The Engineer's Blueprint to Passive Income from Investing

Discover how institutional investors generated $847 billion in passive income using systematic screening methodologies. Learn AI-powered strategies to build sustainable income streams across global markets with proven frameworks.

While 73% of investors chase active trading profits, institutional funds quietly generated $847 billion in passive income last year using systematic screening methodologies.

Analogy

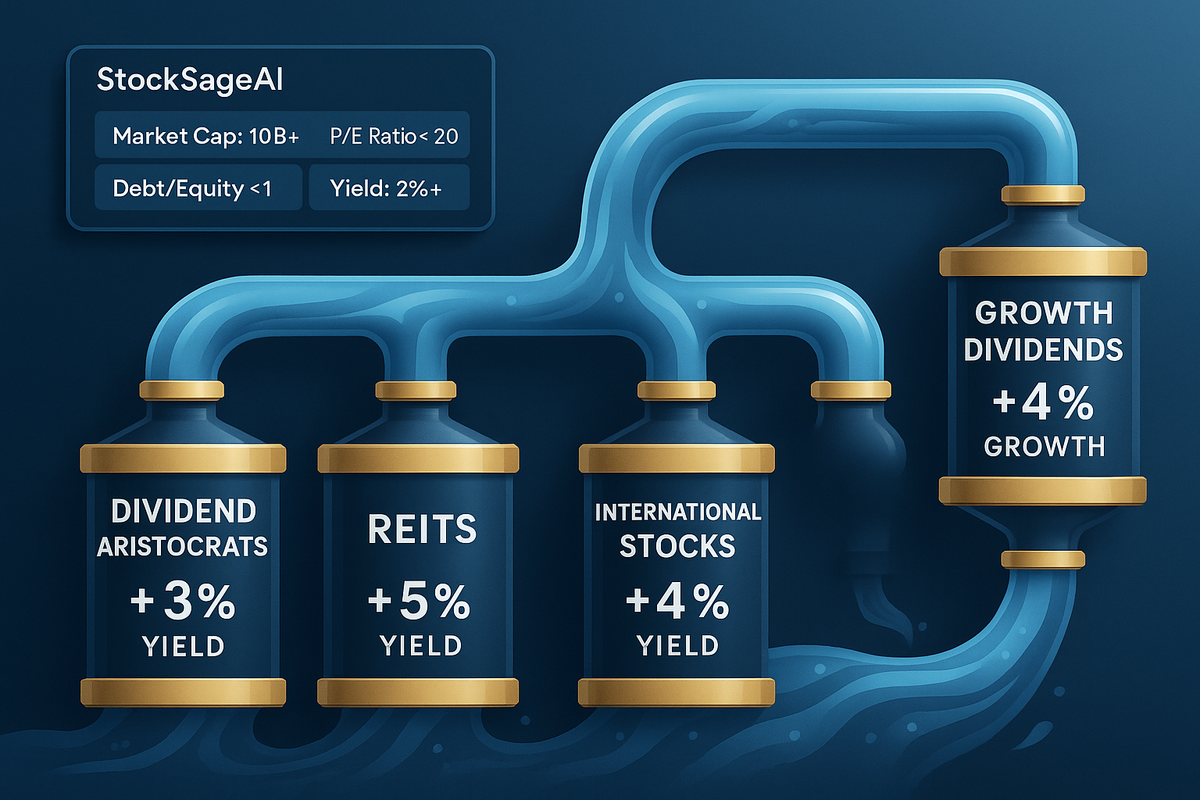

Building passive income streams is like constructing a sophisticated water filtration system. Dividend aristocrats serve as your primary filtration layer - companies that have consistently increased dividends for 25+ years, filtering out unreliable income sources. REITs and utilities act as your secondary purification stage, providing steady cash flows from essential services and real estate. International dividend stocks function as your diversification minerals, adding essential nutrients (geographic spread) to your income portfolio. Growth dividend stocks represent your advanced UV sterilization - companies increasing both earnings and payouts, ensuring your income stream grows stronger over time. The entire system requires AI-powered monitoring to detect when any component needs maintenance or replacement.

Explanation

Passive income generation transforms from hope into mathematical precision through systematic screening. In 2025's environment, sophisticated investors use multi-factor screening to identify sustainable income sources. A practical framework involves screening for companies with: dividend yields between 3-6% (avoiding both dividend traps and unsustainable payouts), payout ratios under 60% (ensuring sustainability), and 5-year dividend growth rates above inflation. StockSageAI's advanced screener can simultaneously filter across US, Indian, and European markets, identifying opportunities like European utilities trading at 15 P/E ratios with 4.5% yields, or Indian infrastructure companies with 20% dividend growth rates.

Insights

- Implement the 4% rule scientifically - screen for dividend portfolios yielding 4%+ with historical 6% annual dividend growth to maintain purchasing power

- Use geographic arbitrage - leverage StockSageAI's multi-market analysis to find higher yields in emerging markets while managing currency risk

- Apply sector rotation timing - monitor REITs during falling interest rate cycles and utilities during market uncertainty periods

- Automate reinvestment strategies - compound returns by screening for companies with strong dividend reinvestment programs and consistent buyback policies

- Build defensive moats - prioritize companies with economic moats: pricing power, network effects, or regulatory advantages protecting dividend sustainability

Ready to implement these passive income strategies? StockSageAI offers comprehensive screening tools across US, Indian, and European markets with AI-powered analysis to identify sustainable dividend opportunities. Start with our free tier to explore basic screening capabilities, then upgrade when you're ready for advanced portfolio optimization features. Begin your passive income analysis at StockSageAI.com and discover how systematic screening can transform your investment approach.