Company Size Matters: The Cruise Ship vs Speedboat Guide

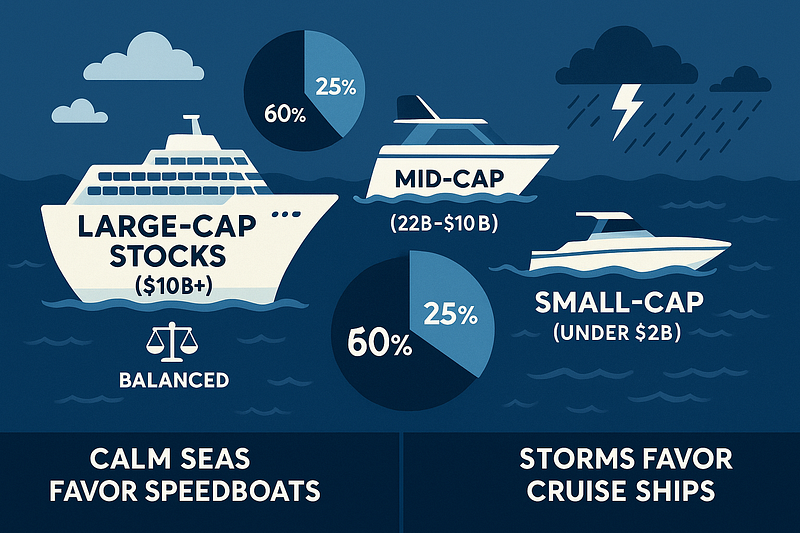

Would you rather sail through a storm on a massive cruise ship or a speedboat? Your answer reveals your perfect stock strategy.

Would you rather sail through a storm on a massive cruise ship or a speedboat? Your answer reveals your perfect stock strategy.

Picture two boats in choppy waters:

- The Cruise Ship: Massive, stable, moves slowly but barely rocks

- The Speedboat: Small, agile, fast but bounces wildly in waves

This is exactly how market capitalization works in stocks.

Market Cap Categories: Large-Cap Stocks ($10B+) = Cruise Ships

- Examples: Apple ($3T), Microsoft ($2.8T), Amazon ($1.5T)

- Pros: Stable, weather economic storms well, steady growth

- Cons: Slower growth, limited upside potential

Mid-Cap Stocks ($2B-$10B) = Yachts

- Examples: Roku ($2.1B), Peloton ($1.9B)

- Pros: Balance of stability and growth potential

- Cons: More volatile than large-caps, less research coverage

Small-Cap Stocks (Under $2B) = Speedboats

- Examples: Many biotech startups, emerging tech companies

- Pros: Explosive growth potential, nimble operations

- Cons: High volatility, higher bankruptcy risk

The Weather Report:

- Calm Markets: Speedboats (small-caps) zoom ahead

- Stormy Markets: Cruise ships (large-caps) provide safety

- Mixed Conditions: Yachts (mid-caps) offer best balance

Smart Allocation Strategy: For most investors:

- 60% Large-cap (cruise ships)

- 25% Mid-cap (yachts)

- 15% Small-cap (speedboats)

Action Step: Calculate your portfolio’s market cap mix. Are you overloaded with speedboats when storm clouds are gathering?

Think About This: In 2008, speedboats (small-caps) sank 37% while cruise ships (large-caps) dropped only 27%. Which would you have preferred?

For more such insights visit www.stocksageai.com and use the platform to make intelligent investment decisions.