The Dividend Paycheck: Stocks That Pay You to Own Them

Imagine if your house paid you rent every month just for living in it. That’s exactly what dividend stocks do — they pay you for the…

Imagine if your house paid you rent every month just for living in it. That’s exactly what dividend stocks do — they pay you for the privilege of owning them.

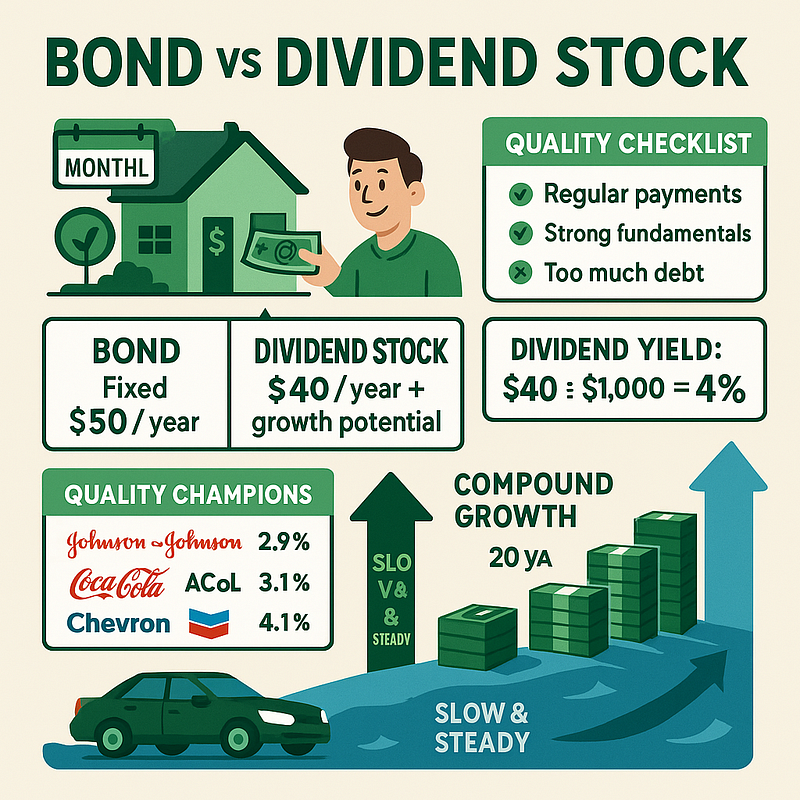

Scenario A: Buy a $1,000 bond earning 5% annually = $50 yearly income Scenario B: Buy $1,000 in dividend stocks yielding 4% = $40 yearly income + potential growth

But here’s the magic: the bond stays $1,000 forever, while the stock can grow to $1,200, $1,500, or more.

Real Dividend Champions:

The Dependable Tenant (Coca-Cola):

- Dividend Yield: 3.1%

- Track Record: 61 consecutive years of dividend increases

- $1,000 investment: Pays $31 annually, grows over time

The Generous Landlord (Verizon):

- Dividend Yield: 6.8%

- Track Record: Steady telecom cash flows

- $1,000 investment: Pays $68 annually

The Growing Tenant (Microsoft):

- Dividend Yield: 0.7% (seems low, but…)

- Growth Rate: Increases dividend 10%+ annually

- $1,000 investment: Pays $7 now, could be $15 in 5 years

The Dividend Yield Formula: Annual Dividend per Share ÷ Stock Price = Dividend Yield

Example: Johnson & Johnson

- Annual dividend: $4.76 per share

- Stock price: $150

- Yield: $4.76 ÷ $150 = 3.17%

The Dividend Quality Checklist:

✅ Green Flags:

- Dividend paid for 10+ consecutive years

- Payout ratio under 60% (company keeps 40% of profits)

- Growing earnings support growing dividends

- Strong cash flow covers payments easily

❌ Red Flags:

- Yield above 8% (often unsustainable)

- Payout ratio above 80% (little margin for error)

- Cutting dividends recently

- Borrowing money to pay dividends

The Compound Magic: $10,000 in S&P 500 dividend stocks (2% yield):

- Year 1: $200 dividends

- Year 10: $366 dividends (assuming 6% annual dividend growth)

- Year 20: $641 dividends + massive stock appreciation

Dividend Strategy by Life Stage:

- 20s-30s: Focus on dividend growers (Microsoft, Apple)

- 40s-50s: Mix of growth and yield (Coca-Cola, Johnson & Johnson)

- 60s+: Higher-yield focus (utilities, REITs)

Action Step: Calculate your portfolio’s current dividend yield. If it’s below 2%, you’re missing free money.

Think About This: Would you rather have a savings account paying 0.5% or dividend stocks paying 3%+ with growth potential? Your future self will thank you for choosing wisely.