The Detective's Toolkit: Advanced Stock Screening Techniques

Sherlock Holmes would excel at stock picking using systematic screening methodologies. Learn professional techniques that eliminate 99.8% of stocks to reveal hidden investment gems.

"Sherlock Holmes would be a phenomenal stock picker. His deductive methodology mirrors how systematic screening eliminates 99.8% of stocks to reveal hidden gems."

Analogy

Advanced stock screening operates like running a sophisticated criminal investigation unit where different analytical techniques serve specific investigative purposes.

Fundamental screening acts as your forensic accounting team, examining financial statements for evidence of strength or fraud.

Technical screening functions as your behavioral analysis unit, studying price and volume patterns to predict future movements.

Quantitative screening serves as your statistical analysis department, identifying mathematical relationships and anomalies across thousands of securities.

Momentum screening works like your surveillance team, tracking which stocks are gaining institutional attention and capital inflows.

Value screening operates as your asset recovery specialists, finding undervalued companies trading below intrinsic worth.

Explanation

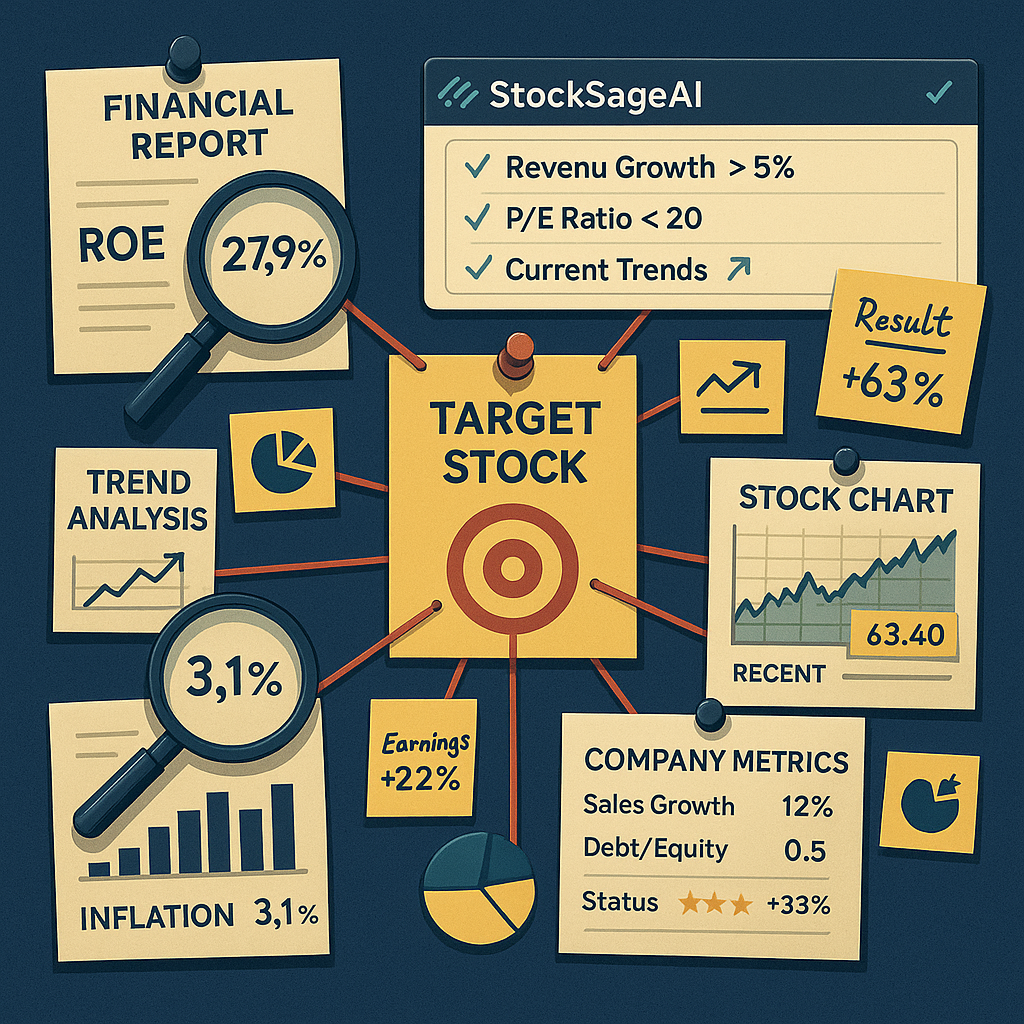

Professional stock screening in 2025 transcends simple filters to become sophisticated analytical frameworks. StockSageAI's multi-factor approach enables complex screening scenarios: identifying stocks with improving fundamental trends (ROE increasing quarterly), technical breakouts (price above 20-day MA with volume confirmation), and favorable sector dynamics (industry outperforming market). Advanced practitioners often combine screens: finding growth stocks at value prices by filtering for companies with 20%+ earnings growth trading under 15 P/E ratios, then applying technical filters for optimal entry timing.

Insights

- Implement progressive screening funnels - start broad with market cap and liquidity filters, progressively narrow with fundamental, technical, and momentum criteria

- Use sector-relative screening - compare stocks within industries rather than absolute metrics to identify sector leaders

- Apply market cycle adaptations - adjust screening criteria for different market environments: growth filters in bull markets, value screens in bear markets

- Leverage StockSageAI's natural language queries - use conversational screening like "show me dividend stocks with increasing payouts in defensive sectors"

- Build custom screening combinations - create saved filters combining multiple methodologies for repeatable investment processes

Put these advanced screening techniques into practice with StockSageAI's comprehensive multi-factor analysis platform. Screen across 50,000+ stocks in US, Indian, and European markets using professional-grade filters that institutional investors rely on. From natural language queries to complex technical combinations, our platform makes sophisticated screening accessible to every investor. Start your advanced stock analysis at StockSageAI.com and discover the hidden gems that systematic screening reveals.