The 52-Week Temperature Check: Hot or Cold Investment Opportunities

Your fever thermometer tells you if you’re sick. The 52-week high/low is your stock’s health thermometer — and it reveals shocking…

Your fever thermometer tells you if you’re sick. The 52-week high/low is your stock’s health thermometer — and it reveals shocking opportunities.

Dr. Martinez examines two patients:

Patient A: Temperature 104°F (52-week high territory)

- Diagnosis: Fever — something’s wrong or fighting infection

- Treatment: Monitor closely, investigate cause

Patient B: Temperature 96°F (52-week low territory)

- Diagnosis: Below normal — possible underlying issue

- Treatment: Run tests, check for hidden problems

The Stock Market Diagnosis:

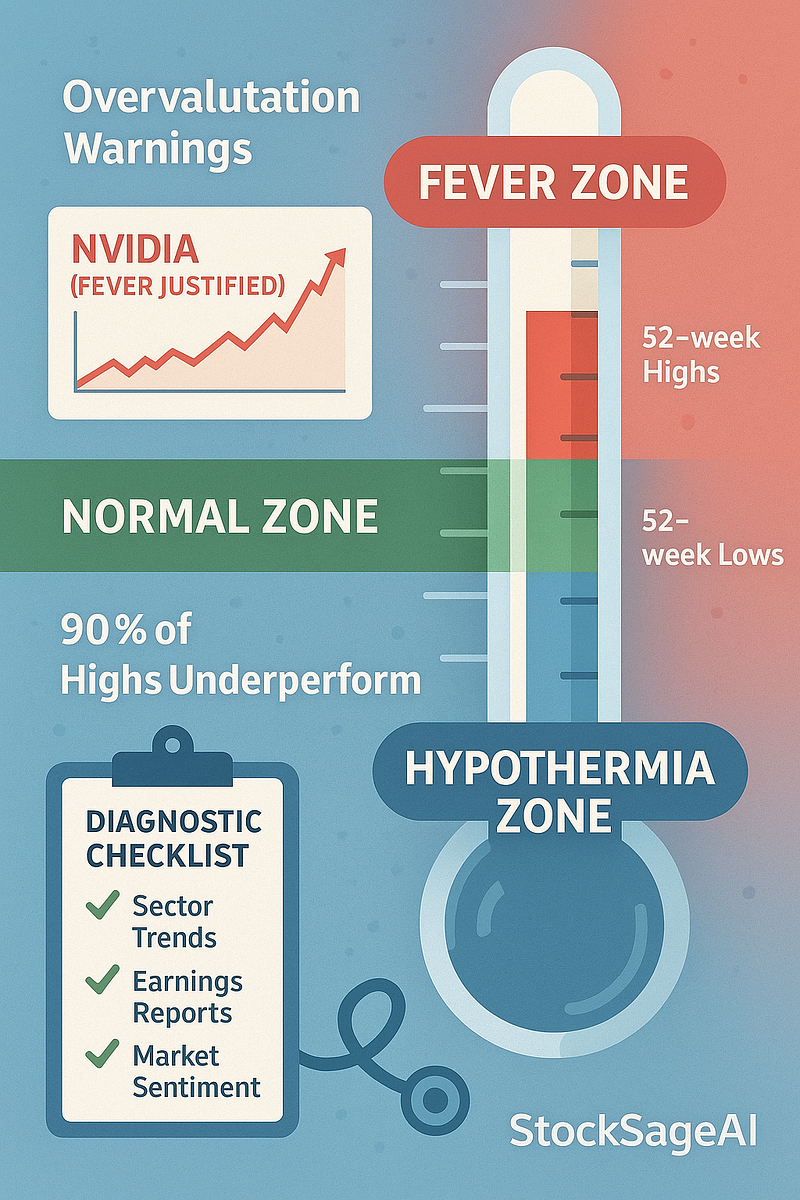

Stocks at 52-Week Highs (Fever Zone):

- Possible Causes: Great earnings, new product launches, market euphoria

- Risk: Overvaluation, buying at peak prices

- Opportunity: Momentum trades, riding the trend

Stocks at 52-Week Lows (Hypothermia Zone):

- Possible Causes: Poor earnings, scandal, market overreaction

- Risk: Value traps, falling knife investments

- Opportunity: Value investments, contrarian plays

The Smart Diagnostic Approach:

For 52-Week Highs:

- ✅ Check if fundamentals support the price (growing earnings)

- ✅ Look for continued momentum indicators

- ❌ Avoid buying just because “it’s going up”

For 52-Week Lows:

- ✅ Investigate WHY it’s down (temporary or permanent problems)

- ✅ Check if company fundamentals remain strong

- ❌ Don’t assume “cheap” equals “good value”

Real Case Studies:

Nvidia (2023): Hit 52-week highs repeatedly

- Diagnosis: AI revolution driving genuine demand

- Result: Continued climbing (fever was justified)

Facebook/Meta (2022): Hit 52-week lows

- Diagnosis: Metaverse skepticism, Apple privacy changes

- Result: Recovered strongly in 2023 (temporary illness)

The Temperature Strategy:

- 90% of 52-week highs: Underperform over next 12 months

- Top 10% of 52-week lows: Often outperform if fundamentals intact

Action Step: Screen your watchlist for stocks near 52-week lows with strong balance sheets. These are your potential recovery plays.

Think About This: Would you buy winter coats in July or swimsuits in December? Contrarian investing follows the same logic — buy when others are selling.