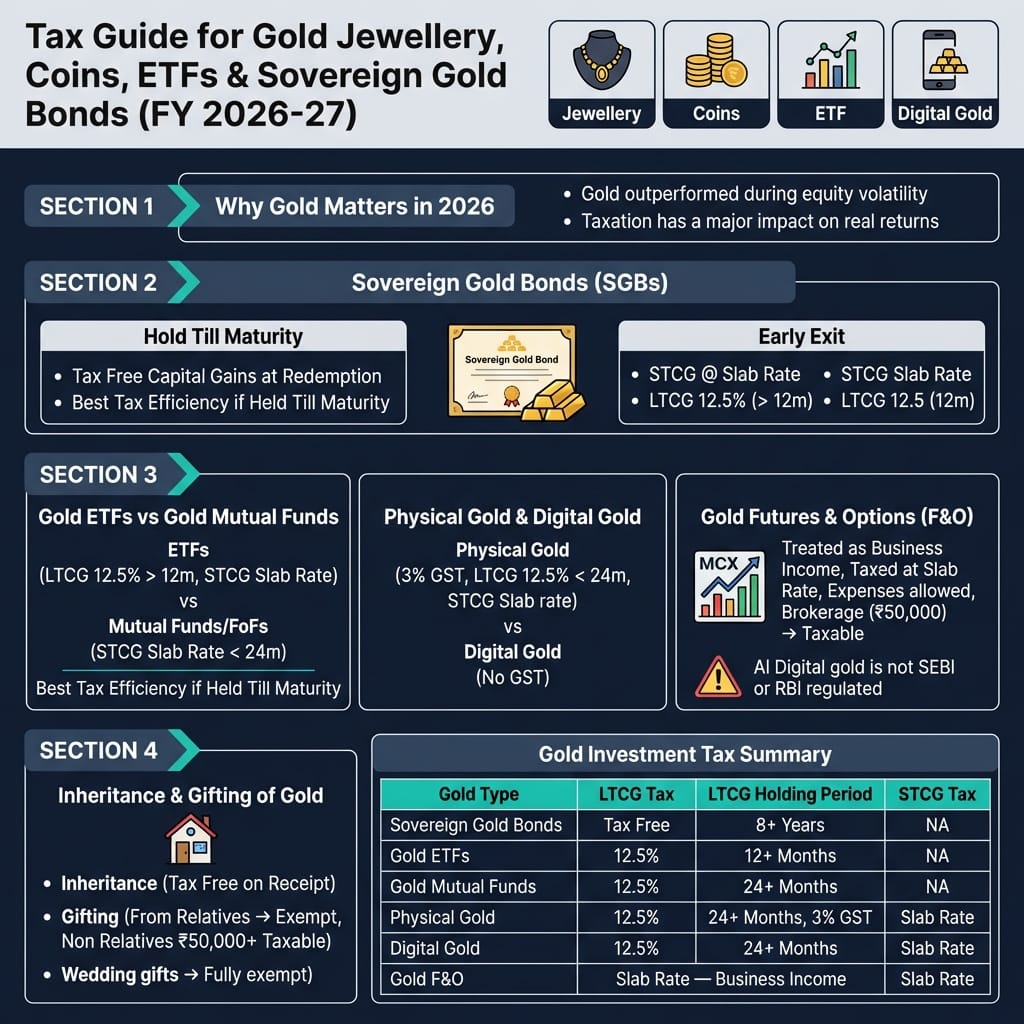

The Complete Gold Investment Tax Guide for FY 2026-27: Maximize Your Returns

Complete guide to gold investment taxation in FY 2026-27. Learn about tax implications of SGBs, Gold ETFs, physical gold, digital gold, and F&O. Maximize your after-tax returns with expert insights.

Gold has long been considered a safe-haven asset, especially during times of economic uncertainty and equity market volatility. As we enter FY 2026-27, understanding the tax implications of your gold investments is crucial for maximizing your real returns. Whether you're investing in physical gold, Sovereign Gold Bonds (SGBs), Gold ETFs, or digital gold, this comprehensive guide will help you make informed decisions.

Why Gold Matters in 2026

Gold has demonstrated impressive performance during recent equity market volatility, reinforcing its position as a portfolio diversifier and hedge against inflation. However, many investors overlook a critical factor that significantly impacts their returns: taxation.

The difference between gross returns and net returns (after taxes) can be substantial. By understanding the tax treatment of different gold investment vehicles, you can optimize your portfolio for better after-tax performance.

Sovereign Gold Bonds (SGBs): The Tax Champion

If there's one gold investment that stands out from a tax perspective, it's Sovereign Gold Bonds.

What Makes SGBs Special?

Sovereign Gold Bonds are government securities denominated in grams of gold. They offer several advantages:

- Tax-Free Capital Gains: If you hold SGBs until maturity (8+ years), your capital gains are completely tax-free

- Additional Interest Income: 2.5% per annum (taxable as per your income slab)

- No Storage Concerns: Held in demat form, eliminating security risks

- Best Tax Efficiency: Unmatched among all gold investment options

Early Exit from SGBs

If you need to exit before maturity:

- After 12 months: Long-Term Capital Gains (LTCG) of 12.5%

- Before 12 months: Short-Term Capital Gains (STCG) taxed at your income slab rate

The Bottom Line

For long-term investors who can hold for 8+ years, SGBs offer the best tax efficiency in the gold investment space. The combination of tax-free capital gains and steady interest income makes them an attractive option for retirement planning and wealth preservation.

Gold ETFs vs Gold Mutual Funds: Which Is More Tax-Efficient?

Both Gold ETFs and Gold Mutual Funds provide exposure to gold prices without the hassles of physical storage, but there are key differences in taxation and structure.

Gold ETFs

Tax Treatment:

- LTCG: 12.5% (holding period: more than 12 months)

- STCG: Taxed at your income slab rate

Advantages:

- Lower expense ratios

- Intraday trading flexibility

- Better tax efficiency with shorter LTCG holding period

- No GST on purchases

Best For: Investors seeking flexibility and cost-efficiency

Gold Mutual Funds / Fund of Funds (FoFs)

Tax Treatment:

- LTCG: 12.5% (holding period: more than 24 months)

- STCG: Taxed at slab rate (less than 24 months)

Advantages:

- No demat account required

- SIP investment option available

- Professional fund management

Best For: Long-term investors preferring systematic investments

Key Insight

Gold ETFs offer better tax efficiency due to the shorter holding period required for LTCG benefits (12 months vs 24 months). However, both options provide significant advantages over physical gold when it comes to convenience and security.

Physical Gold: Understanding GST and Capital Gains

Physical gold in the form of jewellery, coins, or bars remains a popular choice, especially in India. However, it comes with unique tax implications.

Purchase Considerations

GST Impact:

- 3% GST applies on the purchase of physical gold

- This increases your acquisition cost upfront

Tax on Sale

Capital Gains:

- LTCG: 12.5% (holding period: more than 24 months)

- STCG: Taxed at your income slab rate (less than 24 months)

The Hidden Cost

The 3% GST on purchase effectively increases your breakeven point. Gold needs to appreciate by at least 3% just to cover this initial cost, before you even start making profits.

Example:

- If you buy gold worth ₹1,00,000

- GST: ₹3,000

- Total cost: ₹1,03,000

- Gold must rise to ₹1,03,000 just to break even

Digital Gold: Convenience Meets Taxation

Digital gold platforms have made gold investing accessible to everyone, allowing investments as low as ₹1. But how is it taxed?

Tax Treatment

Capital Gains:

- LTCG: 12.5% (holding period: more than 24 months)

- STCG: Taxed at your income slab rate (less than 24 months)

GST Advantage:

- No GST on purchase (unlike physical gold)

- GST only applies if you take physical delivery

Important Considerations

⚠️ Regulatory Alert: Digital gold is not currently regulated by SEBI or RBI. Ensure you use reputable platforms.

Best For

Digital gold is ideal for:

- Small, regular investments

- Investors who want gold exposure without storage hassles

- Those seeking to avoid upfront GST costs

Gold Futures & Options (F&O): Trading with Tax Implications

Gold F&O trading on MCX offers leverage and hedging opportunities but comes with different tax treatment.

Tax Treatment

Business Income:

- Profits are treated as business income

- Taxed at your income slab rate

- No distinction between short-term and long-term

Advantages for Traders

Expense Deductions:

- Brokerage charges (up to ₹50,000) are tax-deductible

- Other trading expenses can be claimed

- Losses can be carried forward

Best For

Active traders and those using gold for hedging strategies. Not suitable for passive long-term investors.

Inheritance & Gifting of Gold: Know the Rules

Understanding the tax implications of receiving or gifting gold can save you significant money.

Inheritance

Tax-Free Receipt:

- Gold received through inheritance is completely tax-free

- No tax liability at the time of receipt

- Capital gains tax applies only when you sell

Cost of Acquisition:

- The original purchase price by the previous owner becomes your cost basis

Gifting Rules

From Relatives - Tax Exempt: Gifts from the following relatives are tax-free:

- Spouse

- Parents and siblings

- Spouse's parents and siblings

- Lineal ascendants and descendants

From Non-Relatives:

- Gold worth more than ₹50,000 is taxable

- Taxed as "Income from Other Sources"

Weddings Exception:

- Gifts received during weddings are fully exempt, regardless of the amount or donor

Gold Investment Tax Summary Table

Here's a quick reference for all gold investment types:

| Gold Type | LTCG Tax | LTCG Holding Period | STCG Tax | Additional Costs |

|---|---|---|---|---|

| Sovereign Gold Bonds | Tax Free | 8+ Years | N/A | None |

| Gold ETFs | 12.5% | 12+ Months | Slab Rate | Demat charges |

| Gold Mutual Funds | 12.5% | 24+ Months | Slab Rate | Expense ratio |

| Physical Gold | 12.5% | 24+ Months | Slab Rate | 3% GST on purchase |

| Digital Gold | 12.5% | 24+ Months | Slab Rate | Platform fees |

| Gold F&O | Business Income | N/A | Business Income | STT, brokerage |

Strategic Recommendations for FY 2026-27

Based on the tax analysis, here are our recommendations:

1. For Long-Term Wealth Preservation (8+ years)

Choose: Sovereign Gold Bonds

- Tax-free capital gains at maturity

- Additional 2.5% interest income

- Government-backed security

2. For Medium-Term Investments (3-5 years)

Choose: Gold ETFs

- Shorter LTCG holding period (12 months)

- Lower costs and better liquidity

- No GST on purchase

3. For Small, Regular Investments

Choose: Digital Gold or Gold Mutual Funds (SIP)

- Start with as little as ₹100

- No storage worries

- Flexibility to convert to physical gold if needed

4. For Portfolio Diversification

Choose: Mix of SGBs and Gold ETFs

- 60-70% in SGBs for tax-free long-term growth

- 30-40% in Gold ETFs for liquidity and flexibility

5. For Active Traders

Choose: Gold F&O on MCX

- Leverage trading opportunities

- Hedging capabilities

- Tax-deductible expenses

Tax-Saving Tips for Gold Investors

1. Hold for LTCG Benefits

Always try to hold gold investments for periods that qualify for LTCG (12 months for ETFs, 24 months for physical/digital gold) to benefit from lower tax rates.

2. Time Your Sales

If you're close to completing the holding period for LTCG, delay the sale by a few months to qualify for reduced tax rates.

3. Use Tax-Loss Harvesting

Offset your gold gains with losses in other asset classes to reduce overall tax liability.

4. Gift Strategically

If transferring wealth to family members, utilize the exemptions for gifts to relatives rather than selling and incurring capital gains tax.

5. Document Everything

Maintain proper records of:

- Purchase invoices (especially for physical gold)

- Dates of acquisition

- Holding statements

- Gift documents from relatives

Common Mistakes to Avoid

❌ Ignoring GST on Physical Gold

Many investors don't factor in the 3% GST when calculating returns on physical gold.

❌ Selling Just Before LTCG Qualification

Selling a few days or weeks before qualifying for LTCG can cost you significantly in taxes.

❌ Not Considering SGBs for Long-Term Goals

Despite being the most tax-efficient option, SGBs are often overlooked for long-term retirement planning.

❌ Mixing Up Holding Periods

Different gold investment types have different LTCG holding periods (12 vs 24 months).

❌ Forgetting to Claim Deductions on F&O

Traders often forget to claim legitimate business expenses like brokerage charges.

How StockSageAI Can Help

At StockSageAI, we provide AI-powered portfolio analysis that factors in tax implications across all your investments, including gold. Our platform helps you:

✅ Optimize asset allocation for tax efficiency

✅ Track holding periods automatically

✅ Get alerts when investments qualify for LTCG

✅ Calculate tax liability on potential sales

✅ Plan tax-loss harvesting opportunities

Start Analyzing Your Portfolio Now

Conclusion

Gold remains a valuable component of a diversified investment portfolio, offering stability and protection against market volatility. However, the tax treatment varies significantly across different gold investment vehicles.

Key Takeaways:

- Sovereign Gold Bonds offer the best tax efficiency with tax-free capital gains if held till maturity

- Gold ETFs provide better tax efficiency than Mutual Funds due to shorter LTCG holding period

- Physical gold carries an additional 3% GST burden

- Digital gold offers GST-free convenience but lacks regulatory oversight

- Gold F&O is treated as business income with expense deduction benefits

By understanding these tax implications and choosing the right investment vehicle based on your goals and time horizon, you can significantly enhance your after-tax returns on gold investments in FY 2026-27.

FAQs

Q: Is the interest earned on SGBs taxable?

A: Yes, the 2.5% annual interest is taxable as per your income slab. However, capital gains at maturity are tax-free.

Q: Can I claim indexation benefit on gold?

A: No, indexation benefits were removed for gold investments from FY 2023-24 onwards.

Q: What happens if I convert digital gold to physical gold?

A: When you take physical delivery, GST applies at the time of conversion. This is not treated as a sale, so no capital gains tax is triggered.

Q: Are gold savings schemes offered by jewelers tax-efficient?

A: These schemes are essentially advance payments for physical gold, so they carry the same tax implications as physical gold (3% GST + LTCG/STCG).

Q: Can I transfer my physical gold to a Gold ETF?

A: No, direct transfer is not possible. You would need to sell physical gold (triggering capital gains tax) and then purchase Gold ETF units.

Disclaimer: This article is for informational purposes only and does not constitute financial or tax advice. Tax laws are subject to change. Please consult with a qualified tax advisor or financial planner before making investment decisions.

Tags: Gold Investment, Tax Planning, FY 2026-27, Sovereign Gold Bonds, Gold ETF, Investment Strategy, Wealth Management, Capital Gains Tax, Digital Gold, Financial Planning