The Data Scientist's Revolution: Explainable AI in Finance

While analysts spend 80% of time gathering data, AI processes 10,000+ financial variables in seconds. Discover how explainable AI transforms investment analysis from art to transparent science.

"While traditional analysts spend 80% of their time gathering data, AI-powered platforms process 10,000+ financial variables in seconds. The revolution isn't coming - it's here."

Analogy

Explainable AI in finance operates like having a team of Nobel Prize-winning economists working 24/7 as your research assistants.

Pattern recognition algorithms serve as your behavioral psychology experts, identifying market sentiment patterns invisible to human analysis.

Natural language processing acts as your multilingual research team, simultaneously analyzing earnings calls, news sentiment, and social media across global markets.

Predictive modeling functions as your econometric statisticians, processing historical relationships to forecast probable outcomes.

Risk assessment engines work as your risk management consultants, continuously calculating portfolio exposure across multiple scenarios. Unlike black-box systems, explainable AI provides transparent reasoning for every recommendation, like having these experts explain their methodology in simple terms.

Explanation

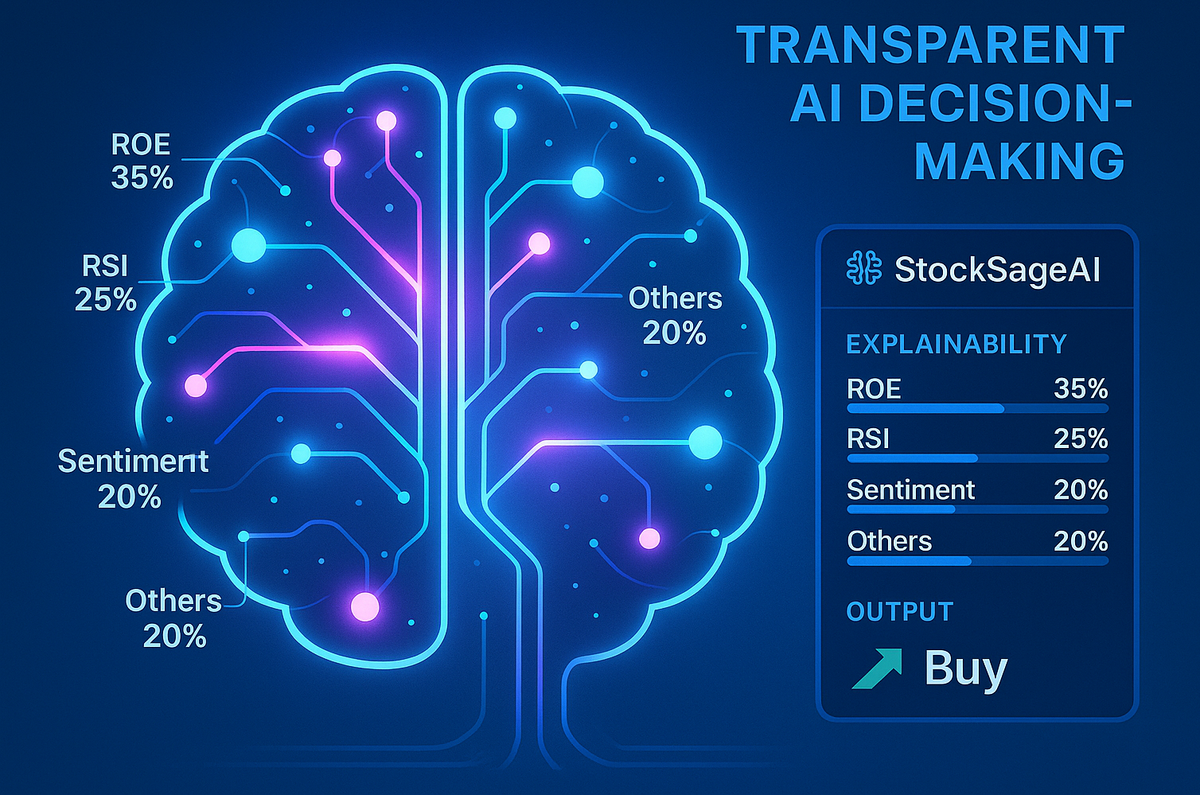

Explainable AI transforms financial analysis from art to science by making complex algorithmic decisions transparent and actionable. StockSageAI's implementation allows users to understand exactly why specific stocks are recommended: the platform might identify that Company X scores highly due to improving ROE trends (15% → 22% over 3 years), technical momentum (RSI recovery from oversold levels), and sector rotation favorability (tech outperforming utilities by 12% quarterly). This transparency enables informed decision-making while leveraging computational power impossible for manual analysis.

Insights

- Implement AI-assisted screening workflows - use explainable algorithms to identify investment candidates, then verify reasoning with traditional analysis

- Leverage sentiment analysis integration - combine StockSageAI's technical indicators with AI-powered news sentiment for enhanced timing decisions

- Apply multi-factor AI models - utilize platforms that explain variable weightings: fundamental metrics (40%), technical signals (35%), market sentiment (25%)

- Validate AI recommendations systematically - track AI suggestion performance over time to build confidence in algorithmic insights

- Use AI for risk scenario modeling - employ explainable models to understand portfolio vulnerability across different market conditions

Experience the power of explainable AI in your investment decisions with StockSageAI's transparent algorithmic analysis. Unlike black-box systems, our platform shows you exactly why stocks are recommended, combining fundamental metrics, technical signals, and market sentiment with clear reasoning. Access institutional-level AI analysis that democratizes sophisticated investment strategies for individual investors. Explore explainable AI investing at StockSageAI.com and discover how transparent algorithms can enhance your investment outcomes.