The Market's Mood Ring - Understanding Fear & Greed Cycles

Master the market's emotional cycles with the Fear & Greed Index. Learn how current 2025 readings swinging from extreme fear (3) to dangerous greed (71) create precise buying and selling opportunities for disciplined investors.

Just like a mood ring changes color with your emotions, the stock market has its own emotional barometer - and right now, it's flashing warning signals that smart investors need to decode.

Imagine if your emotions controlled the temperature in your house. When you're excited (greedy), the heat cranks up to unbearable levels. When you're scared (fearful), it drops to freezing. That's exactly how the stock market works.

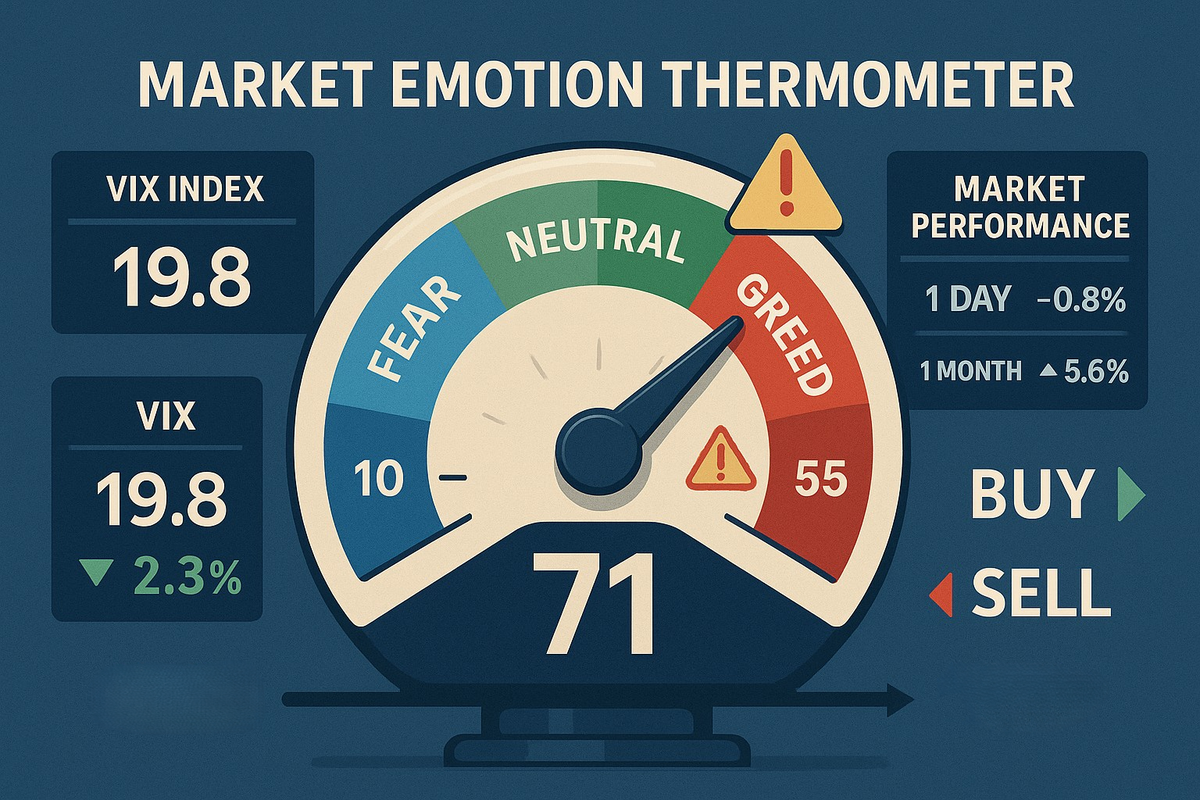

Current Market Reality: As of 2025, the CNN Fear & Greed Index has been swinging wildly - hitting extreme fear levels of just 3 in April 2025 (lowest since March 2020), then surging to greed levels of 71 by May. This emotional roller coaster directly impacts your investment returns.

The Fear & Greed Thermometer:

- Extreme Fear (0-25): Market "hypothermia" - stocks on sale

- Fear (25-45): Cool temperatures - good buying opportunities

- Neutral (45-55): Room temperature - balanced market

- Greed (55-75): Getting hot - be cautious

- Extreme Greed (75-100): Market "fever" - danger zone

Real Data Examples: April 2025: Fear Index hit 3

- What happened: S&P 500 dropped from $516 to historic lows

- Smart move: This was actually prime buying time

- Result: Those who bought during fear saw 17% gains in following weeks

May 2025: Greed Index reached 71

- What happened: S&P 500 rallied to $587, near year-high of $613

- Smart move: Time to take some profits

- Lesson: Greed levels above 70 often precede pullbacks

The Contrarian's Secret: Warren Buffett's famous advice: "Be fearful when others are greedy, and greedy when others are fearful."

Current Market Translation:

- When Fear Index drops below 20: Start buying quality stocks

- When Greed Index rises above 70: Consider taking profits

- When VIX (fear gauge) spikes above 30: Look for opportunities

Action Steps:

- Track the Fear & Greed Index weekly (it's free and updated daily)

- Set alerts: Buy signals when fear hits extreme levels

- Create rules: "I'll invest more when fear is extreme, less when greed dominates"

Think About This: If everyone else is panicking and selling, who's getting the bargains? The investors who understand that markets run on emotion, not logic.

Ready to turn market emotions into investment opportunities? StockSageAI's sentiment analysis tools help you identify optimal entry and exit points across global markets. Our AI-powered screening combines technical indicators with market psychology metrics to pinpoint stocks during fear-driven selloffs and greed-fueled rallies. Start with our free tier to access basic sentiment screening, then upgrade for advanced market timing features. Transform market volatility into systematic profits at StockSageAI.com.