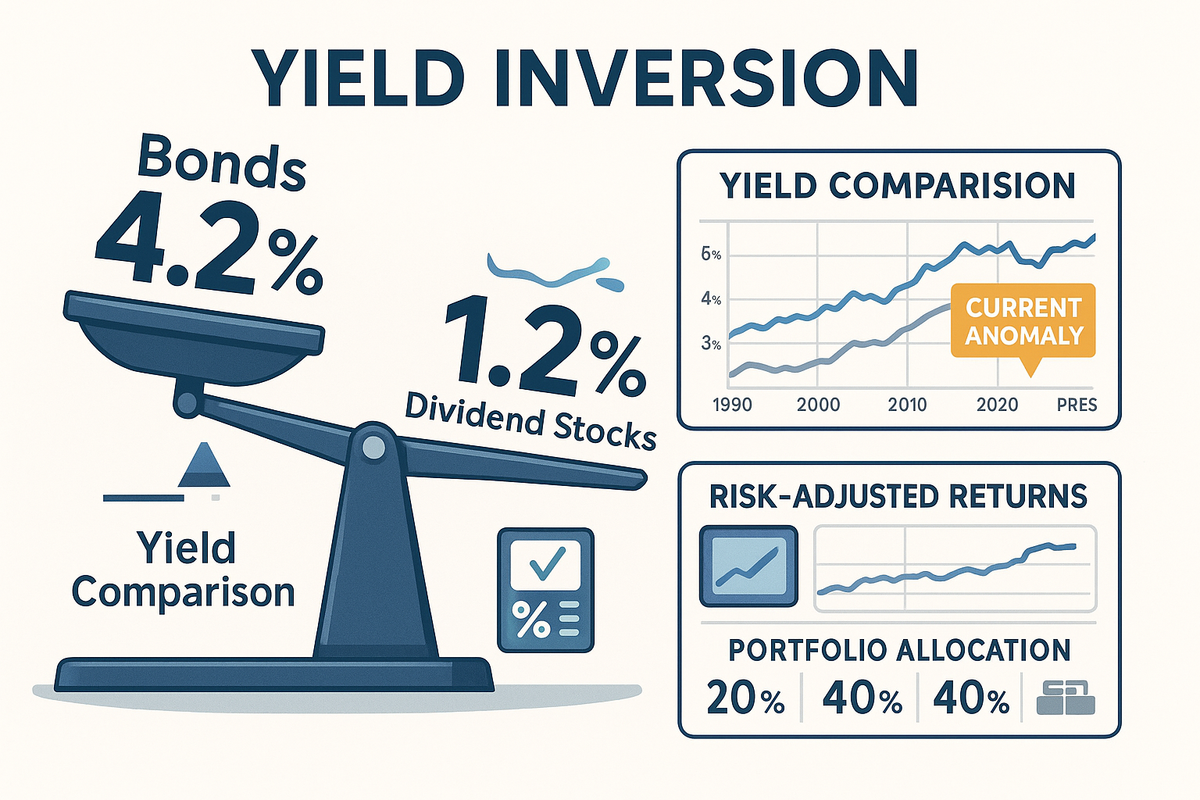

The Interest Rate Seesaw - How 4% Bonds Are Crushing 1% Dividend Stocks

Navigate the income investing revolution as 4.2% risk-free bonds outpay 1.2% dividend stocks for the first time in decades. Discover how rising interest rates are reshaping portfolio allocation and creating new opportunities in fixed income.

Your "safe" dividend stock paying 1.2% is getting demolished by a risk-free Treasury bond paying 4.2%. The income investing world has been turned upside down, and most investors don't realize it yet.

The Story: Imagine you're choosing between two jobs:

- Job A: $50,000 salary, but company might go bankrupt

- Job B: $42,000 salary, guaranteed by the U.S. government

Most people would choose Job B. But dividend investors are somehow choosing Job A every day.

The Great Income Inversion: For the first time in over 20 years, government bonds are paying more than dividend stocks with significantly less risk.

Current Yield Comparison (2025):

- 10-Year Treasury: 4.2% (risk-free)

- High-yield savings: 4.5% (FDIC insured)

- S&P 500 dividend yield: 1.28% (market risk)

- Investment-grade corporate bonds: 5.5%

- High-yield corporate bonds: 7.8%

The Fed Model Reality Check: The "Fed Model" suggests that stock earnings yields (earnings ÷ price) should roughly equal bond yields. Here's the current mismatch:

S&P 500 earnings yield: 3.6% (1 ÷ P/E of 27.6) 10-year Treasury yield: 4.2%

Translation: Bonds are offering better risk-adjusted returns than stocks for the first time since 2008.

Why This Matters for Your Portfolio:

The Old World (2010-2021):

- Bonds: 1-3% yields (investors called them "certificates of confiscation")

- Dividend stocks: 2-4% yields (seemed attractive by comparison)

- Strategy: "There Is No Alternative" (TINA) to stocks

The New World (2022-2025):

- Bonds: 4-5% yields (attractive risk-free returns)

- Dividend stocks: 1-3% yields (no longer competitive)

- Strategy: Alternatives exist - choose wisely

Interest Rate Impact on Different Investments:

Winners in Higher Rate Environment:

✅ Banks: Net interest margins expanding

✅ Insurance companies: Earning more on float

✅ Money market funds: Directly benefit from higher rates

✅ Bond funds (new purchases): Locking in higher yields

Losers in Higher Rate Environment:

❌ REITs: Higher borrowing costs, less attractive yields

❌ Utilities: Bond-like stocks compete directly with actual bonds

❌ High-dividend stocks: Yield becomes less compelling

❌ Growth stocks: Future cash flows worth less when discounted at higher rates

Real Portfolio Impact: Conservative Investor's Dilemma:

- Before: 60% stocks, 40% bonds (bonds yielded 2%)

- Now: Same allocation means accepting 1.3% dividend yield when bonds pay 4%+

- Better approach: Maybe 40% stocks, 60% bonds makes more sense

The Bond Ladder Opportunity: Instead of chasing risky dividend stocks, consider building a bond ladder:

1-Year Treasury: 4.8%

2-Year Treasury: 4.6%

3-Year Treasury: 4.4%

5-Year Treasury: 4.3%

10-Year Treasury: 4.2%

Strategy: Buy bonds maturing in different years to create steady income stream with known returns.

Dividend Stock Survival Guide: Not all dividend stocks are doomed. Focus on:

Dividend Growth Champions:

- Microsoft: 0.7% yield but growing 10%+ annually

- Apple: 0.5% yield but massive buyback program

- Visa: 0.8% yield but 15%+ annual dividend growth

High-Quality High Yielders:

- Realty Income: 5.1% yield, monthly payments, 30-year track record

- Brookfield Infrastructure: 5.2% yield, inflation-protected contracts

- Enterprise Products Partners: 8.1% yield, energy infrastructure

The 4% Rule Reality Check: The traditional retirement "4% withdrawal rule" was based on historical bond yields of 6-8%. With current yields at 4%+, the math works again:

New Retirement Strategy:

- Build bond ladder providing 4% annual income

- Use stock portfolio for growth and inflation protection

- Reduce sequence-of-returns risk by having guaranteed income base

Sector Rotation Strategy: As interest rates stabilize or begin to fall:

- Early cycle: Financials benefit first

- Mid cycle: Technology and growth stocks recover

- Late cycle: Utilities and REITs become attractive again

Action Steps for Current Environment:

- Recalculate your income needs - can bonds meet them?

- Compare all yields to risk-free alternatives

- Consider bond allocation increase for steady income

- Focus on dividend growth over current dividend yield

- Build cash reserves at 4%+ for future opportunities

Smart Fixed Income Strategies:

- I-Bonds: Inflation protection, currently yielding 5%+

- TIPS: Treasury Inflation-Protected Securities

- CD ladders: FDIC insured, predictable returns

- High-grade corporate bonds: Extra yield for minimal extra risk

Think About This: When risk-free returns exceed risky returns, the smart money chooses safety. Your dividend stocks need to justify their risk with superior total returns.

Optimize your income strategy with StockSageAI's yield comparison and fixed income analysis tools. Our platform compares dividend yields to bond alternatives, analyzes interest rate sensitivity across sectors, and identifies the best risk-adjusted income opportunities. Access comprehensive yield screening, duration analysis, and income portfolio optimization across global markets. Build a balanced income strategy that adapts to changing interest rate environments at StockSageAI.com.