The Debt Detective: Uncovering Hidden Financial Risks

Two friends earn $100,000 annually. One lives comfortably, the other is stressed and broke. The difference? Hidden debt that’s crushing…

Two friends earn $100,000 annually. One lives comfortably, the other is stressed and broke. The difference? Hidden debt that’s crushing their finances.

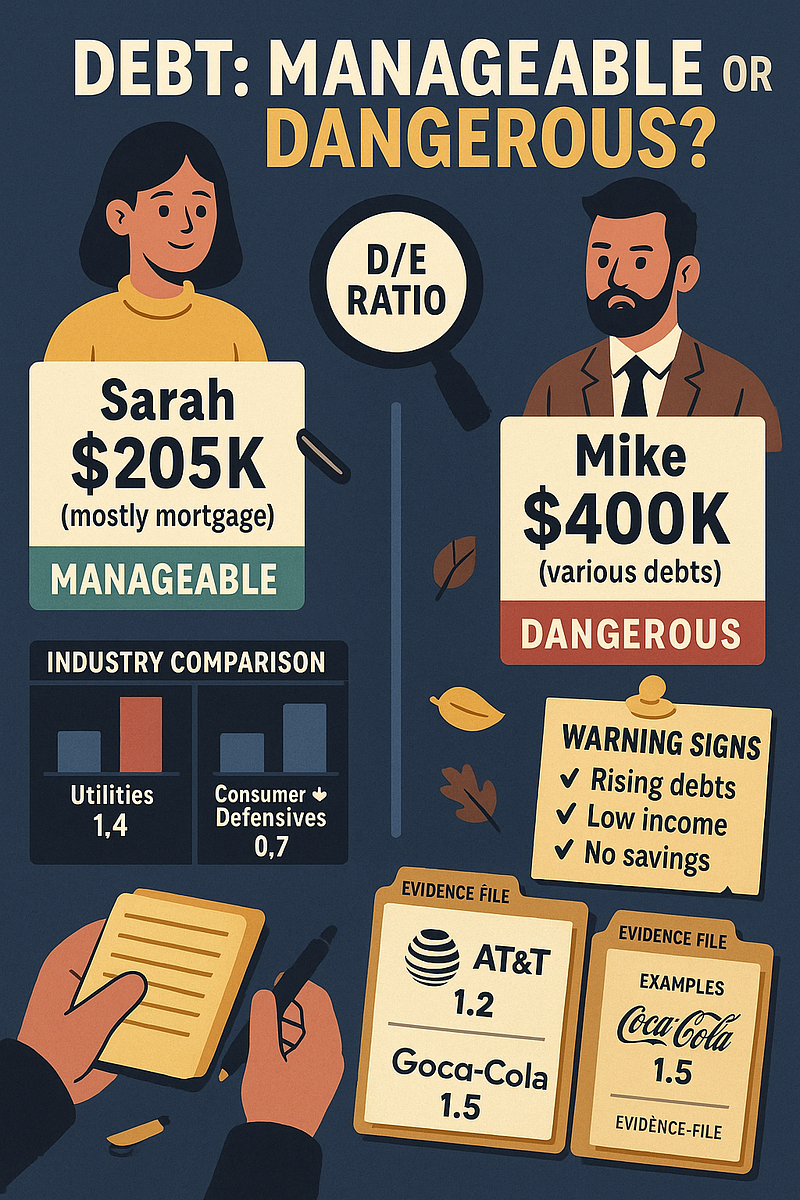

The Story: Sarah: $100,000 salary, $200,000 mortgage, $5,000 credit card debt

- Debt-to-Income: 205% ($205,000 ÷ $100,000)

- Status: Managing well, mortgage is “good debt”

Mike: $100,000 salary, $400,000 in various debts

- Debt-to-Income: 400% ($400,000 ÷ $100,000)

- Status: Financial crisis waiting to happen

The Corporate Parallel: Companies work exactly the same way. The Debt-to-Equity ratio reveals which companies are Sarah (manageable) or Mike (dangerous).

Formula: Debt-to-Equity = Total Debt ÷ Shareholders’ Equity

Real Company Examples:

Conservative Company (Apple):

- Total Debt: $123 billion

- Shareholders’ Equity: $62 billion

- Debt-to-Equity: 1.98 (manageable for tech giant)

Leveraged Company (Ford):

- Total Debt: $156 billion

- Shareholders’ Equity: $45 billion

- Debt-to-Equity: 3.47 (high but normal for automakers)

Danger Zone Company:

- Debt-to-Equity above 5.0 = Red flag territory

- Could struggle during economic downturns

Industry Context Matters:

- Utilities: 2–4 D/E normal (steady cash flows support debt)

- Tech companies: 0.5–1.5 ideal (don’t need much debt)

- Airlines: 3–6 common (capital intensive industry)

- Retailers: 1–3 typical (inventory financing needs)

The Debt Detective’s Checklist:

- ✅ Compare to industry averages (Ford vs. Apple isn’t fair)

- ✅ Check debt trends (increasing or decreasing over time)

- ✅ Examine interest coverage (can they afford debt payments)

- ✅ Look at economic sensitivity (cyclical businesses need lower debt)

Warning Signs:

- Debt-to-Equity increasing rapidly

- Interest payments consuming >30% of profits

- Taking on debt while business is declining

Action Step: Calculate the debt-to-equity ratio for your largest stock holdings. Are you invested in Sarah-type companies or Mike-type disasters?

Think About This: Would you lend money to someone already drowning in debt? Then why invest in overleveraged companies?