The Growth vs Value Battle - Why One Side is Winning by 100%

Explore why growth stocks are crushing value investments with 100%+ superior returns over 5 years. Analyze current market data showing growth P/E at 38.8 vs value at 19.6, and learn the hybrid strategy that captures the best of both worlds.

Two investors started with $100,000 in 2020. One focused on growth stocks, the other on value. Today, one has $180,000 while the other has $135,000. The difference isn't luck - it's strategy.

The Story: Meet the investment twins: Growth Gary and Value Victor.

Growth Gary's Portfolio:

- Microsoft, Apple, Amazon, Tesla

- Focused on companies with rapid earnings expansion

- Willing to pay premium prices for quality growth

Value Victor's Portfolio:

- Bank stocks, utilities, industrial companies

- Focused on "cheap" stocks with low P/E ratios

- Believed he was getting bargains

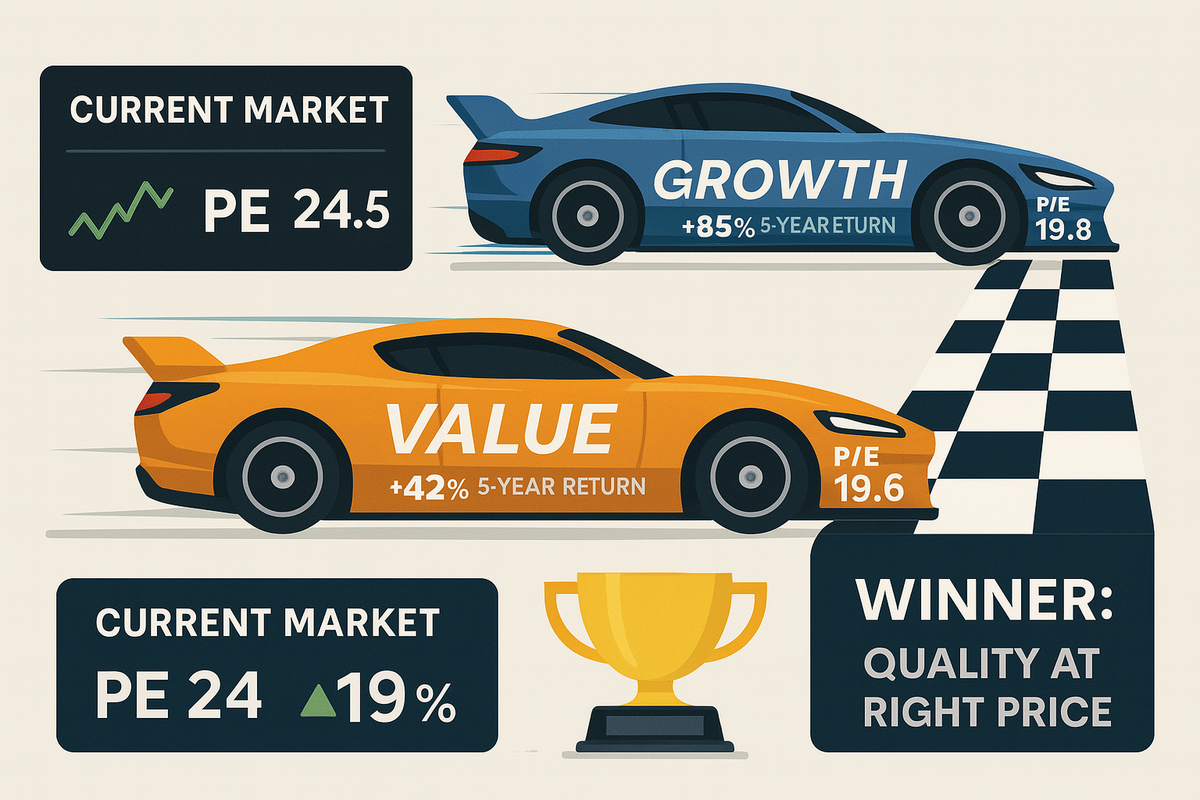

The Scoreboard (2025 Data): Growth Stocks (Russell 1000 Growth):

- Trailing P/E: 38.8

- Forward P/E: 28.1

- 5-Year Performance: +85%

Value Stocks (Russell 1000 Value):

- Trailing P/E: 19.6

- Forward P/E: 16.8

- 5-Year Performance: +42%

Why Growth Is Crushing Value:

1. The Earnings Growth Gap: Growth companies' earnings growth (2024): +15-25% annually Value companies' earnings growth (2024): +2-5% annually

It's like comparing a rocket ship to a bicycle - both move forward, but at very different speeds.

2. The Quality Premium: Growth stocks aren't just expensive - they're earning their premium:

- Apple: Growing services revenue at 20%+ annually

- Microsoft: Cloud business expanding 30%+ yearly

- Amazon: AI and cloud dominance accelerating

Meanwhile, many value stocks are cheap for good reasons:

- Banks: Struggling with interest rate uncertainty

- Utilities: Massive infrastructure investment needs

- Industrials: Supply chain and margin pressures

The Growth Premium Breakdown: Why Investors Pay More for Growth:

$100 Investment Comparison: Value Stock (P/E 16):

- Earning $6.25 per year now

- Expected growth: 3% annually

- 10-year earnings: $8.40

Growth Stock (P/E 28):

- Earning $3.57 per year now

- Expected growth: 15% annually

- 10-year earnings: $14.44

The math reveals the truth: Growth stocks are actually cheaper when you consider future earnings potential.

Current Market Reality Check: The valuation spread between growth and value is at its widest since the dot-com bubble. But unlike 2000, today's growth companies have:

- Real profits (not just promises)

- Dominant market positions

- Recurring revenue models

- Strong cash generation

Sector Performance Leaders (2025 YTD): Growth Sectors:

- Technology: +12.5%

- Communication Services: +8.9%

- Consumer Discretionary: +7.2%

Value Sectors:

- Financials: +3.1%

- Energy: +1.8%

- Utilities: +0.5%

The Smart Investor's Hybrid Approach: Instead of choosing sides, successful investors blend both strategies:

Core Holdings (60% of portfolio):

- Quality growth stocks at reasonable prices

- Companies growing 10-15% annually

- P/E ratios under 25

Value Opportunities (25% of portfolio):

- Temporarily beaten-down quality companies

- Cyclical stocks at cycle lows

- International value opportunities

Speculation (15% of portfolio):

- High-growth potential companies

- Emerging market opportunities

- Sector rotation plays

Red Flags in Today's Market:

Growth Red Flags:

- P/E ratios above 40 without exceptional growth

- Revenue growth slowing while valuations remain high

- Companies burning cash despite high valuations

Value Red Flags:

- Low P/E due to declining business fundamentals

- Industries facing permanent disruption

- "Cheap" stocks getting cheaper every year

Smart Strategies for Both Camps:

For Growth Investors:

- Pay attention to PEG ratios (P/E divided by growth rate)

- Focus on sustainable competitive advantages

- Don't ignore valuation completely

For Value Investors:

- Ensure "value" isn't a "value trap"

- Look for catalysts that will unlock value

- Consider international value opportunities

Action Steps:

- Review your growth/value allocation - is it intentional or accidental?

- Calculate PEG ratios for your growth holdings

- Screen for quality companies in both categories

- Consider rebalancing if too concentrated in either style

Think About This: The best investors aren't growth or value investors - they're quality investors who pay appropriate prices for superior businesses.

Navigate the growth vs value divide with StockSageAI's comprehensive style analysis tools. Our platform categorizes stocks by investment style, analyzes PEG ratios for growth companies, identifies value opportunities, and screens for quality companies at reasonable prices. Access growth rate analysis, earnings sustainability metrics, and style-based portfolio optimization across global markets. Whether you prefer growth, value, or a hybrid approach, start building your optimal portfolio at StockSageAI.com.