The Behavioral Money Trap - Why Smart People Make Dumb Investment Decisions

Overcome psychological investing traps that cause smart people to make costly mistakes. Learn how behavioral biases like loss aversion, anchoring, and herd mentality destroy returns, and discover systematic approaches to emotionally disciplined investing.

A Harvard MBA just panic-sold his entire portfolio at the market bottom, while his neighbor who never went to college doubled his money by staying calm. Intelligence doesn't prevent investment mistakes - understanding psychology does.

The Story: Meet Dr. Sarah, a brilliant neurosurgeon who can perform complex brain surgery but somehow bought GameStop at $300 and Tesla at $1,200. Meanwhile, her electrician neighbor Jim has been steadily dollar-cost averaging into index funds for 20 years and is sitting on $500,000.

The Intelligence Paradox: Smart people often make worse investors because:

- Overconfidence: "I'm smart, I can beat the market"

- Analysis paralysis: Too much research, not enough action

- Complexity bias: Believing sophisticated strategies are better

- Ego protection: Doubling down on mistakes rather than admitting errors

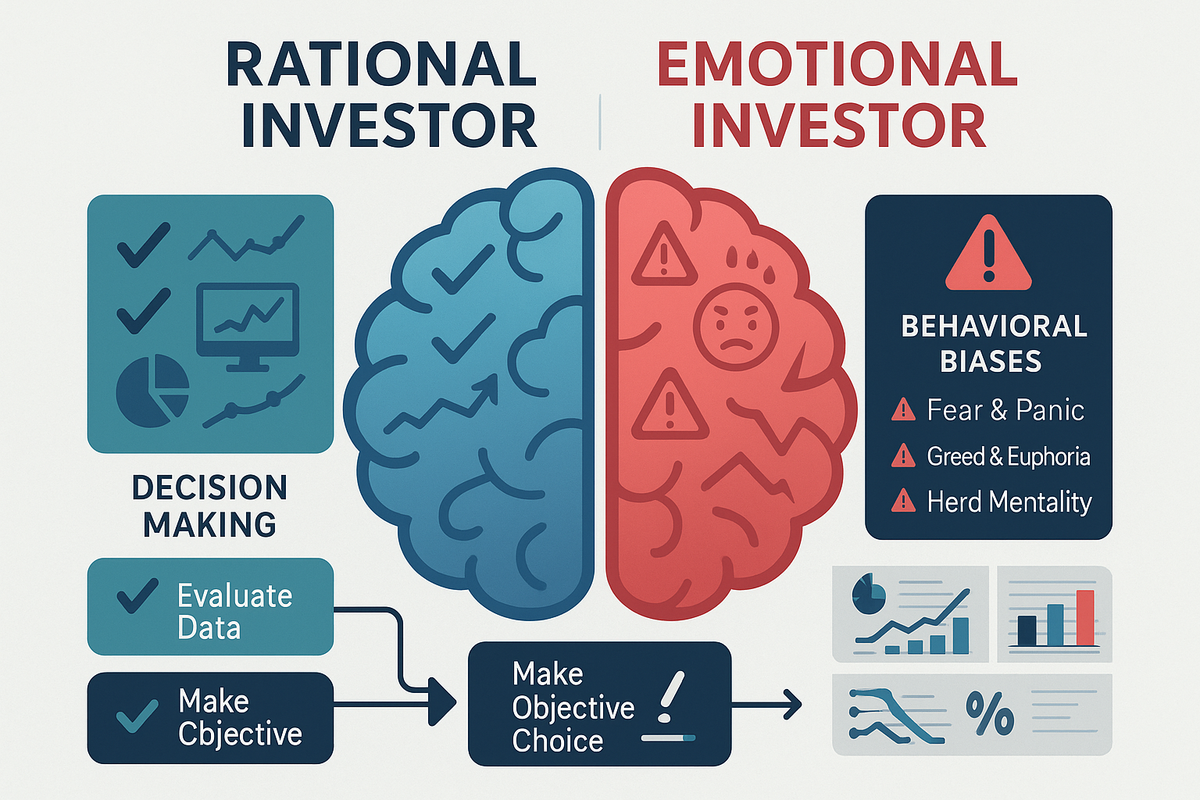

The Brain vs. The Market: Your brain evolved to keep you alive on the savanna, not to make money in financial markets. Understanding these hardwired biases is crucial:

Fear Response (Amygdala Hijack): When markets crash, your ancient brain screams "DANGER!" and triggers fight-or-flight responses:

- Fight: Angry trading, revenge against "manipulated" market

- Flight: Panic selling, retreating to cash

- Better response: Deep breathing, following predetermined rules

Greed Response (Dopamine Addiction): Market rallies trigger the same brain chemicals as gambling:

- Euphoria: "This time is different, easy money forever!"

- FOMO: Fear of missing out drives irrational buying

- Better response: Systematic profit-taking, staying disciplined

Common Behavioral Finance Traps:

1. Anchoring Bias:

Example: Apple stock hits $200, drops to $150, bounces to $175

Trap: "It's still cheap because it was $200"

Reality: $200 might have been overvalued; focus on current fundamentals

2. Loss Aversion:

Example: Refusing to sell losing stock "until it gets back to even"

Problem: Holding losers while selling winners

Solution: Tax-loss harvesting, systematic rebalancing

3. Confirmation Bias:

Example: Only reading bullish news about stocks you own Problem: Ignoring warning signs and contradictory evidence

Solution: Actively seek opposing viewpoints

4. Herd Mentality:

Example: Buying what everyone else is buying (meme stocks, crypto bubbles) Problem: Buying high because "everyone can't be wrong"

Reality: Everyone can be wrong, and often is

5. Recency Bias:

Example: Assuming recent market trends will continue forever

Problem: Buying after rallies, selling after crashes

Solution: Study long-term market history

Real-World Behavioral Examples:

The 2021 Meme Stock Mania:

- Psychological trigger: Social media herd mentality

- Result: GameStop from $20 to $400 to $20

- Lesson: Social proof isn't investment proof

The 2020 COVID Crash:

- March 2020: VIX hit 82, Fear & Greed Index hit 2

- Psychological response: Mass panic selling

- Opportunity: Best buying opportunity in decade

- Winners: Those who fought their fear instincts

The Behavioral Trading Scorecard: Track your own psychological mistakes:

Emotional Trading Signals:

❌ Making investment decisions while angry or excited

❌ Checking portfolio multiple times per day

❌ Trading based on news headlines or social media

❌ Buying/selling without predetermined plan

Rational Investing Signals:

✅ Following written investment plan

✅ Making decisions based on fundamentals

✅ Regular rebalancing regardless of emotions

✅ Learning from mistakes without ego attachment

The Behavioral Antidotes:

Create Systems, Not Goals:

- Wrong: "I want to make 20% this year"

- Right: "I will invest $500 monthly regardless of market conditions"

Automate Everything Possible:

- Automatic transfers to investment accounts

- Systematic rebalancing quarterly

- Dollar-cost averaging to remove timing decisions

Use the 24-Hour Rule: Before making any major investment decision:

- Wait 24 hours (emotional responses fade)

- Write down your reasoning (logic vs. emotion)

- Ask: "Would I advise my best friend to do this?"

The Contrarian's Playbook: Train yourself to think opposite of the crowd:

- When everyone's greedy: Start taking profits

- When everyone's fearful: Start buying quality stocks

- When everyone agrees: Look for what they're missing

Behavioral Finance in Market Cycles:

Bull Market Psychology:

- Early stage: Skepticism (smart money accumulates)

- Middle stage: Optimism (broad participation)

- Late stage: Euphoria (danger zone)

Bear Market Psychology:

- Early stage: Denial ("just a correction")

- Middle stage: Fear (capitulation begins)

- Late stage: Despair (maximum opportunity)

Building Psychological Immunity:

- Study investment history - recognize that cycles repeat

- Practice meditation - train emotional regulation

- Keep an investment journal - track decisions and emotions

- Find an accountability partner - someone to challenge your thinking

- Simulate stress - practice your plan during calm periods

The Ultimate Behavioral Test:

Question: If the market dropped 50% tomorrow, would you:

A) Panic sell everything

B) Do nothing

C) Buy more quality stocks

If you answered A: Work on emotional control systems

If you answered B: Good discipline, could be more opportunistic

If you answered C: You understand behavioral finance

Think About This: The best investors aren't the smartest - they're the most emotionally disciplined. Your biggest enemy in investing isn't the market; it's the person staring back at you in the mirror.

Build emotionally disciplined investing habits with StockSageAI's behavioral analysis and systematic screening tools. Our platform removes emotional decision-making through rule-based screening, automated alerts, and systematic rebalancing features. Access sentiment analysis, contrarian indicators, and psychological bias detection tools that help you invest rationally across global markets. Take the emotion out of investing and start your systematic approach at StockSageAI.com.