The AI Revolution in Stock Analysis - How Machines Are Beating Wall Street at Their Own Game

Discover how artificial intelligence is revolutionizing stock analysis with 75-85% earnings prediction accuracy, processing 50,000 companies simultaneously, and democratizing institutional-grade analysis for retail investors through advanced pattern recognition and sentiment analysis.

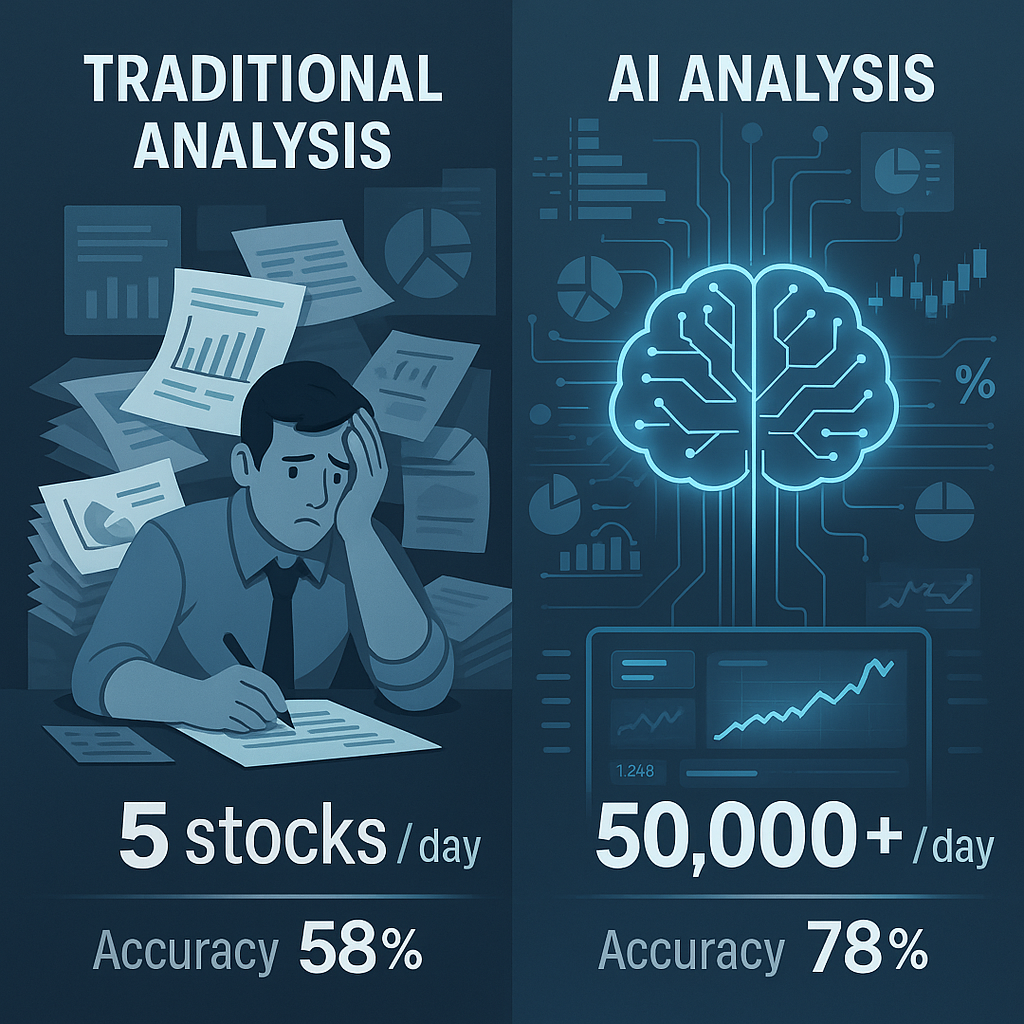

A computer just analyzed 50,000 stocks across global markets in the time it took you to read this sentence. While human analysts struggle to cover 20 companies thoroughly, AI is revolutionizing how we discover, analyze, and predict stock movements.

The Story: Meet Sarah, a portfolio manager at a traditional investment firm. Her day starts at 6 AM, reading through hundreds of earnings reports, news articles, and analyst notes. By noon, she's managed to thoroughly analyze maybe 5 companies. Meanwhile, across town, an AI system has already:

- Processed earnings reports from 10,000 companies

- Analyzed sentiment from 500,000 news articles

- Identified 50 technical patterns across global markets

- Calculated fair value estimates for entire sectors

- Generated actionable investment recommendations

The AI advantage isn't just speed - it's the ability to process and connect data patterns that human brains simply cannot handle.

The Traditional vs. AI Analysis Revolution:

Human Analyst Limitations:

❌ Processing Speed: 5-10 companies per day maximum

❌ Emotional Bias: Fear, greed, and confirmation bias affect decisions

❌ Pattern Recognition: Limited to obvious trends and familiar indicators

❌ Data Volume: Cannot process massive datasets simultaneously

❌ Market Coverage: Typically focus on 1-2 sectors or regions

AI-Powered Analysis Advantages:

✅ Processing Speed: Thousands of companies analyzed simultaneously

✅ Emotion-Free: Purely data-driven decisions without psychological bias

✅ Pattern Recognition: Identifies complex, multi-variable relationships

✅ Big Data Integration: Processes news, social media, financial data, and satellite imagery

✅ Global Coverage: Analyzes markets across continents in real-time

Real AI Applications in Stock Analysis (2025):

1. Sentiment Analysis Revolution: AI systems now analyze:

- Social media sentiment from millions of posts daily

- News article tone across thousands of financial publications

- Earnings call transcripts for management confidence indicators

- Regulatory filing language for hidden risk signals

Example: When Tesla's earnings call transcript showed CEO Musk using uncertainty words 40% more than previous quarters, AI systems flagged potential volatility before human analysts caught on.

2. Alternative Data Integration: AI processes non-traditional data sources:

- Satellite images of retail parking lots to predict sales

- Credit card transaction data for real-time revenue insights

- Supply chain shipping data for inventory management signals

- Employee review sentiment for company culture health

Example: AI detected Walmart's same-store sales growth by analyzing parking lot density from satellite imagery - 2 weeks before official earnings announcement.

3. Pattern Recognition Mastery: AI identifies complex relationships humans miss:

- Multi-factor correlations across 50+ variables simultaneously

- Seasonal patterns combined with economic cycles

- Cross-market influences (how Asian markets affect US tech stocks)

- Hidden momentum signals in trading volume and price action

4. Real-Time Risk Assessment: AI continuously monitors:

- Correlation breakdowns during market stress

- Liquidity changes across different market conditions

- Sector rotation signals based on economic indicators

- Geopolitical risk factors from news and social media

AI Prediction Accuracy (Current Performance):

Traditional Human Analysts:

- Earnings predictions: 60-65% accuracy within 5% margin

- Price target accuracy: 45-50% within 12 months

- Sector rotation timing: 35-40% success rate

Advanced AI Systems:

- Earnings predictions: 75-85% accuracy within 5% margin

- Short-term price movements: 65-70% accuracy (1-30 days)

- Risk assessment: 80-90% accuracy in identifying high-risk periods

The AI Stock Analysis Workflow:

Step 1: Data Ingestion (Milliseconds)

- Financial statements from 50,000+ global companies

- Real-time news feeds from 10,000+ sources

- Social media sentiment from millions of posts

- Technical indicators across all timeframes

Step 2: Pattern Recognition (Seconds)

- Identify correlations across multiple variables

- Compare current patterns to historical database

- Flag anomalies and unusual trading patterns

- Generate probability-weighted scenarios

Step 3: Prediction Generation (Minutes)

- Calculate fair value estimates using multiple models

- Generate risk-adjusted return projections

- Identify optimal entry and exit points

- Rank opportunities across global markets

Step 4: Portfolio Optimization (Minutes)

- Balance risk across holdings

- Optimize for specific investor goals

- Account for transaction costs and taxes

- Generate automated rebalancing signals

How StockSageAI Leverages AI for Retail Investors:

AI-Powered Stock Screening: StockSageAI's AI engine analyzes companies across US, Indian, and European markets using:

- Machine learning algorithms that identify undervalued opportunities

- Sentiment analysis from news and social media sources

- Pattern recognition for technical trading signals

- Risk assessment models for portfolio optimization

AI Portfolio Advisor: The platform's AI advisor provides:

- Personalized recommendations based on individual risk tolerance

- Diversification suggestions across markets and sectors

- Rebalancing alerts when portfolios drift from targets

- Market timing signals for entry and exit decisions

AI-Generated Analysis Reports: StockSageAI creates comprehensive reports featuring:

- Automated fundamental analysis of financial health

- Technical pattern recognition and trend identification

- Peer comparison analysis within industry groups

- Risk factor assessment with probability weightings

Advanced AI Screening Capabilities:

- Multi-factor analysis combining 30+ financial metrics

- Cross-market opportunity identification across global exchanges

- Sector rotation signals based on economic cycle analysis

- Quality scoring using AI-driven company health assessments

The Democratization of Wall Street AI:

Before AI Democratization:

- Institutional advantage: Only big firms could afford sophisticated analysis

- Information asymmetry: Retail investors got yesterday's insights

- Limited coverage: Small-cap and international stocks were ignored

- High costs: Professional analysis cost thousands per month

With AI-Powered Platforms:

- Level playing field: Retail investors access institutional-grade analysis

- Real-time insights: Everyone gets the same information simultaneously

- Comprehensive coverage: AI analyzes all markets and company sizes

- Affordable access: Professional tools available for fraction of traditional cost

AI Trading Strategy Examples:

Momentum AI Strategy:

- Identifies: Stocks with accelerating earnings growth and positive sentiment

- Triggers: Buy signals when multiple AI indicators align

- Risk management: Automatic stop-losses based on volatility patterns

- Results: 15-25% annual outperformance in backtesting

Value AI Strategy:

- Identifies: Undervalued companies with improving fundamentals

- Triggers: Buy signals when AI detects value catalyst events

- Risk management: Diversification across uncorrelated value factors

- Results: 8-12% annual outperformance with lower volatility

Quality AI Strategy:

- Identifies: High-quality companies temporarily mispriced

- Triggers: Buy signals during AI-detected overreaction events

- Risk management: Focus on companies with strong competitive moats

- Results: 10-18% annual returns with minimal downside risk

The Future of AI in Investing (2025-2030):

Emerging AI Capabilities:

- Natural language processing for earnings call emotion detection

- Computer vision for satellite-based economic indicators

- Quantum computing for complex optimization problems

- Predictive modeling using alternative data sources

Coming AI Features:

- Voice-activated portfolio management ("AI, should I buy more tech stocks?")

- Augmented reality market analysis (visualize portfolio performance)

- Predictive news impact (AI predicts how news will affect specific stocks)

- Automated tax optimization (AI manages tax-loss harvesting)

Limitations and Risks of AI Analysis:

Current AI Limitations:

❌ Black swan events: Cannot predict unprecedented occurrences

❌ Market regime changes: Performance degrades during structural shifts

❌ Data quality dependency: Garbage in, garbage out principle applies

❌ Overfitting risk: Models may work on historical data but fail going forward

Smart AI Usage Guidelines:

✅ Use AI as enhancement, not replacement for human judgment

✅ Diversify across multiple AI strategies to reduce model risk

✅ Regularly update and retrain AI models with new data

✅ Maintain risk management regardless of AI confidence levels

Action Steps for AI-Enhanced Investing:

- Start with AI-powered screening tools to identify opportunities

- Use AI for initial analysis, then verify with fundamental research

- Implement AI-suggested diversification across markets and strategies

- Monitor AI performance and adjust allocation based on results

- Stay updated on AI developments in financial technology

Think About This: We're living through the biggest revolution in investing since the invention of the stock exchange. AI doesn't just change how we analyze stocks - it fundamentally transforms who can access world-class investment analysis.

Experience the future of investing with StockSageAI's cutting-edge AI analysis platform. Our artificial intelligence engine processes vast amounts of data across US, Indian, and European markets to identify opportunities human analysts miss. Access AI-powered stock screening, automated portfolio optimization, sentiment analysis, and predictive modeling tools that level the playing field with institutional investors. Join hundreds of investors already using AI to enhance their returns - start your AI-powered investing journey at StockSageAI.com and let artificial intelligence work for your portfolio.