The Beta Test: Measuring Your Stock’s Wild Side

Your friend owns two cars: a steady Honda Civic and a thrilling Ferrari. When gas prices spike, guess which one hurts their wallet more…

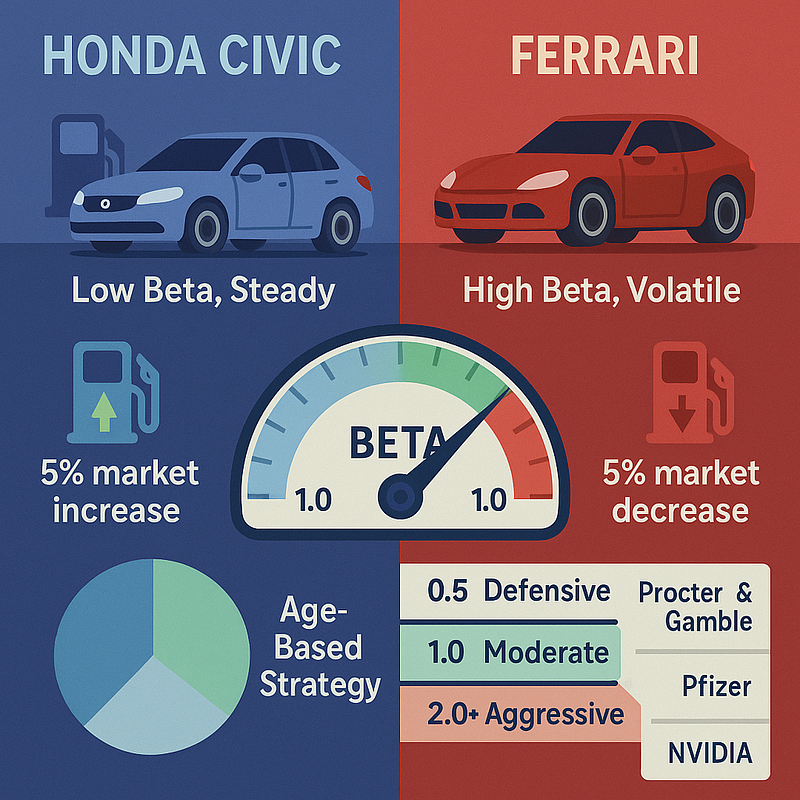

Your friend owns two cars: a steady Honda Civic and a thrilling Ferrari. When gas prices spike, guess which one hurts their wallet more? Beta measures the same thing for stocks.

The Honda Civic (Low Beta Stock):

- Gas prices up 20% → Civic owner’s costs up 10%

- Gas prices down 20% → Civic owner’s costs down 10%

- Reaction: Steady, predictable response

The Ferrari (High Beta Stock):

- Gas prices up 20% → Ferrari owner’s costs up 40%

- Gas prices down 20% → Ferrari owner’s costs down 40%

- Reaction: Amplified, volatile response

Beta in the Stock Market: Beta measures how much a stock moves relative to the overall market.

Beta = 1.0: Moves exactly with the market

- Market up 10% → Stock up 10%

- Market down 10% → Stock down 10%

Beta > 1.0: More volatile than market

- Tesla (Beta 2.3): When market moves 10%, Tesla typically moves 23%

- High-beta stocks: Tech, growth, speculative companies

Beta < 1.0: Less volatile than market

- Walmart (Beta 0.5): When market moves 10%, Walmart moves 5%

- Low-beta stocks: Utilities, consumer staples, bonds

Real Beta Examples:

Wild Ride Stocks (High Beta):

- Zoom (Beta 1.8): Pandemic darling, extreme swings

- Peloton (Beta 1.9): Home fitness boom and bust

- Cryptocurrency stocks (Beta 2.0+): Amplify market movements

Steady Eddie Stocks (Low Beta):

- Procter & Gamble (Beta 0.4): People always need soap

- Berkshire Hathaway (Beta 0.8): Diversified, stable

- Utilities (Beta 0.3–0.7): Regulated, predictable

The Beta Strategy Guide:

Young Investors (20s-30s):

- Can handle higher beta (1.2–1.8)

- Time to recover from volatility

- Seeking growth over stability

Middle-aged Investors (40s-50s):

- Moderate beta (0.8–1.2)

- Balance growth with stability

- Less time for major recovery

Near Retirement (60s+):

- Lower beta (0.5–0.8)

- Preservation over growth

- Need predictable returns

Beta Misconceptions:

❌ Myth: Low beta means low returns

✅ Reality: Low beta means steadier path to returns

❌ Myth: High beta guarantees high returns

✅ Reality: High beta means bigger swings (up AND down)

The Portfolio Beta Calculation: If you own:

- 50% S&P 500 ETF (Beta 1.0)

- 30% Tech stocks (Beta 1.5)

- 20% Utility stocks (Beta 0.6)

Portfolio Beta: (0.5 × 1.0) + (0.3 × 1.5) + (0.2 × 0.6) = 1.07

Action Step: Calculate your portfolio’s beta. If it’s above 1.3, prepare for a wild ride. Below 0.7? You’re in the slow lane (which might be perfect for you).

Think About This: Do you want to drive a Ferrari or a Honda Civic with your life savings? Beta helps you choose the right investment “vehicle” for your journey.