The Compound Interest Miracle - How $5 Daily Becomes $1.2 Million

Transform small daily investments into massive wealth through the miracle of compound interest. Discover how investing just $5 daily can create $1.2 million over 40 years, and learn why time beats investment amount every single time in wealth building.

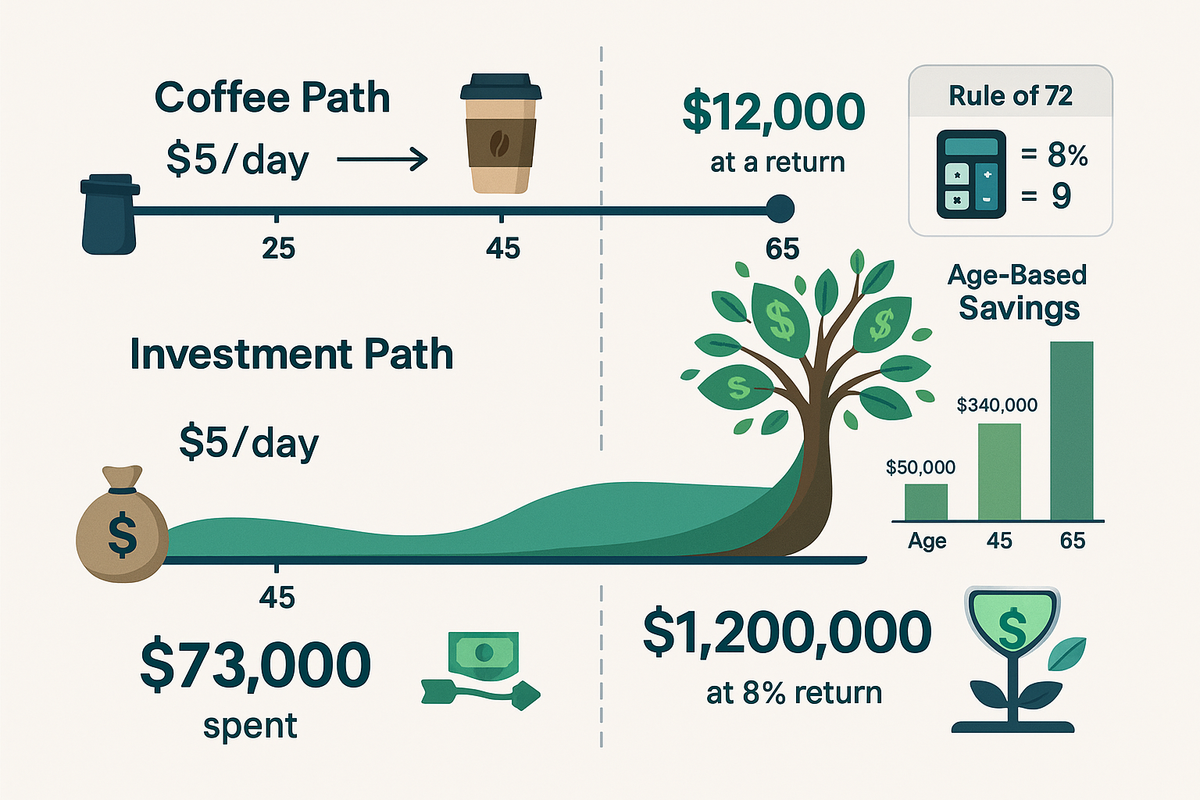

Your daily coffee costs $5. Over 40 years, that's $73,000 spent on caffeine. But if you invested that $5 daily instead, you'd have $1.2 million. The difference between rich and poor isn't income - it's understanding compound interest.

The Story: Two friends, Emma and Jake, both earn $60,000 per year starting at age 25.

Emma's Approach:

- Invests $5 daily ($150/month) starting at 25

- Never increases the amount (keeps it simple)

- Earns average market returns (10% annually)

- Result at 65: $1,175,000

Jake's Approach:

- Spends the $5 daily on coffee and snacks

- Plans to "start investing later when I make more money"

- Finally starts investing $500/month at age 45

- Result at 65: $337,000

Emma becomes a millionaire by investing less total money than Jake. That's the miracle of compound interest.

The Mathematics of Miracles:

Emma's Investment Journey:

- Daily investment: $5

- Monthly investment: $150

- Annual investment: $1,800

- Total invested over 40 years: $72,000

- Final value: $1,175,000

- Growth: $1,103,000 in compound gains

Jake's Investment Journey:

- Monthly investment: $500 (starting at 45)

- Total invested over 20 years: $120,000

- Final value: $337,000

- Growth: $217,000 in compound gains

The Power of Time vs. Amount:

Scenario Analysis:

Start at 25, invest $150/month for 40 years: $1,175,000

Start at 35, invest $300/month for 30 years: $678,000

Start at 45, invest $500/month for 20 years: $337,000

Start at 55, invest $1,000/month for 10 years: $191,000

The lesson: Time beats amount every single time.

Real-World Compound Interest Examples:

The Minimum Wage Millionaire: Sarah works minimum wage jobs her entire career but saves $25/week starting at age 20:

- Weekly investment: $25

- Annual investment: $1,300

- 45-year timeline: Age 20 to 65

- Total invested: $58,500

- Final value: $1,446,000

- Proof: Anyone can become a millionaire

The High Earner's Mistake: Dr. Martinez earns $300,000/year but doesn't start serious investing until age 40:

- Annual investment: $30,000 (10% of income)

- 25-year timeline: Age 40 to 65

- Total invested: $750,000

- Final value: $2,948,000

- Reality: Could have had $8+ million starting at 25

The Compound Interest Rate Impact:

$500 Monthly Investment Over 30 Years:

- At 6% annual return: $497,000

- At 8% annual return: $745,000

- At 10% annual return: $1,130,000

- At 12% annual return: $1,765,000

Translation: Each extra 2% of annual return nearly doubles your wealth over 30 years.

The Magic Numbers:

Rule of 72: Divide 72 by your return rate to find doubling time

- 6% return: Money doubles every 12 years

- 8% return: Money doubles every 9 years

- 10% return: Money doubles every 7.2 years

- 12% return: Money doubles every 6 years

The $100 Doubling Chain (10% returns):

- Year 0: $100

- Year 7: $200

- Year 14: $400

- Year 21: $800

- Year 28: $1,600

- Year 35: $3,200

- Year 42: $6,400

Modern Compound Interest Strategies:

The Automated Millionaire Approach:

- Set up automatic transfers ($5-50 daily into investment account)

- Use index funds (VTI, VTIAX for broad diversification)

- Reinvest all dividends (compound the compounding)

- Increase annually (add raise money to investments)

- Never touch the principal (let compound interest work)

The 401(k) Acceleration:

- Employee contribution: $500/month

- Employer match: $250/month (50% match)

- Tax savings: $150/month (25% tax bracket)

- Total monthly benefit: $900 for $500 out-of-pocket

Age-Based Investment Allocation: Age 20-30 (Maximum Growth):

- 90% stocks (maximum compound potential)

- 10% bonds (minor stability)

- Focus: Time is your biggest asset

Age 30-40 (Aggressive Growth):

- 80% stocks (still prioritizing growth)

- 20% bonds (slightly more stability)

- Focus: Accelerate contributions with salary increases

Age 40-50 (Moderate Growth):

- 70% stocks (balanced approach)

- 30% bonds (increasing stability)

- Focus: Peak earning years, maximize savings

Age 50-60 (Capital Preservation):

- 60% stocks (still need growth for longevity)

- 40% bonds (protecting accumulated wealth)

- Focus: Catch-up contributions, reduce risk

The Tax-Advantaged Compound Accelerators:

Roth IRA Advantage:

- Contribution: $7,000/year (2025 limit)

- Tax treatment: Pay taxes now, grow tax-free forever

- Compound benefit: All growth is tax-free

- 40-year result: Potentially save $300,000+ in taxes

Traditional 401(k) Advantage:

- Contribution: $23,000/year (2025 limit)

- Tax treatment: Deduct now, pay taxes in retirement

- Compound benefit: Larger initial investment compounds more

- Catch-up: Additional $7,500 if over 50

HSA Triple Advantage:

- Tax deduction: Reduce current taxes

- Tax-free growth: Compound without tax drag

- Tax-free withdrawals: For medical expenses

- Retirement bonus: Functions like traditional IRA after age 65

Common Compound Interest Mistakes:

- The "I'll Start Tomorrow" Trap: Every year you delay costs you approximately 10% of your final wealth (assuming 10% returns).

- The "Market Timing" Mistake: Missing just the 10 best market days over 20 years reduces returns by 50%+.

- The "Cash Out" Error: Taking 401(k) loans or early withdrawals destroys compound interest chains.

- The "Not Enough" Excuse: $25/month is infinitely better than $0/month. Start with whatever you can.

The Emergency Fund Foundation: Before aggressive investing:

- Build $1,000 emergency fund (prevent investment raids)

- Pay off high-interest debt (credit cards at 25% vs. market 10%)

- Start small but consistent ($25-100/month minimum)

- Automate everything (remove decision fatigue)

Action Steps for Compound Interest Success:

- Start TODAY - not next month, not next year

- Automate transfers - make investing unconscious

- Use tax-advantaged accounts first (401k, IRA, HSA)

- Invest in low-cost index funds (minimize fees)

- Never interrupt the compound process (stay invested through volatility)

Think About This: Einstein allegedly called compound interest "the eighth wonder of the world." Those who understand it earn it, those who don't pay it. Which side do you want to be on?

Harness the power of compound interest with StockSageAI's portfolio growth modeling and systematic investing tools. Our platform calculates compound growth projections, tracks portfolio performance over time, and helps you build systematic investment strategies across global markets. Access retirement planning tools, growth rate analysis, and automated investing features that maximize compound returns. Start building your wealth systematically at StockSageAI.com and let compound interest work for you.