You:

- Own HDFC Bank? You notice every positive news article and ignore warning signs

- Skeptical of EV companies? You'll find reasons why every Tesla success is "unsustainable"

- Made a prediction? You'll unconsciously seek evidence proving you're right

Real-World Impact: A Stanford study of 5,000 investors found:

- Investors overweight confirming information by 400% versus contradicting information

- 78% of investors could recall positive news about their holdings but only 23% recalled negative news

- This bias delayed selling decisions by an average of 6 months, amplifying losses

The Trading Floor Test: Professional traders are taught to actively seek information that disproves their thesis before making decisions. Retail investors do the opposite.

3. Herd Mentality: Safety in Numbers (Until the Cliff)

The Science: Your brain releases oxytocin (the "bonding hormone") when you agree with a group, making consensus feel emotionally rewarding—even when the group is wrong.

How It Sabotages You:

- "Everyone's buying this stock, so it must be good!" (Bitcoin at ₹52 lakhs in 2021)

- "Everyone's selling, time to get out!" (Panic selling during COVID crash)

- "This investment strategy is trending on social media!" (NFTs, anyone?)

Real-World Impact: Analysis of the 2000 Dot-com Bubble and 2008 Financial Crisis revealed:

- Peak retail investor inflows occur at market tops (buying when stocks are most expensive)

- Peak retail investor outflows occur at market bottoms (selling when stocks are cheapest)

- Herd behavior cost average investors 45% of potential gains over market cycles

Historical Pattern: Every bubble in history follows the same script:

- Smart money buys early (value phase)

- Media amplifies success stories (awareness phase)

- Retail investors pile in en masse (mania phase)

- Market crashes; retail investors left holding the bag (despair phase)

4. Recency Bias: Your Brain's Faulty Prediction Model

The Science: Your brain overweights recent events when predicting the future, assuming "what just happened will keep happening."

How It Sabotages You:

- Market up 30% last year? You expect another 30% (ignoring mean reversion)

- Three consecutive losing trades? You assume you've "lost your edge" (ignoring statistical variance)

- Recent inflation fears? You overweight inflation risk in your portfolio allocation

Real-World Impact: Morningstar's analysis of mutual fund flows shows a devastating pattern:

- 33% of all investor money flows into funds after they've had their best performance (when returns tend to revert)

- Only 12% of investor money flows into funds during underperformance (when future returns are typically highest)

- Result: 1.7% annual underperformance versus simply holding the fund through cycles

The Numbers Don't Lie: The stock market has positive returns in 73% of all years historically, yet most retail investors feel pessimistic after every 10% correction, projecting recent drops into the future indefinitely.

Professional Insights: Rewiring Your Investment Brain

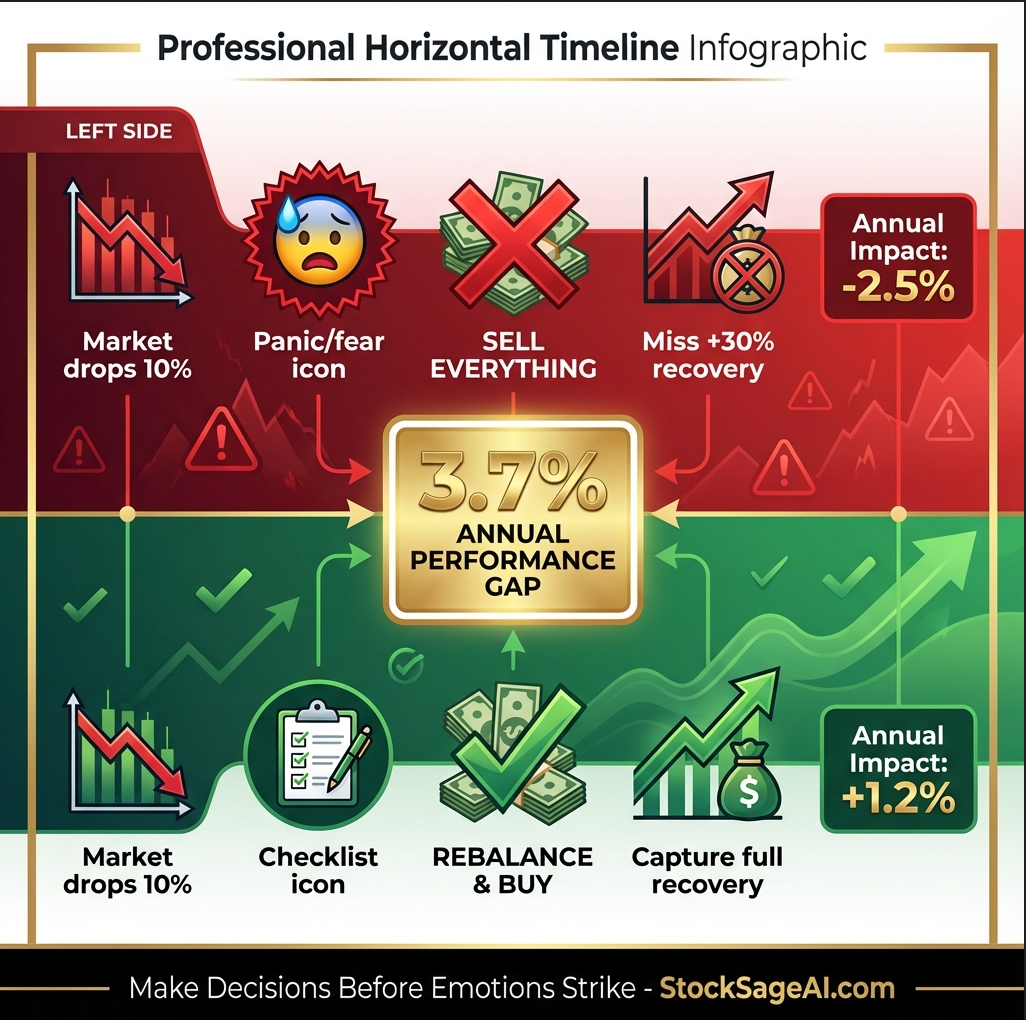

✅ Create Decision Rules Before Emotion Strikes

- Pre-define sell rules: "I'll sell if fundamentals deteriorate by X metrics" (not "when I feel worried")

- Set rebalancing schedules: "Review quarterly on fixed dates" (not "whenever the market looks scary")

- Establish position limits: "Max 10% in any single stock" (removes agonizing over how much to buy)

Why It Works: Decisions made in calm states are rational; decisions made in emotional states are reactive.

✅ Implement Systematic Investment Plans (SIPs)

- Automate monthly investments regardless of market sentiment

- Removes timing decisions (the decision most destroyed by psychology)

- Historical data: SIPs outperform lump-sum timing attempts 78% of the time over 10+ years

Why It Works: You can't make emotional decisions if the decision is automated.

✅ Track Your Behavioral Biases Like Performance Metrics

- Journal every investment decision with your reasoning

- Review decisions quarterly: Identify emotional versus analytical choices

- Calculate the cost of each bias (how much did panic selling cost you?)

Why It Works: Awareness is the first step to behavioral change; measurement drives improvement.

✅ Seek Contradicting Data Deliberately

- Before buying: Spend 30 minutes researching why you shouldn't buy

- Own a stock? Subscribe to opinions from bearish analysts too

- Join investment groups with diverse viewpoints (not echo chambers)

Why It Works: Forced cognitive dissonance breaks confirmation bias loops.

✅ Use Checklists to Override Emotions

- Investment Checklist: "Does the stock meet 8/10 quantitative criteria?"

- Sell Checklist: "Have fundamentals deteriorated, or am I just scared?"

- Rebalancing Checklist: "Is allocation 10% off target?" (not "Does the market feel risky?")

Why It Works: Checklists force System 2 (analytical brain) to engage before System 1 (emotional brain) takes over.

✅ Implement 72-Hour Cooling Periods

- Feel urgent need to buy/sell? Wait 72 hours

- Write down your reasoning; revisit after 3 days

- If logic still holds without emotion, proceed

Why It Works: Emergencies are rare; FOMO and panic are common. Time filters emotion from signal.

Action Steps to Master Investment Psychology

- Diagnose your biggest bias - Review your last 10 trades; which bias appears most?

- Create your decision checklist - Write 5 non-negotiable criteria before buying any stock

- Set automation - Automate monthly investments to remove timing emotions

- Track behavioral costs - Calculate how much your biases cost you last year

- Implement cooling periods - No trade decisions within 72 hours of impulse

How StockSageAI Helps You Overcome Psychological Biases

Emotion-Free Stock Screening: StockSageAI's AI-powered screening removes emotional decision-making from stock selection. Our algorithms analyze companies across US, Indian, and European markets using:

- Quantitative criteria that eliminate confirmation bias (pure data, no opinions)

- Multi-factor analysis that prevents recency bias (includes long-term trends, not just recent performance)

- Risk-adjusted scoring that counters loss aversion (balances upside potential with downside protection)

Behavioral Nudges & Alerts: The platform's AI advisor is designed to counteract herd mentality:

- Rebalancing alerts when portfolios drift from targets (systematic versus emotional decisions)

- Overbought/oversold signals to highlight when consensus may be wrong

- Historical context for market movements ("Current correction is normal; 14 similar events recovered in avg. 4.2 months")

Automated Portfolio Management: StockSageAI removes the emotional component from portfolio decisions:

- Systematic rebalancing based on pre-set rules (not market panic)

- Diversification monitoring to prevent concentration bias

- Performance attribution that separates luck from skill (confronts overconfidence bias)

Investment Journals & Analytics: Track your decision-making patterns:

- Review past trades with timestamped reasoning

- Identify emotional versus analytical decisions

- Calculate the cost of cognitive biases on your returns

Conquer your investment psychology with StockSageAI's intelligent platform. Our AI-driven analysis removes emotional decision-making from stock selection, while systematic screening and rebalancing tools help you stick to rational strategies during market chaos. Access emotion-free stock screening, automated portfolio optimization, and behavioral finance alerts designed to overcome the cognitive biases that sabotage returns. Join hundreds of disciplined investors who've added 3-5% annual performance simply by removing psychology from their process. Start making systematic, data-driven decisions today at StockSageAI.com and let artificial intelligence keep your emotions in check.