The Dividend Drought - Why Your "Safe" Income Investments Aren't So Safe

Uncover the hidden risks in dividend investing as S&P 500 yields hit 20-year lows at 1.2% while risk-free bonds pay 4.2%. Learn to identify sustainable dividend champions and avoid high-yield traps in today's challenging income environment.

Imagine if your employer announced they're cutting everyone's salary by 90% but expected you to stay just as motivated. That's what happened to dividend investors in 2024.

The Story: Rebecca, a retiree, built her entire investment strategy around dividend income. She owned what she thought were "safe" dividend stocks yielding 6-8%. Then 2024 happened.

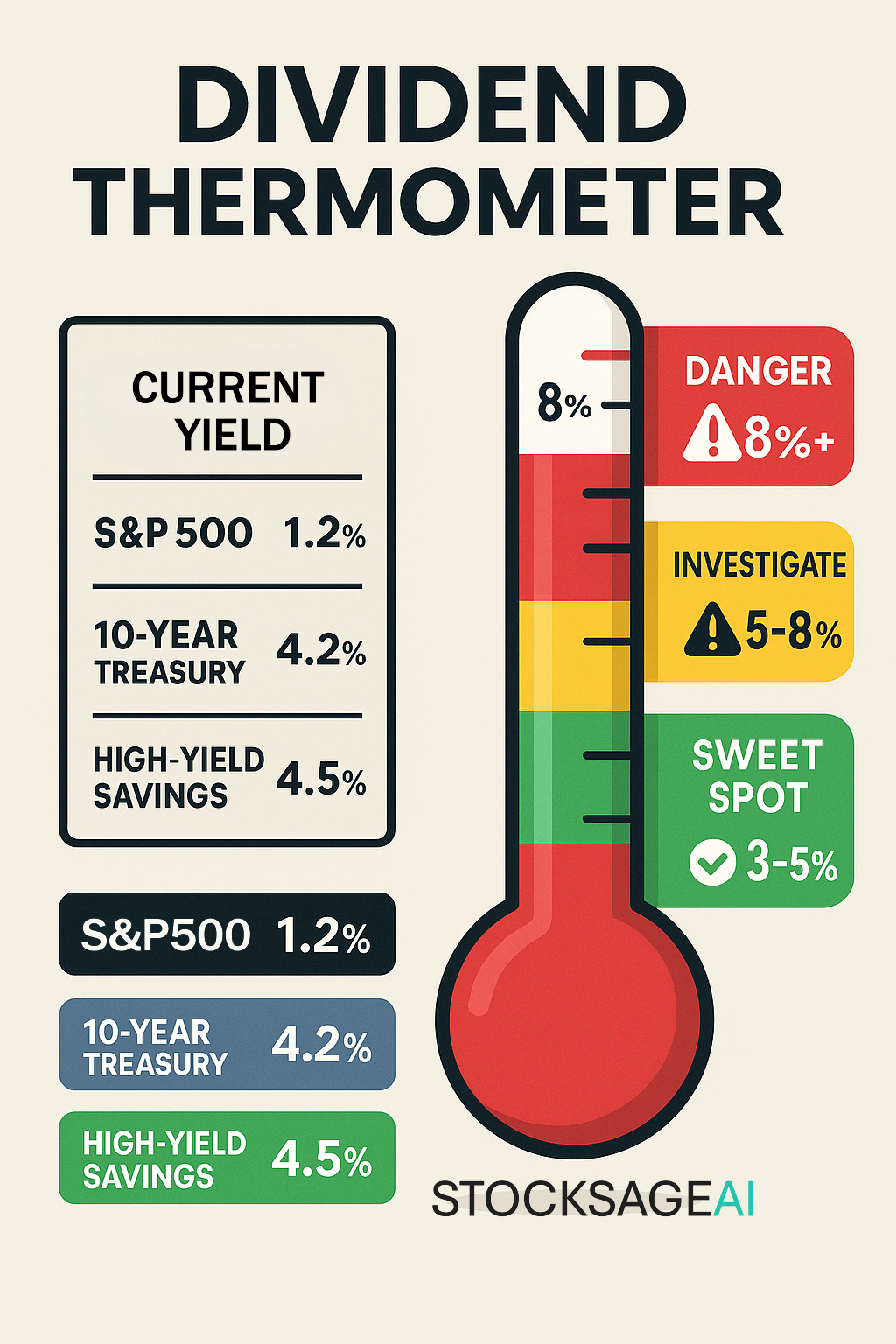

The Harsh Reality: The S&P 500 dividend yield hit 1.2% in late 2024 - the lowest in over 20 years. Meanwhile, 10-year Treasury yields climbed to 4.2%. Rebecca's "safe" dividend stocks suddenly looked risky and poorly paid.

Current Dividend Landscape (2025 Data): S&P 500 Average Yield: 1.28% 10-Year Treasury Yield: 4.2% High-Quality Corporate Bonds: 5.5% Risk-Free Savings: 4.5%

The Income Investor's Dilemma: Rebecca could now earn 4.5% risk-free in a savings account, but her dividend stocks were paying just 1.2% while losing value. She faced the cruel reality: her "conservative" strategy was actually the riskiest option.

The Great Dividend Divide: Traditional Dividend Champions:

- Coca-Cola: 3.1% yield (above average but still below bonds)

- Johnson & Johnson: 3.2% yield (pharmaceutical risks emerging)

- Procter & Gamble: 2.4% yield (consumer staples under pressure)

Modern Dividend Disruptors:

- Meta: Started paying dividends in 2024 (finally!)

- Alphabet: Joined the dividend club in 2024

- Alibaba: First-ever dividend in 2024

The Dividend Quality Scorecard:

Green Light Dividends (Buy):

✅ Yield: 3-6% (reasonable but not excessive)

✅ Payout Ratio: Under 60% (company keeps profits for growth)

✅ 10+ years of increases

✅ Strong cash flow coverage

Yellow Light Dividends (Caution):

⚠️ Yield: 6-8% (investigate why it's high)

⚠️ Payout Ratio: 60-80% (less margin for error)

⚠️ Inconsistent payment history

⚠️ Debt-heavy balance sheet

Red Light Dividends (Avoid):

❌ Yield: 8%+ (often unsustainable)

❌ Payout Ratio: 80%+ (borrowing to pay dividends)

❌ Recent dividend cuts

❌ Declining business fundamentals

Real Examples - The Good, Bad, and Ugly:

The Good - Brookfield Infrastructure (BIP):

- Yield: 5.2%

- Track Record: 15 consecutive years of increases

- Growth Rate: 9% annual dividend growth

- Sustainability: Strong cash flows, inflation-protected rates

The Bad - Pfizer (PFE):

- Yield: 6.1% (looks attractive)

- Problem: Post-COVID vaccine revenue cliff

- Risk: Sustainability questions with pipeline gaps

- Reality: High yield might be market warning

The Ugly - Many REITs:

- Yields: 8-12% (too good to be true)

- Problem: Rising interest rates crushing property values

- Result: Many cut dividends in 2024

Smart Dividend Strategy for 2025:

- Yield Sweet Spot: Target 3-5% yields

- Quality Over Quantity: Better to own 5 great dividend stocks than 20 mediocre ones

- Growth Focus: Prioritize dividend growth over current yield

- Diversification: Mix dividend stocks with bonds and international exposure

The New Income Portfolio Blueprint:

- 40%: High-quality dividend growth stocks (3-4% yield)

- 30%: Intermediate-term bonds (4-5% yield)

- 20%: International dividend stocks (hedging currency risk)

- 10%: REITs or dividend-focused ETFs (diversification)

Action Steps:

- Audit your current dividend holdings using the quality scorecard

- Calculate your true yield versus risk-free alternatives

- Consider bond ladders for guaranteed income

- Diversify income sources beyond just stock dividends

Think About This: When risk-free returns exceed your dividend yields, it's time to question whether you're being paid enough for the risk you're taking.

Build a sustainable dividend portfolio with StockSageAI's dividend screening and analysis tools. Our platform identifies dividend aristocrats, analyzes payout sustainability, tracks dividend growth rates, and compares yields across global markets. Screen for quality dividend stocks with strong fundamentals, consistent payment histories, and growth potential. Access comprehensive dividend analysis including yield trends, coverage ratios, and sector comparisons. Start building your income portfolio at StockSageAI.com with our specialized dividend screening tools.